Narrative Economics: The New Fundamental?

Posted on: July 19, 2024

Last week I published a newsletter article titled “Will The Stock Market Return to The Fundamental?” I have received a good number of responses, and as promised, today I will share my thoughts.

The traditional economic theory has always presumed that economic actors are calculating and rational. The application of this presumption in the investment field is the efficient market hypothesis, which basically says that investors rationally pay the prices for expected future earnings adjusted for risk. The biggest proponent of the efficient market hypothesis is Nobel Prize winner Eugene Fama.

The efficient market hypothesis has its biggest opponent in Robert Shiller, who years ago published his seminal work that illustrated how a 1% change in dividends can oftentimes result in a 15% change in the stock price. If investors are, in fact, calculating and rational, stock prices shouldn’t fluctuate so much relative to dividends.

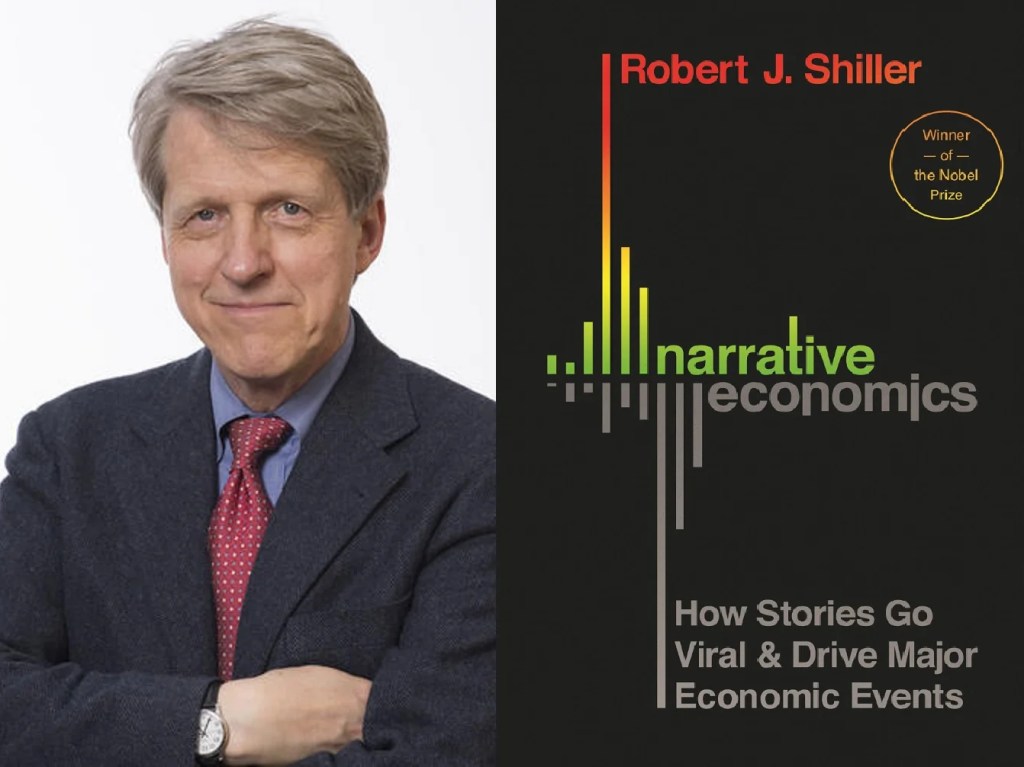

Interestingly, Eugene Fama and Robert Shiller shared the Nobel Prize in economics in 2013. Both of them have had new research published in the last five years that should shed light on the question at hand. Today I’d just like to highlight Robert Shiller’s.

In 2019, Shiller published a new book: Narrative Economics: How Stories Go Viral and Drive Major Economic Events. What I have learned from his book is this: stock prices are no longer driven only by earnings, or more broadly, economic fundamentals, they are also driven by powerful narratives. This phenomenon is aided by the rise of social media: the speed with which a story can go viral, and the way communities can sustain a story regardless of truth or falsehood.

Whether it’s BTC, or TSLA, or NVDA, they all have a powerful story behind them that resonates with a large segment of the public.

The spread of stories is like the virus, there is always a dominant strand. This means only a small number of stocks whose stories will go viral and help deliver outsized returns.

How this insight from Robert Shiller could help us invest better? I don’t know yet. I am curious about your thoughts. Do you agree with Robert Shiller’s thesis? Feel free to reply with your comments.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment