Archive for the ‘Stock Market’ Category

This is an article I wrote fourteen years ago that was inspired by Daniel Kahneman’s Nobel Lecture “Maps of Bounded Rationality.” Here I will repost it without changing one word – I am proud of the evergreen nature of my articles. At the end, I will make a few additional comments in red that include new insights from the last fourteen years.

Do you know that the top three one-day drops in Dow Jones happened in October? On the 19th of October 1987, Dow Jones fell nearly 23%, making the day the worst day in the US stock market history. It was followed by the 24th and 29th of October 1929, when Dow Jones fell 13.5% and 11.5% respectively, ushering in the Great Depression. These events are commonly remembered as the crash of 29 and the crash of 87.

Read the rest of this entry »Let me first define the term “small cap value premium.” It’s an observation (and indeed historical fact up until about five years ago) that small cap value stocks outperform large cap growth stocks in a rather consistent manner.

In academia, there are two theories attempting to explain it: 1) risk-based and 2) behavior-based.

The risk-based theory was pioneered by Nobel winner Eugene Fama, who argued that small cap value stocks are inherently riskier than large cap growth stocks, thus they deserve higher returns to compensate for higher risks.

Read the rest of this entry »My long-term readers will remember that since I started writing investment missives, I have always advocated small-cap value investing. That is, holding a broadly diversified portfolio but with a weighting tilt towards small-cap value stocks.

Up until 2014, the historical evidence is overwhelming. Literally, since there have been stock market data, looking at rolling ten-year periods (see chart below,) there have been only two ten-year periods when small-cap value stocks under-performed large-cap growth stocks, ending in 1998 and 1999 respectively. These ten-year periods corresponded to the dot-com tech-stock bubble in the US.

Read the rest of this entry »In June of 2007, I wrote my first article on stock market seasonality. There I wrote that there was a rather persistent and robust stock market phenomenon that the market tended to perform well in the winter months than in the summer month. By “persistent” I meant that it lasted for decades in the US market, by “robust” I meant that the phenomenon showed up in other stock markets as well, as can be seen by this chart.

I started writing the Investment Scientist newsletter in May of 2007, and I think it would be fun to review my old articles. First of all to see if I was right back then, and if I wasn’t completely right, to see what I would write differently with the benefit of hindsight.

In May, 2007, I wrote three articles. In the first one, “The Unbearable Lightness of Chinese Stocks,” I made the statement that there was a huge bubble in the Chinese equity market and investors should stay away. In fact during that time, many (American) clients wanted me to invest in Chinese stocks, so much so that they said the reason they signed up with me was they thought I would help them do that. At the time I wrote it, the Shanghai Stock Exchange Composite (SSEC) just passed 4000, now it stands at 3412. After 15 years, it is still 15% below the level at the time. I lost a few clients for steering their money away from Chinese stocks, but in retrospect, I am glad that I made the right call.

Buying Strong Stocks On Sale

Posted on: March 25, 2020

Now that the panic has abated a little, many financial advisors (FAs) are advising their clients to buy strong stocks on sale. None other than Jim Cramer made the same proclamation, he even mentioned ten stocks by name. (Just FYI, he did the same in 2008 – and I did a study afterward – 8 out of the 10 underperformed the S&P 500 index that year.)

So what are the strong stocks to own? Are they industrial titans like Boeing or GE? They were strong stocks but are they still? Are they Wall Street banks too big to fail like JP Morgan or Citibank? But how do we know they’re not just another Lehman Brothers? Is it a consumer tech giant like Apple? How can we be sure it won’t go the way of Sony, which was the previous consumer tech giant. How about Netflix? When we are stuck at home social distancing, you’ve got to watch Netflix right? But what if Amazon, Apple and the other big boys jumping in the streaming market eat its lunch?

What Kills Investment Returns?

Posted on: November 23, 2019

Last week’s newsletter article “Why It’s Awesome To Have a Loser in Your Portfolio” has proven to be quite controversial. More than a few of my readers emailed me to warn that my Finance professor at Oxford was full of bullshit. Let’s put that aside for now, and consider this question:

If there is an investment that has an average return of 25%, would you invest in it?

If you did not jump in right away, you are a smart investor! Investment A falls 50% in one year and gains 100% the next, giving it exactly a 25% average return. If you invest $1000, however, you make absolutely $0 on this investment. On the other hand, investment B gains 25% in both years, so it also has exactly a 25% average return, but now the gain from $1000 investment is $562.5. You can not pick an investment in isolation of its volatility. Because …

Don’t take my word for it, this was covered in my Finance class at Oxford. Let me see if I can get the gist across with a few graphs.

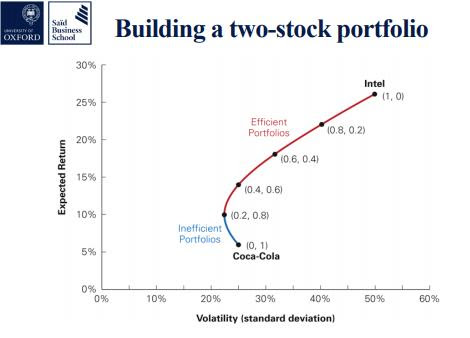

The graph below shows the risk/return profiles of a continuum of two stock portfolios of Coca-Cola and Intel. The vertical axis represents the expected return, and the horizontal axis represents volatility risk.

As you can see, Coca-Cola by itself is a low risk – low return stock, while Intel by itself is a high risk – high return stock. By using different weighting in the two stock portfolios, we can create different risk return trade-offs, represented by the curve. Read the rest of this entry »

As of the market close on Monday, December 17th, both the Dow and the S&P 500 have a 14% discount, the Nasdaq has a 18% discount and the small cap Russell 2000 index has a 22% discount.

As of the market close on Monday, December 17th, both the Dow and the S&P 500 have a 14% discount, the Nasdaq has a 18% discount and the small cap Russell 2000 index has a 22% discount.

On the Asian front, the Chinese market has a 27% discount, the Hong Kong market has a 22% discount, and the Japanese market has a 12% discount.

On the European front, the German market has a 21% discount, the UK market has a 14% discount, and the French market has a 15% discount.

According to my wardrobe theory of investment, this is a good time to buy stocks. If you were excited about buying stocks a few months back (when these markets were raising prices to new highs), you should be even more excited now!

(Feel free to share if you find it insightful.)

Schedule a Discovery review with me, or get my white paper for free: The Informed Investor: 5 Key Concepts for Financial Success.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Ever since Fama and French published their seminal paper “The Cross-Section of Expected Stock Returns” in 1992, the world (at least the academic world) has come to understand that over the long run, small cap stocks outperform large cap stocks and value stocks outperform growth stocks.

This quest to understand stock returns has not stopped. In 2013, Robert Novy-Marx published “The Other Side of Value: The Gross Profitability Premium” in the Journal of Financial Economics. In the course of this research, he discovered that profitability, measured by gross profits-to-assets, has roughly the same power as book-to-market in predicting the cross-section of average returns. Profitable firms generate significantly higher returns than unprofitable firms, despite having higher valuation ratios.

Almost concurrently, other researchers confirmed Novy-Marx’ discovery, notably Fama and French’s new paper “A Five Factor Asset Pricing Model” and Hou, Xue and Zhang’s “Digesting Anomalies: An Investment Approach.” Both papers were published in 2015.

Unlike the small cap premium and value premium, the profitability premium does not have a satisfactory risk-based explanation.

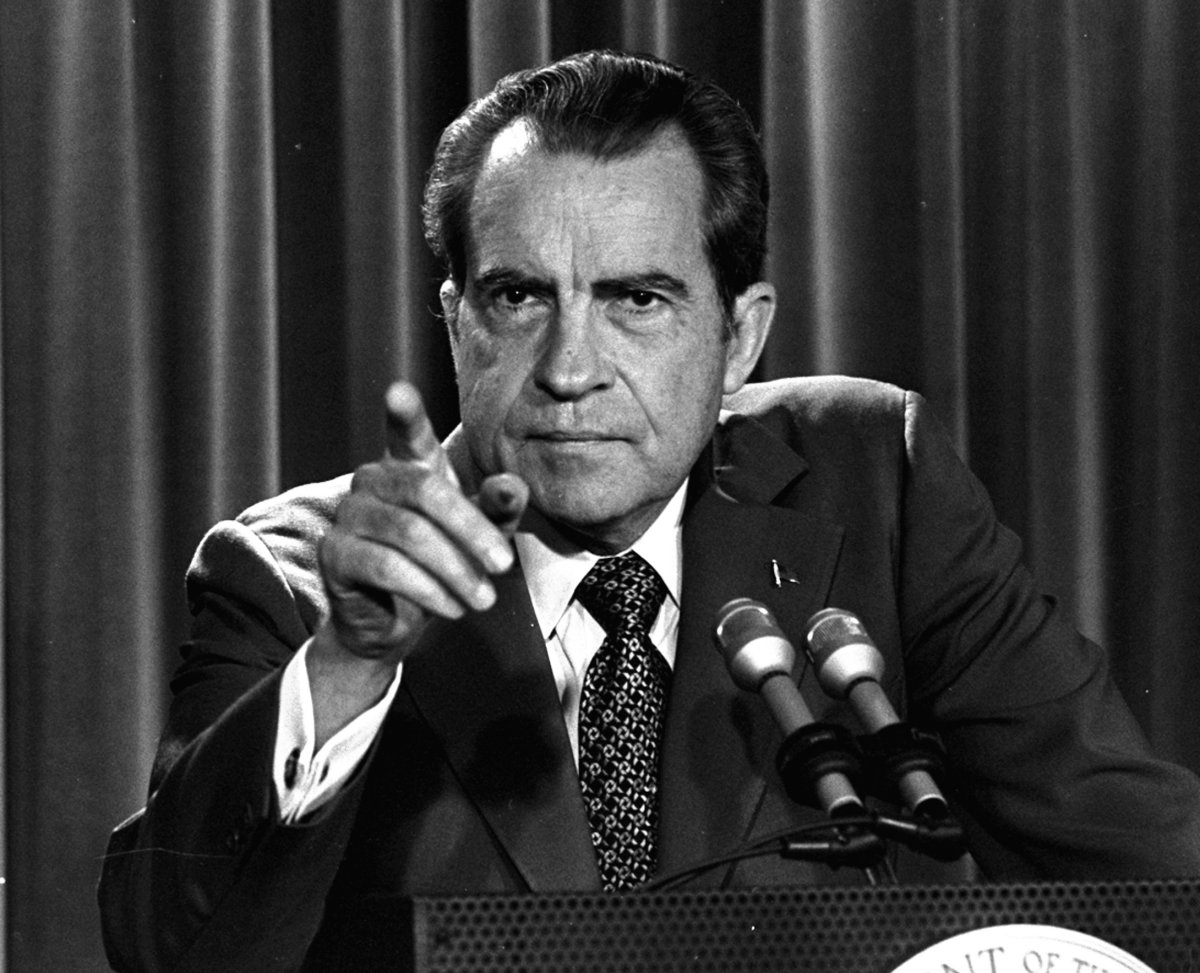

After the Comey firing and the dropping of a few other shoes, there is enough talk about the similarity to Watergate that piques my interest to study the stock market’s reaction during the Watergate period.

After the Comey firing and the dropping of a few other shoes, there is enough talk about the similarity to Watergate that piques my interest to study the stock market’s reaction during the Watergate period.

The Watergate period started with the arrest of five burglars breaking into the DNC offices located in the Watergate Hotel on 6/17/1972 and ended with Nixon’s resignation on 8/8/1974. I split that time period into three different stages.

-

The early stage: from 6/17/1972 to Nixon winning re-election on 11/11/1972.

-

The middle stage: from 11/11/1972 to 10/20/1973 when Nixon fired Archibald Cox and abolished the office of the special prosecutor. Attorney General Richardson and Deputy Attorney General William D. Ruckelshaus resigned. The day’s events are commonly known as the Saturday Night Massacre.

-

The final stage: from 10/20/1973 to 8/8/1974 when Nixon resigned.

Stocks Decline 14% (June 1950 to July 1950) North Korean troops attack along the South Korean border. The U.N. Security Council condemns North Korea. The U.S. gets involved.

Stocks Decline 14% (June 1950 to July 1950) North Korean troops attack along the South Korean border. The U.N. Security Council condemns North Korea. The U.S. gets involved. - Stocks Decline 20.7%, (July 1957 to October 1957) The Suez Canal crisis manifests itself, the Soviets launch Sputnik and the U.S. slips into recession.

- Stocks Decline 26.4% (January 1962 to June 1962) Stocks plunge after a decade of solid economic growth and market boom, the first “bubble” environment since 1929.

- Stocks Decline 22.2% (February 1966 to October 1966) The Vietnam War and Great Society social programs push government spending up 45% in five years. Inflation takes off.

- Stocks Decline 36.1 % (November 1968 to May 1970) Inflation really starts to pick up, hitting 6.2% in 1969 up from an average of 1.6% over the previous eight years. Vietnam War escalates. Interest rates surge; 10-year Treasury rates rise from 4.7% to nearly 8%.

- Stocks Decline 48% (April 1973 to October 1974) Inflation breaks double-digits for the first time in three decades. There is the start of a deep recession; unemployment hits 9%.

- Stocks Decline 19.4% (September 1976 to March 1978) The economy stagnates. High inflation. Adjusted for inflation, corporate profits haven’t grown for eight years.

- Stocks Decline 17.1% (February 1980 to March 1980) Interest rates approach 20%, the Read the rest of this entry »

Is A Market Crash Imminent?

Posted on: July 30, 2014

Yesterday I received an email from a doctor client of mine telling me how he had a conversation with some fellow doctors, and all of them are pulling their money out of stocks because they feel that with the market breaking new high after new high, a crash is imminent. He wanted my opinion.

Yesterday I received an email from a doctor client of mine telling me how he had a conversation with some fellow doctors, and all of them are pulling their money out of stocks because they feel that with the market breaking new high after new high, a crash is imminent. He wanted my opinion.

First of all, while all of his doctor friends might feel a market crash is imminent and certain, there is simply no such thing as certainty in the stock market. All we can work with are odds. The following are the odds of market corrections:

| Magnitude of market decline | Frequency of occurrence (out of 64 years from 1950-2013) |

| >5% | Every year (94%) |

| >10% | Every two years (58%) |

| >20% | Every five years (20%) |

| >30% | Every ten years (10%) |

| >40% | Every fifty years (2%) |

My study also shows that the market breaking a new high does not substantially change the odds of returns. In other words, the odds of the market dropping over 20% in the next twelve months are still about one in five; the odds of the market dropping over 30% in the next twelve months are still about one in ten.

Read the rest of this entry »

Investors Good At Hurting Themselves: Investor Returns vs Investment Returns

Posted on: March 18, 2014

In 2009, Morningstar did a study comparing mutual fund returns vs investor returns. Here is what they got:

| Fund Category | Fund Return | Investor Return | Investor Lag |

| Large-Cap Blend | -1.4% | -5.7% | -4.3% |

| Large-Cap Growth | -1.7% | -7.7% | -6.0% |

| Large-Cap Value | -1.8% | -2.2% | -0.4% |

| Mid-Cap Blend | 0.4% | -3.0% | -3.4% |

| Small-Cap Blend | -0.5% | -6.9% | -6.4% |

| Europe/Pacific | 3.1% | 0.5% | -2.6% |

| Emerging Markets | 15.6% | 3.8% | -11.8% |

| Financials | -10.5% | -28.6% | -17.9% |

| Health Care | -1.3% | -3.1% | -1.8% |

| Communications | 1.9% | -3.7% | -5.7% |

| Energy | 8.6% | 4.0% | -4.6% |

| REITs | -2.5% | -11.8% | -9.3% |

| Technology | -2.6% | -8.3% | -5.7% |

| Utilities | 5.5% | 2.1% | -3.4% |

| Total and Simple Averages | 1.0% | -3.5% | -4.5% |

Source: Morningstar

We can make a few observations about these data:

January Indicator: 2014 Could Be a Year of Opportunity for Wealth Accumulator

Posted on: February 6, 2014

Last year after the market was up about 5% in January, I wrote a newsletter to introduce my clients to the so-called “January Indicator”:

According to research done by Cooper and McConnell, what the market does in January has a strong predictive power for what the market will do for the rest of the year.

Using data since 1940, they found that if the market is up in January, it will rise an additional 14.8% for the rest of the year; if the market is down in January, it will rise only 2.92% for the rest of the year. This gives rise to a spread of almost 12%, a highly statistically significant number.

According to Sam Stovall, chief equity strategist at S&P Capital IQ, the S&P 500 since 1945 has risen 56% of the time following a down January. That is lower than the 84% frequency of February-through-December gains following a higher market in January.

2013 has been a stellar year for stocks. As of today, the S&P 500 is up more than 25%. There are about ten trading days left and barring unforeseen circumstance, the index will end the year in the 20+% range.

2013 has been a stellar year for stocks. As of today, the S&P 500 is up more than 25%. There are about ten trading days left and barring unforeseen circumstance, the index will end the year in the 20+% range.

A few of my clients are concerned; with the market doing so well this year, what does that bode for 2014? Well, I don’t have a crystal ball, so all I can do is to look at historical data to make an imperfect reference.

To answer the question, I asked my intern Nahae Kim to do a study of the relationship of immediately subsequent year returns. Specifically, can one year return predict the next year?