Archive for the ‘Tax Mitigation’ Category

Two weeks ago I wrote about the tax strategy to use during a sabbatical, career transitions, and early retirement. This week’s article is a continuation of that theme, focusing on tax gain harvesting.

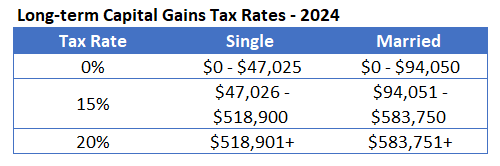

This discussion stems from the fact that investment gains are taxed differently than our ordinary income. In fact, they have their own tax brackets. See below:

Let’s take Joe Doe for example. He is a lawyer and his usual taxable income is $600k. That puts him squarely in the 20% capital gains tax bracket. On top of that, based on his income, he must also pay the Obamacare surtax of 3.8%. That makes the tax rate on his investment gains (and qualified dividends) 23.8%.

Read the rest of this entry »Tax Saving Strategies for Sabbaticals, Career Transitions or Early Retirement

Posted on: April 10, 2024

I have a client who is planning to take a year off to take care of her mother, another one who has quit his job to launch a new business, and yet another one who has retired early and needs to wait a few years to receive her pension and social security.

What they all have in common is that they will have at least one year during which they will have very low or even no income. I have been thinking about how they can take advantage of their situations to increase their lifetime wealth-being, or more specifically to reduce their lifetime tax liabilities. Here are two strategiesI came up with: 1) Roth Converstion and 2) Tax Gain Harvesting.

Folks who save money for retirement usually stash their money in three types of accounts: taxable accounts like banks and brokerages; tax-deferred accounts like IRAs, SEPs and 401ks, or tax-exempt accounts like Roth IRAs and HSAs.

With tax-deferred accounts, once you are over 71 years old, there will be a RMD (required minimum distribution) that will increase as you age. If you invest well, eventually this RMD will push you into the higher tax brackets like 35% or even 37%. Here is a table of tax brackets for 2024.

Read the rest of this entry »About a month ago, I wrote about the silver lining of fallen bond prices. The message I tried to get across was that the lower prices are not a bad thing: 1) You will still get your principal back; 2) You will earn higher interest income. Today I would like to tell you about another money-making opportunity presented by fallen bond prices – tax loss harvest!

This technique is usually used for stocks, but you can use it for bonds as well.

Let’s say that at the end of last year, you had $200k invested in various bond funds. Since then, bond prices have fallen about 10%. Your bond funds will show a $20k loss on paper. Now you can sell these funds to realize the loss and use the proceeds to buy other bond funds so that you have the same exposure.

Read the rest of this entry »Yesterday, a young tech worker from the West Coast signed up for my 2nd opinion review. He just had a very successful exit from an IPO, and is now sitting on $20mm worth of company stock, much of it capital gains. Morgan Stanley is pushing strongly for him to put his money into a QOF, and he wanted my view on that.

I happened to have just written a paper on this topic for a Oxford Private Equity class assignment, so I have done some pretty in-depth research. Mindful that most people don’t have the patience to read a long essay like that, I will summarize my findings as succinctly as possible here.

What is a Qualified Opportunity Zone (QOZ)?A QOZ is an economically depressed area that can’t attract investments on its own. The Tax Cut and Jobs Act of 2017 established this designation and certain tax benefits for investments into these areas.

What is a Qualified Opportunity Fund (QOF)?A QOZ is a private investment vehicle (in the form of a partnership or LLC) that invests in QOZs.

Read the rest of this entry »Tax Advantaged Investing

Posted on: June 18, 2021

Recently, Dimensional Fund Advisors (DFA,) a mutual fund company whose funds I use a lot for my clients, replaced its Tax-Advantaged US Core 2 Equity Fund DFTCX with an ETF DFAC. In this article, I will explain how a mutual fund can achieve tax-advantaged status, and I will further explain how it is even more advantageous to move to an EFT.

A mutual fund is simply a pooled investment vehicle. Many folks’ money is pooled together in the fund, and the fund manager invests it. As a fund investor, you may still hold the fund and therefore there is no realization of capital gains on the portfolio level. But on the fund level, there are still capital gains because of trading. These gains are passed down to each individual investor, and they must pay taxes on them. This is despite the fact that they have not sold the fund.

A tax-aware fund manager can reduce this tax burden on the fund’s investors by trading less, especially by deferring the realization of gains. That’s why a fund’s turnover is an indicator of a fund’s hidden cost. The higher the turnover, the higher the transaction costs and tax burden.

Read the rest of this entry »The Value of Tax Loss Harvesting

Posted on: May 23, 2020

Over the last few weeks, I have been busy 1) rebalancing – including increasing exposure to the digital platform economy I discussed in my past post, 2) migrating from mutual funds to ETFs because of the latter’s tax benefit, and 3) tax loss harvesting.

Over the last few weeks, I have been busy 1) rebalancing – including increasing exposure to the digital platform economy I discussed in my past post, 2) migrating from mutual funds to ETFs because of the latter’s tax benefit, and 3) tax loss harvesting.

Today I am gonna discuss tax loss harvesting. So what exactly is tax loss harvesting? It’s basically realizing a capital loss while maintaining the same exposure. For instance, if in your portfolio, there is a US equity fund with a $30k loss, you can sell the fund to realize the loss and buy a substantially similar US equity fund to take its place. This way you maintain the same exposure but book an accounting loss of $30k. This maneuver is called tax loss harvesting.

Before we discuss the cost of advanced taxation (or the benefit of deferred taxation,) I need to first introduce the concept of time value of money. That is to say, $100 a year from now is different from $100 today.

Let’s say I owe $100 in taxes due to be paid next year, but for some tricky reason, the IRS wants me to pay that now. How costly is this advanced taxation to me? Well, if I didn’t have to pay the tax today, I could invest the $100. Let’s also assume the return is 8%, so by next year, I would have had $108. I could pay the $100 tax and get to keep the remaining $8. If I have to pay $100 today, I forgo that $8. That’s the cost of advanced taxation.

With this concept established, now let me run an experiment with the following assumptions:

- The investment cycle is 20 years.

- The investment return per year is 8%.

- Of the 8%, 2% is dividend distributions that are taxed at a 50% marginal income tax rate.

- The remaining 6% is the capital gain. Capital gain distributions (“CGD”) range from 0% to 5%, and they are taxed at the long-term capital gain tax rate of 20%.

The study is about how changing the CGD rate affects the investor’s tax liability as a percentage of initial principal investment.

The following is a hypothetical but highly realistic example of mutual fund advanced taxation. You invest $100,000 in a stock mutual fund on Dec 20th. You get a distribution of $10,000 on Dec 23rd. The distribution is reinvested. When you go check your account balance at year-end, the account balance has gone down a little to $99,950. No big deal.

The following is a hypothetical but highly realistic example of mutual fund advanced taxation. You invest $100,000 in a stock mutual fund on Dec 20th. You get a distribution of $10,000 on Dec 23rd. The distribution is reinvested. When you go check your account balance at year-end, the account balance has gone down a little to $99,950. No big deal.

In January, you get a 1099-DIV form from the mutual fund company showing you have dividend income of $2,000 and capital gains of $8000. (They add up to $10,000). You have to pay taxes on those! You jump from your chair: “What! I lost money in the investment, and I have to pay taxes on income and gains I don’t see?! What gives?”

It turns out that mutual funds are required by law to distribute any dividend incomes and all net capital gains by year-end. Usually, they have a record date in December. If you are a fund-holder on record at that time, you will receive the distributions. Most mutual funds have their record dates fall between December 10 and December 20. Read the rest of this entry »

Just this week I get an email from a client of mine asking me if she should contribute to her HSA (health saving account) and if so, how much. So I thought this would be a good time to talk about HSAs.

Just this week I get an email from a client of mine asking me if she should contribute to her HSA (health saving account) and if so, how much. So I thought this would be a good time to talk about HSAs.

What is a HSA?

A HSA is a tax-advantaged savings account for health care purposes for folks who enroll in a qualified high-deductible health plan (HDHP.)

HSAs were brought about by President George W. Bush in the same legislation that added prescription drug benefits to Medicare. It was established without much fanfare because at the time all the sound and fury was about the prescription drug benefit. Little did we know that one and a half decades later, it would be becoming more and more popular in the corporate health insurance marketplace.

How does it work?

After my last newsletter article “Top Ten Reasons to Avoid Exchange Funds” went out, I got an email asking how to deal with a concentrated highly appreciated stock position. To this, I replied, “It helps to have some charitable inclination.”

After my last newsletter article “Top Ten Reasons to Avoid Exchange Funds” went out, I got an email asking how to deal with a concentrated highly appreciated stock position. To this, I replied, “It helps to have some charitable inclination.”

If you have no charitable inclination, no amount of gimmicks can get you off the hook of paying the huge capital gain taxes. At best, you can pay a hefty fee to have someone kick the can down the road by using exchange funds.

However if you are charitably inclined, then a charitable remainder trust (CRT) is a great tool to save on taxes, reduce undiversified risk, create income and benefit charities.

What is a CRT?

A CRT is a trust that lets you convert convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. And it lets you help one or more charities that you care about.

President Trump unveiled his tax reform proposal two days ago. I must say that it by and large follows the contour of my best guess from six months ago. Here is an updated summary:

President Trump unveiled his tax reform proposal two days ago. I must say that it by and large follows the contour of my best guess from six months ago. Here is an updated summary:

- Corporate tax rate will be reduced from 35% to 20%.

- Estate tax will be eliminated.

- The number of tax brackets will be reduced from seven to three, with the top rate going down from 39.6% to 35%.

- The standard deduction will double while personal exemptions and many itemized deductions (with the exception of mortgage interest and charitable donations) will be eliminated.

However, there is one big surprise that will affect many small business owners and maybe even physicians/dentists in private practice.

That is, the tax rate on pass-through earnings will be set at 25%!

I own such a pass-through entity, MZ Capital Management, through which I deliver my wealth management services. The earnings of the firm are not taxed at the firm level, rather they pass through to my tax return as personal income, thereby subject to my personal income tax rate. Since I am in the second highest tax bracket, the marginal tax rate on my pass-through income is currently 35%. (If I had not set up a defined benefit plan for myself, my marginal tax rate would have been 39.6%. This belongs to another article on tax mitigation.)

An Update on Trump’s Tax Plan

Posted on: February 1, 2017

t week I attended a tax seminar organized by McLean Estate Planning Council. The keynote speaker was a CPA and lobbyist for the AICPA on Capitol Hill. He is privy to Trump’s tax reform plan and a number of other Republican tax reform plans. These plans have a long way to go to become law, but the contour is taking shape so I thought I would share what I learned with you in a few bullet points. Note that I bolded the parts that may be disadvantageous to taxpayers.

t week I attended a tax seminar organized by McLean Estate Planning Council. The keynote speaker was a CPA and lobbyist for the AICPA on Capitol Hill. He is privy to Trump’s tax reform plan and a number of other Republican tax reform plans. These plans have a long way to go to become law, but the contour is taking shape so I thought I would share what I learned with you in a few bullet points. Note that I bolded the parts that may be disadvantageous to taxpayers.-

The number of tax brackets will be reduced from seven to three, and the top marginal income tax rate will be reduced from 39.6% to 33%.

-

Personal exemptions will be eliminated.

-

Standard deduction for married filing jointly will rise from $12,600 to $30,000.

-

Itemized deductions will be capped at $200,000 per household.

-

Mortgage interest deduction will be eliminated.

-

Tax rate will be reduced from 35% to 25%.

With the election of a Republican president and a Republican Congress, the tax Wheel of Fortune is spinning again. Since it’s December 2016, you will have to make an educated guess and place your bet now before the wheel comes to a stop.

Tax cuts are very likely, as is a cap on deductions. According to President-elect Trump’s tax proposal, the seven tax brackets will be reduced to three, the top marginal rate will be reduced from 39.6% to 33%, and the 3.8% Obamacare surtax on investment will be repealed. However, itemized deductions that include mortgage interest and charitable donations will be capped at $200k for joint filers.

If you make a few smart moves now, you can potentially save big.

- Delay recognition of incomes and accelerate recognition of expenses/deductions.

- Maximize retirement savings

- Take capital losses.

- Front load your charitable contributions

You can use a donor advised fund to front load your charitable contributions. Take my situation,for example. I typically give about $3000 a year to charities. I now have a d Read the rest of this entry »

I visited a physician client in Wisconsin while on vacation in Chicago this week. He has been my client for several years now and his personal finance is in very good order. As I was driving the four hour stretch of highway, I thought: What idea I could bring to him that could make his situation tens or even hundreds of thousands of dollars better?

I visited a physician client in Wisconsin while on vacation in Chicago this week. He has been my client for several years now and his personal finance is in very good order. As I was driving the four hour stretch of highway, I thought: What idea I could bring to him that could make his situation tens or even hundreds of thousands of dollars better?

This physician client of mine is easily in the top income tax bracket, meaning marginal tax rate for him is nearly 50% combining federal and state. He also gives away about $10k to various charities a year. He plans to retire in about 10 years.

When he retires, he will continue to give away $10k a year. In fact, there is a good chance he will give away more since people become more charitable inclined when they get older and having a meaningful impact becomes much more important to them.

If he lives another 30 years after retirement, he will give away a minimum of $300k. Here is the problem, he will have little income to write off, thereby wasting up to $150k worth of tax savings.

Alas, but there is a way to recapture these tax savings, it’s called Donor Advised Fund or DAF.

In the last two days I have been doing tax loss harvesting for my clients.

According to Google,

Tax loss harvesting is the practice of selling a security that has experienced a loss. By realizing, or “harvesting” a loss, investors are able to offset taxes on both gains and income. The sold security is replaced by a similar one, maintaining the optimal asset allocation and expected returns.

That sounds simple enough, but actually I learned a few things doing tax loss harvest. 1) You can make money and still claim a tax loss. 2) The difference between TTM Yield vs 30 Day SEC Yield and how to use them to select a bond fund.

Take one high net worth client for example, he has about $500k of DWFIX, an international bond fund. I sold that to realize a $31k loss that he can use for tax deductions. But during the three years that the position was in his portfolio, it generated more than $100k in incomes. So he makes money in this position but still gets to claim a tax loss. How nice!

Year End Moves for Tax Savings

Posted on: December 4, 2014

As 2014 draws to a close, my wife and I have sprung into action to save on our 2014 taxes. Here are a few things we do. We are no CPAs, so what we do is pretty easy to mimic.

As 2014 draws to a close, my wife and I have sprung into action to save on our 2014 taxes. Here are a few things we do. We are no CPAs, so what we do is pretty easy to mimic.

Donate all the garbage. I couldn’t believe how many items in my household we literally didn’t touch, not even once, in the whole of 2014. Things like that are immediate candidates for donation. Things that fall into this category could be electronics, furniture, books, clothes, kitchenware, bedroom sets, used toothbrushes, etc. Ok, maybe not used toothbrushes, but just about anything you don’t use, you can find a better home for, and get a tax deduction for doing so. In some years, we’ve gotten $10,000 worth of deductions. Read the rest of this entry »