Archive for June 2015

What If the Market Falls 30%?

Posted on: June 19, 2015

Ever since it touched bottom on March 9th, 2009, the market has been going up and up and up with barely any hiccup. That’s dangerous! Because our minds could get complacent. That’s why I want to do a mental exercise with all of you: What would you do if the market fall 30%?

Ever since it touched bottom on March 9th, 2009, the market has been going up and up and up with barely any hiccup. That’s dangerous! Because our minds could get complacent. That’s why I want to do a mental exercise with all of you: What would you do if the market fall 30%?

First of all, recognize these two important facts:

- Market fall of 30% and above happened every ten years or so. If we use history as a guide, we should expect a 10% odds of that happening over the next 12 months. (So don’t be surprised.)

- All market tumbles of that magnitude were recovered within 18 months in the US. (So don’t despair.) Read the rest of this entry »

Six Costly Investment Behavior

Posted on: June 1, 2015

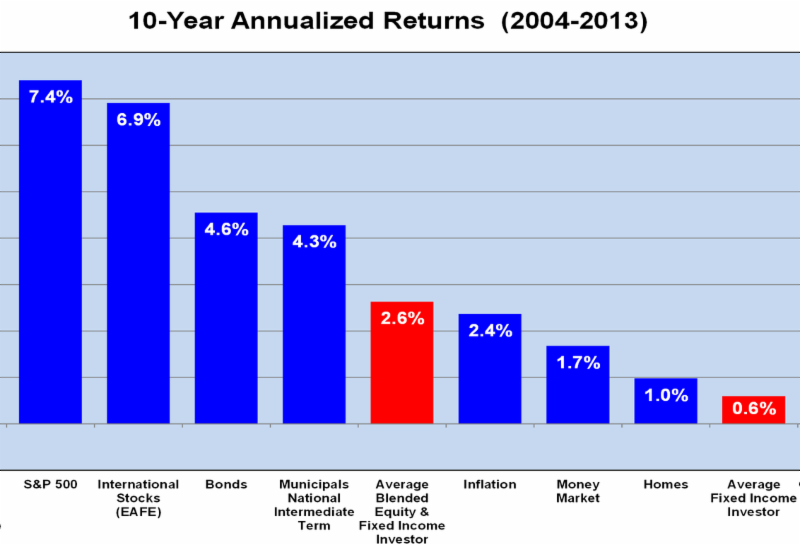

Most investors are very good at hurting themselves financially. According to latest release of Dalbar’s Quantitative Analysis of Investor Behavior (QAIB), the average investor has a return of only 2.6% over the last ten years. That’s pathetic compared to what the markets gave. See the chart below, over the same period, the S&P 500 gave an annualized return of 7.4% and the bond market gave 4.6%.