A client of mine recently shared a real-life story from a friend – let’s call him John.

John recently retired from his long-time job and had accumulated $1mm in his 401k. He correctly recognized that, without his salary, he and his wife are now in a much lower tax bracket, maybe 12%. To take advantage of this, he converted all of his $1mm into a Roth IRA.

John was totally flabbergasted to learn that he owed more than $300k in federal tax and nearly $100k in state tax from this conversion. To raise money to pay these taxes, he was forced to sell some appreciated investments, which led to his owing even more tax. What went wrong?

Read the rest of this entry »Yesterday, the price of gold dropped 10% in one day. Even with that decline, it is still up 12% this year and up 84% since the beginning of 2025. Today, I will write a bit about gold because I have built a small position for all of my clients since 2022, after the Russia-Ukraine conflict started.

Remember when the US and EU froze Russia’s foreign reserves? That move, which was intended to hit Russia hard, sent a chill through central banks everywhere, especially in the Global South. Until then, the US dollar had served as a reserve asset in many sovereign central banks, meaning that they needed to acquire US dollars before they could issue their own currencies.

The Great Dollar Diversification

Read the rest of this entry »Today I am writing about a paper by MIT professor and 2024 Economic Nobel Laureate Daron Acemoglu titled “The Simple Macroeconomics of AI”.

Unlike the bullish projections of AI’s transformative impact on economics, Acemoglu’s view is much more measured. Given the overwhelming media coverage favoring maximalist views on AI, his perspective offers a necessary counterpoint.

Acemoglu argues that over the next ten years, AI will likely automate only 5% of tasks and increase the GDP by about 1%. He explains that while AI excels in specific tasks with clear truths, most real-world jobs involve complex, tacit, contextual knowledge and social intelligence that AI can not easily replicate and replace.

His paper also makes these important points:

Read the rest of this entry »

A client of mine asked me this question and I thought many of my readers might have the same question.

What Happened to the Dot-com Bubble?

When the dot-com bubble popped in March of 2000, the Nasdaq lost nearly 80% of its value over a two-year bear market stretch, and it took 15 years, that is, until 2015, for the Nasdaq to regain its previous high. As you can imagine, that was financially devastating for investors fully invested in the Nasdaq.

Are We in a Similar Bubble, Only Now Driven by AI?

It’s highly likely. As I write now, NVDIA’s market cap is over $5T. In other words, a company with + 36,000 employees is now valued higher than the entire GDP of Japan, an advanced country with a population of 140 million. If that’s not a sign of a bubble, what is?

Will It Pop Like the Dot-com Bubble and Wipe Out 80% of Its Value?

Read the rest of this entry »

Recently, I’ve noticed a recurring theme in my conversations with clients and friends: economic anxiety, even among those who are financially well-off.

Take, for example, a friend of mine who works at Meta. With total compensation exceeding $350,000, she’s comfortably in the top tier of American income earners. Yet a large house, a luxury car, and costly extracurriculars for her children mean she’s living paycheck to paycheck.

On top of that, her work demands are immense. Not only does she work standard office hours, but late-night meetings with overseas suppliers are a daily occurrence, leaving her burnt out and longing for a less demanding role. However, the thought of a pay cut and the lifestyle changes it would bring prevent her from exploring alternatives, even as her health suffers.

She recently came to me for a second opinion financial review. While I didn’t magically solve her issues overnight, I did provide clear direction. The relief she experienced was so tangible that she shared her experience with several Meta colleagues, all of whom reached out for similar guidance.

Read the rest of this entry »

Many successful individuals, often those who’ve risen from humble beginnings, find themselves in a high tax bracket while their parents remain in lower income brackets. They feel a strong desire to provide financial assistance to their parents. This article outlines a strategic approach to help family members financially while simultaneously optimizing tax outcomes.

Understanding the Tax Advantage

For high-income earners, long-term capital gains are typically taxed at 20%, with an additional 3.8% net investment income tax (NIIT) on those gains. However, a significant tax advantage exists for individuals with lower taxable incomes. If your parents’ taxable income is below $98,000 annually (in 2025), their long-term capital gains tax rate is 0%. Furthermore, if their Modified Adjusted Gross Income (MAGI) is less than $250,000—a threshold easily met if they qualify for the 0% capital gains rate—they are also exempt from the net investment income tax.

The Strategy: Gifting Appreciated Stocks

Read the rest of this entry »Imagine giving your child a head start that could turn them into a millionaire by retirement—without relying on an inheritance or a lucky lottery ticket. Thanks to the new Trump Account, a federal savings initiative launched for children born between 2025 and 2028, this dream can become a reality for proactive parents.

What Is the Trump Account?

The Trump Account is a government-backed investment plan that automatically provides every eligible newborn a $1,000 seed deposit from the U.S. Treasury. Parents, relatives, and employers can then contribute up to $5,000 each year until the child turns 18. All contributions are invested in a low-cost, diversified U.S. stock index fund.

How Does It Work?

Read the rest of this entry »The “GENIUS Act,” officially known as the Guilding and Establishing National Innovation in U.S. Stablecoins Act, represents a significant shift in the financial landscape. This legislation allows private entities, including banks, hedge funds, and technology firms, to issue payment US dollar stablecoins. This opens up a new frontier for financial transactions and investment opportunities.

What Are Payment US Dollar Stablecoins?

Payment US dollar stablecoins are cryptocurrencies designed to maintain a 1:1 value with the U.S. dollar. They are intended to facilitate seamless transactions with the stability of a traditional fiat currency.

Who is Eligible to Issue US Dollar Stablecoins?

Qualified issuers include subsidiaries of banks and nonbank companies that receive approval from the Office of the Comptroller of the Currency (OCC). A critical requirement for approval is maintaining a reserve that covers 100% of the stablecoin issuance. This reserve can consist of actual U.S. dollars or short-term Treasury bills with a maturity of less than 90 days.

Existing USD Stablecoins

The market already features several USD stablecoins. Tether’s USDT and Circle’s USDC are the two largest, with a combined market value of approximately $250 billion. The daily transaction volume of USD stablecoins exceeds $20 billion, primarily within the cryptocurrency ecosystem.

Intended Purposes of the Legislation

Read the rest of this entry »Longtime readers of my newsletter know that I am an advocate of comparing your portfolio to your wardrobe. When the market offers you a discount, you shouldn’t see your wardrobe/portfolio as losing value. Instead, you should see this as an opportunity to add to your collection of clothing items/investments.

I also like to explain that in your retirement, your well-being will depend not on past prices, but on the number of durable assets you own. Some of you might ask:

What is a durable asset?

In my mind, a durable asset is an asset that grows with humanity, independent of technology and politics.

A prime example of this is the global stock index fund. It includes nearly all traded stocks in both the US and international markets. It represents the total business value of humanity. As long as humanity exists and demands higher living standards, the total business value of humanity will increase.

Is an outstanding stock like AAPL a durable asset?

Read the rest of this entry »How to Deal With Big Market Drops

Posted on: April 7, 2025

Since April 2nd, the S&P 500 has dropped by 10.5%; and since its recent peak on February 19, it has fallen by 18.4%. How should we react to such significant market drops?

To answer this question, I want you to imagine that you bought all your clothes from Neiman Marcus and they are hanging (or sitting) in your wardrobe. Now imagine that Neiman Marcus announces an across-the-board 30% discount on all of their clothing items. Would you say “Damn, my clothes are now worthless” and sell them all at a flea market? You probably wouldn’t and might even make a trip to Neiman Marcus to buy a piece or two to add to your wardrobe.

Read the rest of this entry »Triffin’s Dilemma: The Privilege and The Curse of the Dollar As World Currency

Posted on: March 28, 2025

Following our series about academic research, today I will write about Triffin’s Dilemma, a theory proposed by Dutch economist Robert Triffin in the 1960s.

The theory postulates that the country that owns the world’s reserve currency will inevitably face a persistent trade deficit that will imperil the confidence in that currency.

The theory was originally tied to the Bretton Woods Accord after World War II, where the US dollar was pegged to gold, and the rest of the world’s were pegged to the dollar. In 1971, President Nixon announced the de-pegging of the dollar from gold, effectively, making the dollar a fiat currency that the government could “print” as much of as they wanted.

This is an exorbitant privilege that other countries do not enjoy. By this, I mean that no matter what problems our country faces, we can print our way out of trouble. The oversupply of the dollar would normally cause hyperinflation in our country, but since ours is the world currency, we can export our surplus dollars to the rest of the world by running a trade deficit.

Exporting dollars is a great business to have, since instead of goods, which requires costly manufacturing, dollars can be created by simply adding an entry into the Fed’s computer system. However, a side effect is, that nobody wants to invest in manufacturing and no young people want to work in factories. All smart kids want to be in finance, the industry that is closely related to money creation, allocation, and management. This has led to overfinancialization and the gradual deindustrialization of the country (See chart below.)

Read the rest of this entry »Continuing the streak of writing about the most prominent academic research papers on finance and investment, today I will write about “Returns to Buying Winners and Selling Losers,” which was published in 1993 in the Journal of Finance and is currently the third most highly quoted paper in history.

The authors, Narasimham Jegadeesh and Sheridan Titman, studied whether there is persistent money to be made by buying winners and selling losers, otherwise known as the momentum strategy. If the answer is yes, what is the best way to execute it?

They found that if one buys a portfolio of winners (stocks with the top decile returns in the previous 12 months) and sells a portfolio of losers (stocks with the bottom decile returns in the previous 12 months), and holds that for 3 months, one can achieve a return of 1.49% per month on paper. This is huge! This level of monthly returns translates into nearly 18% annual return.

Throughout my 20 years of giving financial advice, I have noticed that amateur investors love momentum strategy, while more mature investors shun it because they have learned the caveats.

So what are the caveats?

Read the rest of this entry »How To Pick Mutual Fund Winners

Posted on: January 27, 2025

In answer to my readers’ response to my survey last year, I will be writing a series of articles about academic research in the realm of finance, focusing on studies that are pertinent to us, the average investor.

Today, I am writing about the most cited research in the Journal of Finance. It’s written by Mark M. Carhart, and titled “On Persistence in Mutual Fund Performance”, published in 1997.

Why should you care?

Well, if the research were able to help us identify a few persistent winners among the more than 10,000 available funds, wouldn’t that make our investment life a lot simpler? We could hold only the winners and be done with it. Unfortunately, the research did not find any persistent winners. More precisely, other than a small momentum effect, the research found no evidence that any mutual fund has the ability to consistently outperform the market.

However, the research did find that mutual fund expenses and transaction costs are persistent predictors of underperformance. A 1% increase in expense ratio correlates to a 1.5% decrease in fund performance and a 1% increase in fund turnover results in a 0.95% decrease in fund performance.

Here are the three expenses or costs that you should especially watch out for.

Read the rest of this entry »How to Be A Resilient Investor

Posted on: January 12, 2025

Recently, Markus Brunnermeier, the president of the American Finance Association, gave a presidential address titled “Macrofinance and Resilience”. In this address, he introduced the concept of resilience, which he distinguished from risk. He admonished finance researchers and practitioners to change their focus from risk management to resilience management.

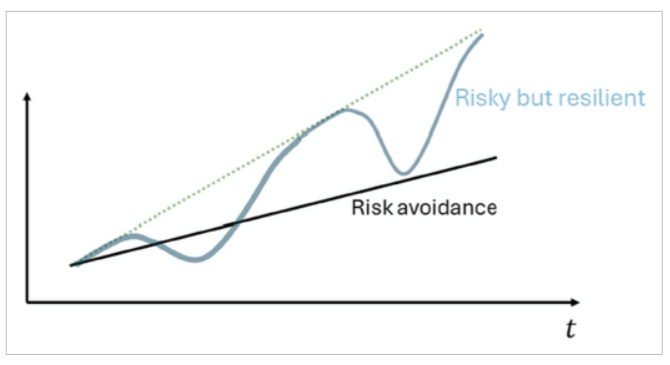

He defined resilience as systematic positive reactions to negative economic shocks. He used the following chart to illustrate the effect of resilience vs. risk avoidance.

Put into layman’s terms, if you are financially resilient, you can potentially take on more risk and earn higher rewards.

The concept of resilience can be applied to many areas, from personal finance to investing. Today let’s focus on investing and ask ourselves what it takes to be a resilient investor. Financial resilience has a much broader scope and will be covered in my next article.

I’d like to suggest a four-point approach to being a resilient investor:

Read the rest of this entry »This article was forwarded to me by a client of mine. It was written by Mr. David Karp, who asked seven questions regarding one’s relationship with their advisor. These are excellent questions! I will repost Mr. Karp’s questions and responses, along with my own answers in red and bold.

Besides our family members and close friends, few relationships in life are as important as that of client and wealth advisor … and long lasting. After all, your wealth advisor is trusted with the financial well-being of you and your family, hopefully for generations to come. A good wealth advisor does much more than just manage your investments. He or she will get to know you and your family, your hopes and dreams and the legacy you want to leave. It’s a holistic approach that should be wholly based on the best interests of you and your family.

So how do you evaluate a wealth advisor to ensure you partner with someone who can provide the comprehensive, yet highly individualized set of solutions you need and deserve? Below are seven questions to ask prospective wealth advisors:

Read the rest of this entry »- In: Life

- Leave a Comment

The eBook version of my book “Entrepreneur Wealth Management Made Easy” is now free! on Amazon for the next three days. Go get it: https://shorturl.at/xKa8z

Note that Amazon will try to lure you into subscribing to their KindleUnlimitedwith the first big yellow button “Read for Free”, avoid that. Click the second deeper yellow button “Buy now with 1-click” instead.

This is my New Year gift for all entrepreneurs out there. Please forward to your entrepreneur friends.

Get informed about wealth building, sign up for The Investment Scientist newsletter