Archive for October 2023

In this article, I want to show how, in the last 15 years, the Fed’s money supply has driven stock prices higher and higher and how this situation going to reverse.

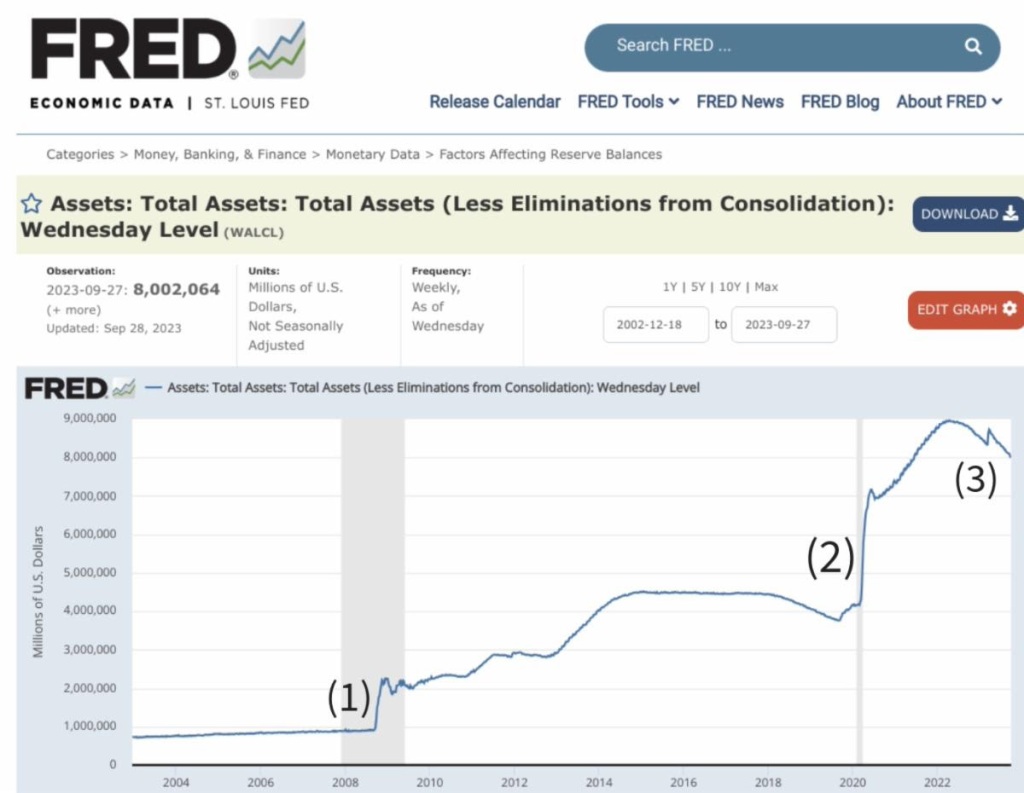

Prior to the 2008 financial crisis, the Fed kept the money in circulation in the economy relatively steady, just under $1T. Then the 2008 recession hit and to save the economy, the Fed began to “print” money. This action is given various lofty names like Quantitative Easing and Balance Sheet Expansion. The end result, however, was the same, about $1T was released into the economy. This is illustrated in spot (1) in the chart below.

A Federal Budgetary Hell?

Posted on: October 4, 2023

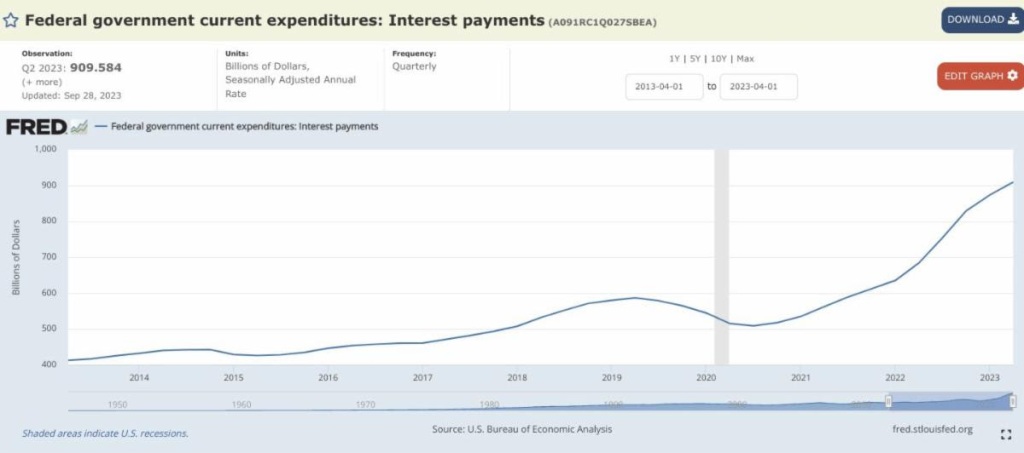

Two weeks ago, I wrote about the retirement income nirvana that is allowing retirees to finally get some serious income from their savings, starting with Treasury bills. The money that goes into retirees’ pockets has to come from somewhere, so let’s look at this chart produced by the Saint Louis Fed.

It shows the interest payments the federal government has made every year up to 2023. One can see that, ten years ago, the interest payments came to about $400 Billion. Today, it’s over $900 Billion! Now, it’s true that some of these payments are to other government agencies like the Social Security trust fund or the Medicare trust fund. Even after adjusting for that, the NET interest payments by the federal government rose from about $225b in 2014 to $700b in 2023.

The federal budget is a trainwreck waiting to happen – a disaster that would make the current government shutdown drama look like child’s play.

In 2023, the actual federal revenue is $4.3 Trillion, but the federal expenditures total $6.2 Trillion, resulting in a budget deficit of nearly $2 Trillion. Since the government is short of this money, they have to borrow it.

How does the government spend money?

Read the rest of this entry »