Archive for June 2014

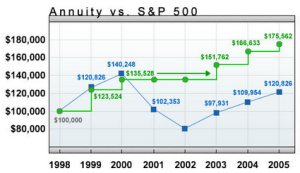

Financial author Allan Roth once wrote an article called “Investment Trick – Annuity Style” where he asks a rhetorical question, “If the S&P 500’s total return is 12% in a given year, what do you think your equity index annuity (that is supposed to track the S&P 500) would return”?

- 10%

- 8%

- 5.4%

- 3.4%

Allan Roth goes on to explain why the correct answer is 3.4%. Boy, was he wrong! Read the rest of this entry »

A client of mine bought a fixed rate annuity a few years ago. She was told by the agent that it’s just like a savings account, only with a higher interest rate of 3%.

A client of mine bought a fixed rate annuity a few years ago. She was told by the agent that it’s just like a savings account, only with a higher interest rate of 3%.

Recently, we took the money out in favor of a better investment, and boy was she in for a shock! There was a $17k surrender charge and nearly $3.6k in tax withholdings. All the interest she supposedly earned in the annuity went to the surrender charges, and now she has to pay income taxes on that interest!

Here is why a fixed rate annuity is nothing like a savings account.

1. A savings account is FDIC guaranteed, in other words, it has the full faith and credit of the US government behind it. A fixed rate annuity is NOT FDIC guaranteed, it only has the credit of the issuing company behind it. Think AIG! Read the rest of this entry »

Many people keep their bad annuity investment because it imposes a stiff surrender charge. This is a stereotypical example of sunk cost fallacy, an academic term which describes people throwing good money after bad.

Many people keep their bad annuity investment because it imposes a stiff surrender charge. This is a stereotypical example of sunk cost fallacy, an academic term which describes people throwing good money after bad.

Why surrender charges are sunk costs?

Imagine you were sold a $100k variable annuity with a ten year surrender period. The agent who sold you the contract collected a 10% commission, or $10,000. Where do you think this money came from?

Bingo! Your pocket. I hate to break it to you, but insurance companies are not in the charity business and they sure as heck aren’t gonna tell you that 10 of the 100Gs you just handed over to them are going to pay the agent’s commission! If they did that you’d pull your money out and rightly avoid them like the plague in the future.

Variable Annuity: Bad Investment!

Posted on: June 5, 2014

Recently I was approached by two prospective clients. The husband is a very successful entrepreneur and they are also very frugal. As the result of that, they have accumulated substantial wealth – north of $5mm.

Recently I was approached by two prospective clients. The husband is a very successful entrepreneur and they are also very frugal. As the result of that, they have accumulated substantial wealth – north of $5mm.

The only problem? all of that money is in about 28 variable annuities they purchased over the years. In examining these variable annuities, I turned up the following problems:

1. Horrible returns

For each variable annuity, I was able to calculate its annualized return.

Out of the 28 variable annuities, only two have annualized returns above 4%. Seven have annualized returns between 3% and 4%. Six have annualized returns between 2% and 3%. The rest (13 of them) have returns less than 2% including a few that have negative returns. The average annualized return? 2.12%. Not enough to beat inflation!

2. Horrible surrender charges

There is this one annuity they purchased from Jackson National Life in 2007 for $200k; today it has grown to a “value” of $245k, but if they should cash it out, they would only get $221k since there is a surrender charge of $24k. After seven years, there is still a surrender charge of 12%! This is just horrible! Read the rest of this entry »