Archive for October 2022

The Durable Asset: My Answer

Posted on: October 16, 2022

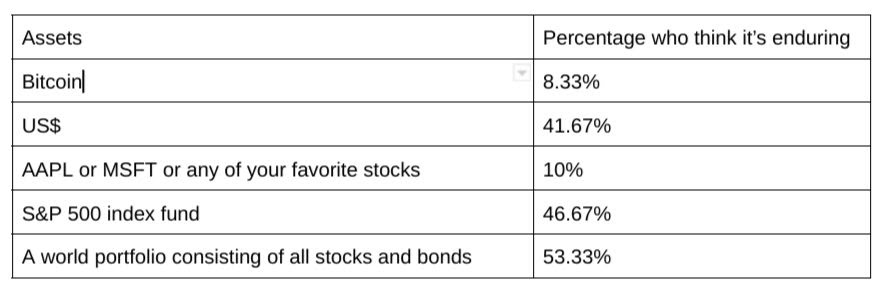

Thank you for all the responses to my last survey. Here is the breakdown of your answers – the table below shows the percentage of you who think the specific asset is an enduring asset.

Bitcoin is not an enduring asset. The so-called cryptocurrency is neither used for any meaningful exchange, the primary function of a currency, nor is it safe from hacking or outright bans from governments.

Read the rest of this entry »My last newsletter illustrated an actual example of a client portfolio that had fallen 17% in value over the previous 12 months. Despite that, the portfolio’s projected income had increased by 10%.

This client’s portfolio is a 50/50 portfolio, with 50% in bond funds and 50% in stock funds. The same factor that drives the portfolio value’s fall also drives the increase in income. The factor I’m talking about is the long-term interest rates.

Don’t mistake this for the Fed’s interest rate hike. The Fed only controls the overnight Fed fund rate, it does not control the long rates like the 5-year rate, 10-year rate, etc. It is the market that sets the long rates. When the market believes that the Fed needs to tighten up a lot more to control inflation, long rates increase across the board, causing both stock and bond values to fall. (If the central bank will pay high overnight interest long into the future, all existing investments become less valuable.)

Read the rest of this entry »