What Hidden Costs a Portfolio Review Can Reveal

Posted on: August 23, 2024

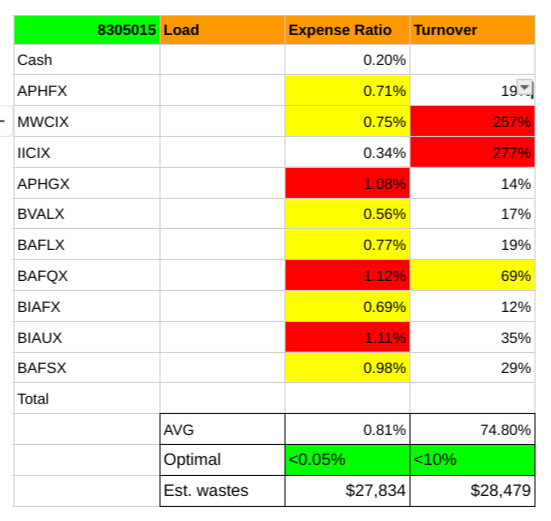

This morning, I did a portfolio review for a 2nd Opinion Review customer. It is a portfolio worth just under $4mm and I found $56k of hidden costs per year.

Load is the least hidden of all hidden costs, it is a one-time charge that happens when the broker (“financial advisor”) puts your money in a mutual fund. The mutual fund immediately takes a percentage of your money and gives it to the broker as commission. Since this is too obvious, few brokers are that blatant these days.

Expense ratio is the percentage the fund deducts from your investment, and part of this deduction is given to the broker as a kickback. It is even more costly since it occurs every year. It creates an adverse incentive, since the broker is more inclined to put your money in funds that give them a higher kickback. The gold standard of expense ratio is 0.05%. Note that many funds in this analysis have an expense ratio over 1%, over twenty times more expensive than the gold standard.

Turnover measures how frequently the fund manager churns your investments. The more frequent the churn, the more money you lose and the more money the brokerage that handles the trades makes. The gold standard of turnover is less than 10%. If a fund has more than 100% turnover, it belongs in the category of horrible, since 100% equates about 1.2% loss of return.

See below the result of the portfolio review. Numbers in yellow are bad, numbers in red are outright horrible. Compare these numbers to the numbers in green, which is our gold standard.

If you work with a broker as your financial advisor, there is an extremely high chance you are giving away money without even being aware of it. I strongly recommend you take advantage of my 2nd Opinion Review to find out how much you are paying unnecessarily.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment