Archive for January 2025

How To Pick Mutual Fund Winners

Posted on: January 27, 2025

In answer to my readers’ response to my survey last year, I will be writing a series of articles about academic research in the realm of finance, focusing on studies that are pertinent to us, the average investor.

Today, I am writing about the most cited research in the Journal of Finance. It’s written by Mark M. Carhart, and titled “On Persistence in Mutual Fund Performance”, published in 1997.

Why should you care?

Well, if the research were able to help us identify a few persistent winners among the more than 10,000 available funds, wouldn’t that make our investment life a lot simpler? We could hold only the winners and be done with it. Unfortunately, the research did not find any persistent winners. More precisely, other than a small momentum effect, the research found no evidence that any mutual fund has the ability to consistently outperform the market.

However, the research did find that mutual fund expenses and transaction costs are persistent predictors of underperformance. A 1% increase in expense ratio correlates to a 1.5% decrease in fund performance and a 1% increase in fund turnover results in a 0.95% decrease in fund performance.

Here are the three expenses or costs that you should especially watch out for.

Read the rest of this entry »How to Be A Resilient Investor

Posted on: January 12, 2025

Recently, Markus Brunnermeier, the president of the American Finance Association, gave a presidential address titled “Macrofinance and Resilience”. In this address, he introduced the concept of resilience, which he distinguished from risk. He admonished finance researchers and practitioners to change their focus from risk management to resilience management.

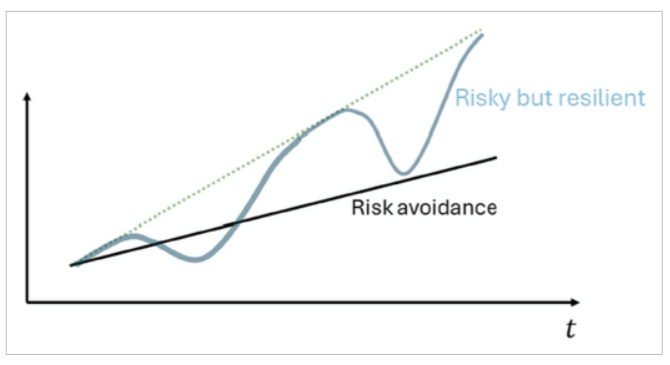

He defined resilience as systematic positive reactions to negative economic shocks. He used the following chart to illustrate the effect of resilience vs. risk avoidance.

Put into layman’s terms, if you are financially resilient, you can potentially take on more risk and earn higher rewards.

The concept of resilience can be applied to many areas, from personal finance to investing. Today let’s focus on investing and ask ourselves what it takes to be a resilient investor. Financial resilience has a much broader scope and will be covered in my next article.

I’d like to suggest a four-point approach to being a resilient investor:

Read the rest of this entry »