Archive for the ‘Economics & Markets’ Category

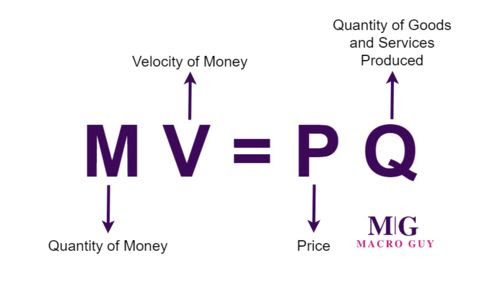

In a previous article, I used the Quantity of Money equation to explain what the Fed had done to rescue the economy from imminent collapse at the onset of the Pandemic. Today I will explain why doing that caused inflation and why that inflation is not unlikely to be transitory unless certain things happen.

I learned this “Quantity of Money” equation during my Oxford program and it has greatly helped me understand Fed’s actions and their implications.

I am writing this article one hour before today’s market close. If there are no surprises, the S&P 500 will end the day in a bear market, meaning the index is giving us a 20% discount from its peak. As a comparison, the Nasdaq is already giving us a 30% discount.

As savvy investors, many of my clients and readers want to know: will the discount get deeper? And how long will the discount last? Well, like I always say, nobody can predict the future, but we surely can learn from history. That’s why I have done a study of all twelve bear markets since 1950. The table below illustrates my findings:

Read the rest of this entry »If you bought a bond fund three months ago, you may have seen your fund go down about 10% in value! What the heck is going on? Aren’t bond funds supposed to be safe? In today’s newsletter, I will explain what’s going on, I will explain why you should still consider your bond funds safe, and I will even give you some hidden upsides of bond funds going down in value.

What’s Going On?

Last month we saw interest rates rallying. Bonds are essentially fixed future promised payments. The current value of a bond is the sum of all fixed payments discounted by interest rates. When interest rates go up, it stands to reason that, applying the mathematical formula, the current value of the bond will go down. This mathematical logic applies to all bond funds.

From the peak, Nasdaq is down about 24% and the S&P 500 is down about 14%. I am sure when you read your investment statement, you will feel queasy and wonder if you should stay invested. I think this is a good time to review my wardrobe theory of investment. Here is what I wrote in December 2018:

Treat your investment portfolio the same way you would treat your wardrobe…

For simplicity’s sake, let’s say you acquire your entire wardrobe from Neiman Marcus. If Neiman Marcus had an across-the-board 50%-off sale, would you throw up your hands in despair and say, “Darn it, my entire wardrobe just lost half of its value. I better sell it all at the flea market or I will lose everything?”

Read the rest of this entry »The Ukraine War and Inflation

Posted on: April 13, 2022

The US inflation numbers for March just came out – it’s 8.5%, another 40-year high. I am afraid that, with the Ukraine War still raging, inflation will get worse before it gets better.

Shortly after the Russian Invasion of Ukraine, the West adopted the “Nuclear Option” of economic sanctions – expelling Russia from the SWIFT system. SWIFT is the payment system that undergirds international trades. Now that Russia is no longer part of this, it can not sell its energy and agricultural products to the world market.

How Would That Affect Global Commodity Prices?

Russia is one of the top three exporters of the following commodities: oil and gas, wheat, maize, sunflower seeds, sunflower oil, and fertilizers. On average it accounts for about 15% of world supplies. When these supplies are pulled out of the global market, the price of these commodities will skyrocket as they already have. Since these are basic commodities, and many products use them as inputs. The price shock is going to filter through downstream products as well.

In the face of rising uncertainties and the prospect of persistent inflation, today I investigated the historical performance of stocks and gold relative to inflation. Here is what I found:

Read the rest of this entry »Over the last few days, I have begun to sense that a number of my clients are worried since the S&P 500 has dropped 13% and Nasdaq, about 20%.

I would like to argue, if you are going to worry about something, please worry about the inflation rate, which just went up to 7.9% in February even before Russia’s invasion of Ukraine.

Why is inflation so much more damaging?

You could have kept your money in a safe, and yet you still lost 7.9% to inflation in one year. If this level of inflation keeps going for ten years, you will lose 79% of the value of your money. That’s basically a wipeout.

Last Thursday when the news reported that Russia had just launched an invasion of Ukraine, the market opened down nearly 800 points. A client called to ask if we should move to safety, but I was able to persuade him to stay put. I did that without knowing that the stock market would end the day slightly positive, followed by the BEST rally since 2020 on Friday. Such is the unpredictable nature of the stock market. Today I am gonna show you, missing the best days of the market can be extremely costly.

Below is research from JP Morgan that I found on the internet. You can see that between 1995 and 2014, the annual return of the S&P 500 is 9.85% if invested through the whole duration. But missing just the 10 best days would drop the annual return to only 6.1%. Missing the 20 best days would drop the annual return to 3.62%. Missing the best 30 days would further drop the annual return to only 1.49%.

Read the rest of this entry »Yesterday, when I had a lunch meeting with the chief scientist at Fannie Mae, our conversation quickly turned to inflation.

My view of that is more pessimistic than the Fed and most mainline economists. Somehow, these economists seem to have forgotten a basic economic tenet – the rational expectation theory. This theory, to put it in layman’s terms, basically says that on aggregate, what people expect to happen will happen. That’s why Fed officials have long been extremely careful about what they say that could change people’s expectations.

Today’s Fed under Jerome Powell has been much less careful. Here are the three acts of the current Fed that have crushed the expectation that inflation will stay low and stable.

Read the rest of this entry »Fed Accelerates Tapering

Posted on: December 22, 2021

In my last newsletter article, I explained what tapering means and how that would affect the market. At the end of the article, I opined that the Fed’s leisurely pace of turning off the money spigot may not be enough to turn the tide of inflation.

It now appears the Fed agrees with me. The latest announcement from the Fed has dropped the word “transitory”, signaling its recognition that inflation is here to stay. Not only that, but the Fed’s taper timetable has been expedited. The original plan was $15B less money “printed” every month, with July being the month that money printing will come to an end. The new timetable is to end money printing by March. After that, the Fed plans to raise interest rates three times.

The Fed is the banker for banks. When the Fed raises interest rates, banks have less incentive to lend out money since they could easily make a profit by just parking their money with the Fed. This is the traditional way of reducing the amount of money in circulation.

Read the rest of this entry »Recently, Fed Chairman Powell signaled that the Central bank will begin the process of “tapering”, and in fact may speed up the process given the recent inflation reports. What does that mean? How would that affect investors?

A little bit of background

Since the onset of the pandemic, the Fed has engaged in “unlimited” quantitative easing, a euphemism for money creation. The money base has ballooned from about $4T to $7T. (T here means trillions.) In other words, about $3T worth of new money was created. As of right now, this process has not stopped. Every month, another $120B is being created. (B here means billions.)

Where did all that money go?

This torrent of money is rushing into all manners of markets: stocks, bonds, commodities, real estate, crypto, labor and even our daily groceries, making all prices go up, though to differing degrees and extents. As investors, we all benefit from the Fed’s action, however, as consumers, we will suffer, if we are not already.

Inflation Change and Stock Return

Posted on: May 27, 2021

Last week, I wrote an article on inflation and stock returns. This week I will continue the theme but study it from a different angle.

Specifically, last April the inflation rate was 0.3%, but this April it was 4.2%. In one year’s time, the inflation rate has gone up nearly 4%, what does that portend for the stock market? Again, Taro helped me run the numbers and we came up with this scatter plot relating inflation changes to stock returns. Please look at it and see if you can draw some inferences yourself.

Inflation and Stock Return

Posted on: May 20, 2021

Since I started investment management fifteen years ago, I can’t recall a time when the risk of inflation is as pronounced as it is today. Since the onset of the pandemic, the Fed has created $5 trillion worth of money. Now, as the economy is reopening, the torrent of money is gushing into circulation, lifting inflation to 4.16% in April alone and possibly higher down the road. How the market behaves is our study today.

I asked Taro to look up Bob Shiller’s dataset and Kenneth French’s dataset and run a correlation analysis of stock returns vs inflation. Here is the result in a chart along with my observations.

This May End In A Lot Of Tears

Posted on: February 1, 2021

I promised to continue the GameStop story so here I am. Let me first explain why the broader market dropped about 3% to 4% while the GME frenzy was going on. Remember in the last article, Melvin, a name I will use to denote all the hedge funds that shorted GME, needed about $1.3 billion when GME prices rose from $20 to $30. When GME prices shot up to $420, Melvin needed $55 billion to meet the margin call. Where would they get the money? Well, they could sell other stocks they hold. This mass liquidation led to a small drop in the market. Should long-term investors worry? The answer is no, since a liquidity shock like this has no lasting effect. But the saga does reveal a flaw in the system that we weren’t aware of before. More about that later.

Now in this pitched battle between the retail traders centered around Wall Street Bets and the hedge funds, I am afraid this will end badly for the retail traders. Yes, a few of them may benefit handsomely, turning $50k into $20mm as some of the stories go, but the majority of them who joined the battle when prices crossed $200, $300, and $400 may lose everything. In the end, prices will come back down to the stock’s fundamental value which is likely in the single or low double digits. After all, Melvin was not stupid.

Read the rest of this entry »The GameStop Story

Posted on: January 31, 2021

Before I tell the story, let’s get a few concepts clear.

Short Sell (short) means selling shares you don’t actually own. Instead, you borrow them from the brokerage to sell, but you have to buy them back at some point in the future, hopefully at a lower price, to pay back the brokerage shares you owe. To guarantee that you have the money to buy back shares you owe at all times, the brokerage requires you to have a maintenance margin of 130% of the value of the shorted shares to keep the position open. If you fall under the margin requirement, you will get a margin call to post additional money. Should you fail that, the brokerage will close your positions. This is done by buying shorted shares in the market using your money in the margin account. This forced action can cause a short squeeze. I will give you the definition with an actual example of GameStop (GME).

Just two weeks ago, GME was being traded at around $20. Some big hedge funds like Melvin Capital (Melvin), thought it should be worth only $5, so they began to short the stock. At one point, the short interest ratio, the number of shorted shares relative to the number of outstanding shares, was 140%. Since GME has about 70 million shares outstanding, Melvin shorted nearly 100 million shares of GME. Apparently, a portion of those shares was borrowed and sold twice.

Read the rest of this entry »