Archive for the ‘Investor Behavior’ Category

Recently, I’ve noticed a recurring theme in my conversations with clients and friends: economic anxiety, even among those who are financially well-off.

Take, for example, a friend of mine who works at Meta. With total compensation exceeding $350,000, she’s comfortably in the top tier of American income earners. Yet a large house, a luxury car, and costly extracurriculars for her children mean she’s living paycheck to paycheck.

On top of that, her work demands are immense. Not only does she work standard office hours, but late-night meetings with overseas suppliers are a daily occurrence, leaving her burnt out and longing for a less demanding role. However, the thought of a pay cut and the lifestyle changes it would bring prevent her from exploring alternatives, even as her health suffers.

She recently came to me for a second opinion financial review. While I didn’t magically solve her issues overnight, I did provide clear direction. The relief she experienced was so tangible that she shared her experience with several Meta colleagues, all of whom reached out for similar guidance.

Read the rest of this entry »Longtime readers of my newsletter know that I am an advocate of comparing your portfolio to your wardrobe. When the market offers you a discount, you shouldn’t see your wardrobe/portfolio as losing value. Instead, you should see this as an opportunity to add to your collection of clothing items/investments.

I also like to explain that in your retirement, your well-being will depend not on past prices, but on the number of durable assets you own. Some of you might ask:

What is a durable asset?

In my mind, a durable asset is an asset that grows with humanity, independent of technology and politics.

A prime example of this is the global stock index fund. It includes nearly all traded stocks in both the US and international markets. It represents the total business value of humanity. As long as humanity exists and demands higher living standards, the total business value of humanity will increase.

Is an outstanding stock like AAPL a durable asset?

Read the rest of this entry »How to Deal With Big Market Drops

Posted on: April 7, 2025

Since April 2nd, the S&P 500 has dropped by 10.5%; and since its recent peak on February 19, it has fallen by 18.4%. How should we react to such significant market drops?

To answer this question, I want you to imagine that you bought all your clothes from Neiman Marcus and they are hanging (or sitting) in your wardrobe. Now imagine that Neiman Marcus announces an across-the-board 30% discount on all of their clothing items. Would you say “Damn, my clothes are now worthless” and sell them all at a flea market? You probably wouldn’t and might even make a trip to Neiman Marcus to buy a piece or two to add to your wardrobe.

Read the rest of this entry »How to Be A Resilient Investor

Posted on: January 12, 2025

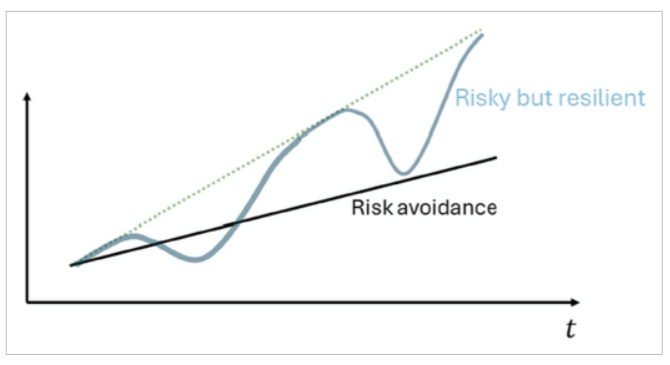

Recently, Markus Brunnermeier, the president of the American Finance Association, gave a presidential address titled “Macrofinance and Resilience”. In this address, he introduced the concept of resilience, which he distinguished from risk. He admonished finance researchers and practitioners to change their focus from risk management to resilience management.

He defined resilience as systematic positive reactions to negative economic shocks. He used the following chart to illustrate the effect of resilience vs. risk avoidance.

Put into layman’s terms, if you are financially resilient, you can potentially take on more risk and earn higher rewards.

The concept of resilience can be applied to many areas, from personal finance to investing. Today let’s focus on investing and ask ourselves what it takes to be a resilient investor. Financial resilience has a much broader scope and will be covered in my next article.

I’d like to suggest a four-point approach to being a resilient investor:

Read the rest of this entry »Stock market sentiment refers to the overall sentiment of investors towards the stock market. This sentiment can be either positive or negative, indicating whether investors are optimistic or pessimistic about the future direction of the market.

There is a lot of evidence that stock market sentiment is a contrarian indicator of future market returns. Let me cite a few recent examples.

- When Covid hit the US in March of 2020, the entire market was gripped with fear and there was panic selling. Since then, however, the market has nearly doubled.

- In February of 2022 when the Ukraine War broke out, European markets also experienced panic selling. It was rumored that billions upon billions of dollars were moved from Europe to invest in the US market. Who would have thought that by the end of 2022, European markets would have higher returns than the US market?

- In March of this year, the US experienced two of the largest bank collapses in history. Some of my clients sent me doomsday articles and asked me if they should pull all their money out of the market just to be safe. Since then, the market has gone up around 20%.

In fact, this phenomenon has been rigorously studied. The chart below details the research results of Harvard Professor of Business Administration Malcolm Baker and NY University Nomura Professor of Finance Jeffrey Wurgler. Here you can see that across all market capitalizations (that is regardless of large stocks or small stocks) the negative sentiment leads to better subsequent one-year returns than the positive sentiment.

Read the rest of this entry »It happened when she still lived in China. One day she telephoned me, saying that a friend from her church told her about a fantastic investment opportunity. A brother in Christ had an ingenious business idea; he would buy water ponds, set them up for fish farming and sell his daily yield to restaurants for profit. He promised great returns. To get it going, he needed to borrow money with an annual interest rate of 36% (or 3% monthly.) He also wanted to keep this lucrative opportunity exclusively for fellow believers. My mom’s friend further testified to her that she had invested $10k and had already received her monthly interest, which she promptly invested back into the enterprise upon advice of this fellow Christian.

I told my mother to stay away from such a scheme since it made neither economic sense nor incentive sense – see my previous article.

My mom countered with these arguments:

Read the rest of this entry »Three weeks ago, in the middle of the Silicon Valley Bank saga, some of my clients got really panicky because they read predictions that we would soon see a total banking system collapse.

At the time, I advised sitting tight and, if indeed the market should fall, using this chance to buy durable assets at a discount. I know full well how messed up the system is, but I also know that as long as the US dollar remains the world currency, there is unlimited ammunition to deal with the problem. We are not Zimbabwe or Argentina.

And that is exactly what happened (see the Fed balance sheet here.) In the three weeks since the SVB collapse, the Fed has printed nearly $400B of new money, reversing 2/3 of the tightening we have seen since March of 2022. In other words, since the Fed decided to fight inflation in March of 2022, about $600B has been unprinted (this compared to $5T that was printed after the Pandemic.) However, in just a short three-week time, $400B was printed to rescue weak banks.

Read the rest of this entry »In a previous article, I argued that for folks in the wealth accumulation phase, market discounts like we are getting now, between 22% of the S&P 500 and 33% of the Nasdaq, are actually good news. The same amount of money can now buy more enduring assets. And yes, owning more enduring assets in retirement is absolutely better than owning fewer! In the future, I shall write another article about what constitutes enduring assets (#). But back to the current topic.

I got an email from a retired client of mine, who asked: “What about me? I am past the accumulation phase. I need to draw a fixed income from my portfolio, and I just saw it shrink by nearly 20%.” We did a review of his portfolio, afterward, he felt much more reassured.

Did I do some kind of magic trick? No, I simply showed him what was hidden in his portfolio statements. I compared not just the value of his portfolio, but also his projected yearly portfolio income between August of last year to this August. Here is the comparison table.

Read the rest of this entry »From the peak, Nasdaq is down about 24% and the S&P 500 is down about 14%. I am sure when you read your investment statement, you will feel queasy and wonder if you should stay invested. I think this is a good time to review my wardrobe theory of investment. Here is what I wrote in December 2018:

Treat your investment portfolio the same way you would treat your wardrobe…

For simplicity’s sake, let’s say you acquire your entire wardrobe from Neiman Marcus. If Neiman Marcus had an across-the-board 50%-off sale, would you throw up your hands in despair and say, “Darn it, my entire wardrobe just lost half of its value. I better sell it all at the flea market or I will lose everything?”

Read the rest of this entry »I gained a lot from my Oxford experience. Some of the gains are for me personally, some of the gains are for my business, and yet others can help me better serve my clients. I would count the latter as my clients’ gains.

The biggest gain undoubtedly came from Professor Sussman’s macroeconomics class. There I learned all the intricacies of macroeconomics, including how monetary policy is conducted. The class helped me understand a language called “Fed speak.” For instance, in March last year, when the entire stock market was in a tailspin, the Fed came out with an announcement of “unlimited” QE. The me without the Oxford education would have not understood what that meant. But alas, after the macroeconomics class, I knew exactly what the Fed was planning to do and understood its implications for the market. Thus in the depth of market despair, I was confidently rebalancing my clients’ money into stocks. Sure enough, the market snapped back quickly and has been rising ever since.

Back then I wrote a newsletter article where I informed you:

Read the rest of this entry »This is an article I wrote fourteen years ago almost to the exact day. Here I repost it without changing one word. I do make a few additional comments with red letters.

On July 17th, the S&P 500 reached its peak after breaking a string of records. In a two week time however, both the S&P 500 and the Nasdaq Composite have lost 7.7%. The index that represents smaller stocks suffered a bigger loss of more than 10%. Are you feeling any pain and anxiety? I know I am.

The market is breaking new highs, but it can turn on a dime. Understanding how you will feel in a falling market is very important.

Before I talk about how I deal with the pain and anxiety arising out of the market tumble, I’d like to first talk about Equity Premium Puzzle and Myopic Loss Aversion. These are weighty academic terms, but they would help us understand our psychology and how it could drive us to do stupid things.

Read the rest of this entry »Today I finally finished the Oxford class on Private Equity, and I’d like to share with you, my readers, some of my takeaways.

Long-time readers of my newsletter should know that I have long advised against investing in private investments unless 1) you know the business and 2) you have a measure of control. The reason for this is that private investments are not under the purview of the SEC, and thus provide a fertile ground for conflict of interest. After the Oxford course on private equity, I feel completely vindicated.

Some of my readers, if you are wealthy enough, will be approached with private equity investment opportunities. You will be presented with mouth-watering return numbers. My professor called these numbers complete “garbage,” they can be manufactured (but not fabricated.) Fabricating numbers is against the law, but manufacturing numbers is not, and there is only a hair’s breadth separating them. Next time you see a number like 36.8% annual return, think “manufacturing” and don’t waste your time! I will show you how they manufacture numbers in the next article.

Read the rest of this entry »I wrote this article in 2007. It’s every bit as valid today as 14 years ago.

I am an amateur pilot. I remember vividly an episode that happened during my training a few years ago. That was a very windy day. Up to that point, I had only experience flying in calm weather. As soon as my Cessna took off, I immediately felt the difference. My plane was tugged and pulled in all directions by crosswinds. I felt like I was losing control of the plane, and fear swelled up from the bottom of my spine to the top of my head. I sat stiffen in the pilot seat and my sweaty palms grabbed tightly at the control handles like a sinking person grabbing onto a straw.

My trainer sensed my tenseness and she asked: “Are you OK?”. Not willing to acknowledge my fear, I asked her instead: “Is it more dangerous to fly in turbulent weather like this?” The trainer smiled and said: “It is not more dangerous to fly in turbulent weather. The plan was built to withstand any turbulence. But occasionally, an amateur pilot would lose his cool and do something stupid. That’s the real danger.”

Read the rest of this entry »Berkeley professor Terry Odean published an interesting paper in the Quarterly Journal of Economics in 2001 about how men and women invest differently. It was an empirical study based on stock transaction data in tens of thousands of accounts over a seven year period provided by a brokerage firm.

These investment accounts were either opened by a man or a woman, and were single or joint accounts. Thus there were four account types. An interesting phenomenon emerged from the study: the more a man is in control of an account, the worse the performance. (See net return vs benchmark.)

Here the benchmark is not any composite index, it is simply the return that resulted from no trades being made throughout the whole year.

Intelligent Ignorance Is Bliss

Posted on: April 3, 2020

Allow me to indulge in a bit of fancy. I would love to be remembered as the person who invented the oxymoron “Intelligent Ignorance.” By the end of this essay, I hope to convince you that intelligent ignorance can make you a better investor.

Allow me to indulge in a bit of fancy. I would love to be remembered as the person who invented the oxymoron “Intelligent Ignorance.” By the end of this essay, I hope to convince you that intelligent ignorance can make you a better investor.

Like the other oxymorons “jumbo shrimp”, “pet peeve”, “bloody awesome” etc., this one needs a story as well. It all started with Nobel Prize winner Daniel Kahneman’s discovery that we humans experience joy when making money and pain when losing money – Duh! Hold on, keep on reading, there’s more. The pain is usually twice as intense as the joy even if the amount of money lost or gained is the same. This means that if you pay too close attention to a volatile market, it could be a hell of bad experience. Bad experiences lead to bad judgments and before long you are making bad trades.

Allow me to ask you a seemingly unrelated question: what do you think the most common hair color in Ireland is? If you answered red, you are like the majority of people, but you are also wrong. The most common hair color in Ireland is dark brown (80%.)

Allow me to ask you a seemingly unrelated question: what do you think the most common hair color in Ireland is? If you answered red, you are like the majority of people, but you are also wrong. The most common hair color in Ireland is dark brown (80%.)

As you answered that question, what went through your mind? What mechanism caused you to arrive at the wrong answer? How is it relevant to stock market investing? I will answer these questions one by one in the space below.

If you answered red, you were using a mental shortcut called the representative heuristic to answer the question. What is the representative heuristic, exactly? It essentially says we humans tend to erroneously equate what is representative to what is likely. Indeed, red hair is representative of Irish people. Just under 10% of the Irish are redheads, compared to 1% of the rest of Europe. So the typical Irish in your head is a redhead, probably wearing green clothes and holding a pint of Guinness. Since you can easily recall a redhead Irish in your mind, you think therefore that the Irish are more likely to be redheads.