Posts Tagged ‘inflation’

Last week I published a newsletter article titled “Will The Stock Market Return to The Fundamental?” I have received a good number of responses, and as promised, today I will share my thoughts.

The traditional economic theory has always presumed that economic actors are calculating and rational. The application of this presumption in the investment field is the efficient market hypothesis, which basically says that investors rationally pay the prices for expected future earnings adjusted for risk. The biggest proponent of the efficient market hypothesis is Nobel Prize winner Eugene Fama.

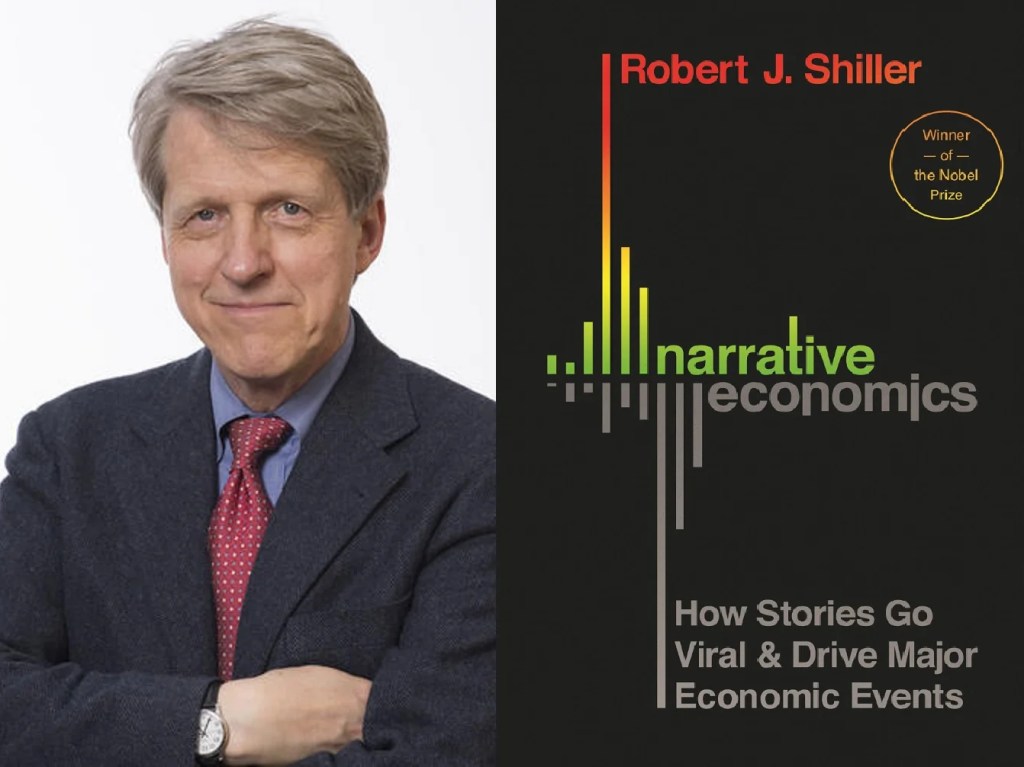

The efficient market hypothesis has its biggest opponent in Robert Shiller, who years ago published his seminal work that illustrated how a 1% change in dividends can oftentimes result in a 15% change in the stock price. If investors are, in fact, calculating and rational, stock prices shouldn’t fluctuate so much relative to dividends.

Read the rest of this entry »America’s national debt is spiraling out of control. It’s at $34.4T right now and is increasing at a rate of $2T per year. Today I am going to prognosticate what will likely happen and what it will mean for us investors.

To make the projection, I will assume things will stay largely as they are:

- Inflation around 4%

- Interest rate about 5%

- Budge deficit around at $2T

At this rate, in five years, the total federal debt will be over $44T. At an average interest rate of 5%, the total interest payments in the federal budget will be $2.2T. In 2023, the total federal tax revenue came at only $4.6T. In other words, in five years or so, the interest payments alone will amount to nearly half of the federal tax revenue.

With a budgetary shortfall at that level, there will be no other option but to “print’ more dollars. Today I will not discuss the mechanism of printing money. Suffice to say that printing money will lead to inflation and inflation necessitates that the Fed keeps the Fed fund rate high.

Read the rest of this entry »[Adapted from my Morningstar contribution] A year ago this month, after a trip to China I wrote ominously about inflation hitting the US economy like a tsunami.

My opinion was based on two observations:

- China’s labor costs were galloping at a 20% to 30% clip per year, and so much of what we consume is produced in China now.

- The Fed was printing money like crazy.

So far I have been wrong. The February 2011 inflation rate was 2.11%; though a slight uptick from 1.63% in January, it was by no mean a tsunami. Recently, Fed Chairman Ben Bernanke testified before the Senate Banking Committee that the Fed projects an inflation rate of less than 2% for the next 3 years.

When China runs out of cheap labor

Posted on: April 22, 2010

China has 1.3 billion people. In the last two decades, it is the source of seemingly limitless supplies of cheap labor to the world’s manufacturing industries. Believe it or not, this pool is about to run dry. When that happens, there will be huge implications for the world.

Even before my trip to China, I had read with incredulity that China’s exporting provinces are experiencing severe labor shortages requiring firms to raise wages 20%–30% just to keep the workers they have. My first stop in China was Shenzhen, a city that is home to Walmart’s worldwide procurement center. I stayed in the Evergreen Resort, a facility owned and operated by my friend Mr. Lin.

Inflation is the silent killer of wealth. It does not have the “bark” of a full-blown financial crisis, but it certainly has the “bite.” Just imagine if the inflation rate is 4% over the next 10 years; within a decade you would lose nearly 40% of your wealth if you didn’t do anything about it.

Inflation over the next decade is highly probably because of two simple macro realities:

- America – from the federal government to the states down to individual households – is heavily in debt. The easiest way to get out of debt is to print money. There is a tremendous political incentive to do so.

- China, which has been the low-price setter for the past two decades, has seen labor costs galloping at a 20% to 30% annual clip lately (thanks to the one-child policy). Before long, that will translate into higher prices at your local Walmart.