Posts Tagged ‘investment’

How to Be A Resilient Investor

Posted on: January 12, 2025

Recently, Markus Brunnermeier, the president of the American Finance Association, gave a presidential address titled “Macrofinance and Resilience”. In this address, he introduced the concept of resilience, which he distinguished from risk. He admonished finance researchers and practitioners to change their focus from risk management to resilience management.

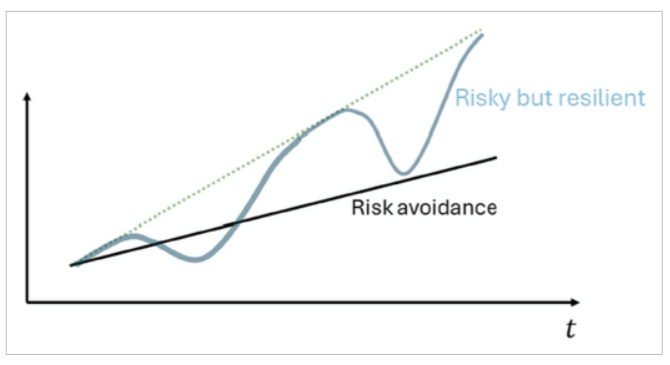

He defined resilience as systematic positive reactions to negative economic shocks. He used the following chart to illustrate the effect of resilience vs. risk avoidance.

Put into layman’s terms, if you are financially resilient, you can potentially take on more risk and earn higher rewards.

The concept of resilience can be applied to many areas, from personal finance to investing. Today let’s focus on investing and ask ourselves what it takes to be a resilient investor. Financial resilience has a much broader scope and will be covered in my next article.

I’d like to suggest a four-point approach to being a resilient investor:

Read the rest of this entry »I asked my assistant to do an updated stock market seasonality study.

The data we used was the S&P 500 index from 1927 which we found in Nobel Prize winner Robert Shiller’s database.

We assumed that at the beginning of each year we invested $1 in the index, and we observed how the investment fluctuated over the year. Then we took the average over three different periods of time: the last 20 years, the last 50 years, and the last 86 years.

Here is the chart we got: Read the rest of this entry »

It really caught me by surprise when Eugene Fama, the newly minted Nobel laureate in Economics said: “It doesn’t matter that much.” when speaking about investing outside of the US.

It really caught me by surprise when Eugene Fama, the newly minted Nobel laureate in Economics said: “It doesn’t matter that much.” when speaking about investing outside of the US.

OK sure, I can understand his point. Why invest outside of the US when the US markets already account of 40% of world capitalization? “The U.S. market is so well-diversified already that combining it with global markets doesn’t really matter,” so said Fama.

However, I think it actually does matter ….

Proportionally, the US market is getting smaller. Right after the second world war, the US market accounted for 70% of world capitalization, now it only accounts for 40%. For a country that boasts only 5% of of the world’s population, this is still exceptionally high.

For the foreseeable future, there are better than even odds that the combined markets outside of the US will grow faster than the US market will do alone. Why forego those opportunities?

The diversification benefit you’d get is certainly not negligible either. During the so-called ‘lost decade’ of 2000 to 2009, the US market, as measured by the S&P 500, had a net loss of 9.1%, while international developed markets went up by an anemic 12.4%, but emerging markets went up by a whopping 154.3%.

It would have made a bog difference if you have a piece of emerging markets in your portfolio.

Firm | Youtube | Facebook | Twitter | LinkedIn | Newsletter

Request White Paper | Request Discovery Meeting

Get informed about wealth building, sign up for The Investment Scientist newsletter

I just came back from a long trip in China and Taiwan. During the trip, what impressed me the most was China’s bullet train. We rode the longest high-speed rail line in the world – Beijing to Guangzhou – which started services only a few months ago.

The train is futuristic, comfortable and extremely smooth. Zipping at speed of 300 km/h or about 190 mph, the water in my glass sitting on the table stayed still.

With such a speed, one could travel from New York City to Washington DC in one hour and 15 minutes, or from New York City to Chicago in three and a half hours. High-speed rail truly shrinks the country.