Posts Tagged ‘stocks’

The title of this article comes from a recent discussion I had with a client of mine. First, we should define what “the fundamental” means. It is best defined in Intelligent Investor, a book by Warren Buffet’s teacher Benjamin Graham. In short, his idea of a good investment is a stock with good earnings selling at a cheap price.

Graham’s insights were lately confirmed by Eugene Fama’s Nobel Prize-winning research, where Fama found that throughout history (until maybe 2015,) small-cap value stocks performed the best.

At present, the stock market in the US is definitely not following Ben Graham’s fundamentals. 70% of all returns are concentrated in the seven biggest tech stocks, all of which are very expensive. Nvidia for example, has a $3T valuation, which is 4 times the GDP of Taiwan, where its AI chips are made.

Read the rest of this entry »I asked you all this question yesterday, and today I will share select replies followed by my comments on the matter.

JG wrote: The joy ride will eventually end. The current price dictates an annual revenue growth of 10 percent per year for the next 100 years. This isn’t happening. Ultimately, the dream will fade, and many will lose their money.

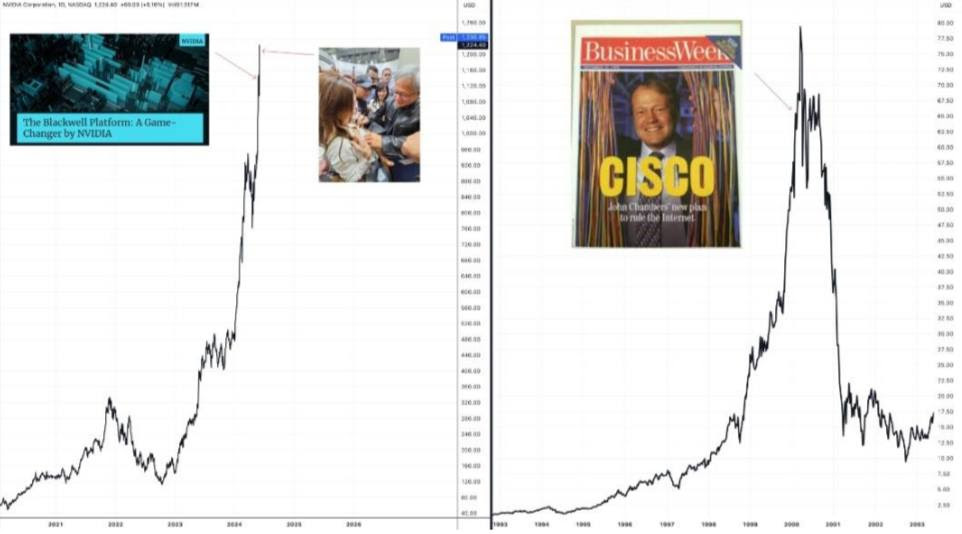

JG also shared the chart below. What CSCO was for the internet age, NVDA is for the AI age, namely, an infrastructure provider. This picture is indeed worth a thousand words.

Is A Market Crash Imminent?

Posted on: July 30, 2014

Yesterday I received an email from a doctor client of mine telling me how he had a conversation with some fellow doctors, and all of them are pulling their money out of stocks because they feel that with the market breaking new high after new high, a crash is imminent. He wanted my opinion.

Yesterday I received an email from a doctor client of mine telling me how he had a conversation with some fellow doctors, and all of them are pulling their money out of stocks because they feel that with the market breaking new high after new high, a crash is imminent. He wanted my opinion.

First of all, while all of his doctor friends might feel a market crash is imminent and certain, there is simply no such thing as certainty in the stock market. All we can work with are odds. The following are the odds of market corrections:

| Magnitude of market decline | Frequency of occurrence (out of 64 years from 1950-2013) |

| >5% | Every year (94%) |

| >10% | Every two years (58%) |

| >20% | Every five years (20%) |

| >30% | Every ten years (10%) |

| >40% | Every fifty years (2%) |

My study also shows that the market breaking a new high does not substantially change the odds of returns. In other words, the odds of the market dropping over 20% in the next twelve months are still about one in five; the odds of the market dropping over 30% in the next twelve months are still about one in ten.

Read the rest of this entry »