Author Archive

Recently, I came across a 20 Year Periodic Return Table prepared by Black Rock. I want to share this with you since this table illustrates the investment principles I have been emphasizing: 1) asset class diversification; 2) disciplined rebalancing; and 3) small value tilt. Today’s focus is on 1); the other two points will be discussed in future articles.

9. Is Managed Futures an Asset Class?

8. Recession and Stock Market Performance

7. Will Greece Sink Your Portfolio?

6. The 2011 Estate Tax Changes (by Christopher Guest)

5. America’s Top Financial Advisors: How Are They Made?

4. Variable Annuity Fees You Don’t Know You Are Paying

3. Bonus Depreciation: Congress Wants Businesses to Invest in 2011 (by Jeremy Bendler)

1. Profit From Harry Dent’s Prediction? Thank Again

Get informed about wealth building, sign up for The Investment Scientist newsletter

How to Pick a Trustee

Posted on: June 30, 2011

[Guest Post by Christopher Guest] I have stated numerous times in my newsletters, I am not an automatic proponent of creating trusts for people. I will tailor an estate plan for a client depending on the needs of the client. However, many times creating some form of trust is necessary. The basics of trusts can be found by clicking here. One of the most important roles in the success of a trust is the trustee. Thus, making sure that the correct person is named trustee and that the trustee understands their role, responsibilities and whether a corporate trustee should also play a role in your trust is vital to ensure the settlor’s intent.

June Wealth Management Roundup

Posted on: June 30, 2011

Why Physicians Are Not Wealthy my latest contribution to KevinMD.com

How Complex Derivative Products Imperils Seniors’ Retirement Security by John Wasik

Financial Wealth – It’s Time, Not Money by Allan Roth at MoneyWatch.com

CME Pushes Managed Futures: Wealth With Little Risk by Allan Roth at MoneyWatch.com

Why the Economic Recovery is Lagging by Richard Posner

Three Reasons to Avoid Corporate Bonds by Larry Swedroe at MoneyWatch.com

Will FINRA Stop the Structure Product Insanity? by Seth Lipner at Forbes.com

Random Views on US Default by Menzie Chinn at EconoBrowser.com

Forecasting Commodity Prices by Menzie Chinn at EconoBrowser.com

Get informed about wealth building, sign up for The Investment Scientist newsletter

[Guest post by Andrew Platou] Who qualifies as a plan’s fiduciaries? Fiduciaries are generally those individuals or entities who manage an employee benefit plan and its assets. A plan must have at least one fiduciary, a person or an entity, named in the written plan, or through a process described in the plan. The named fiduciary can be identified by office or by name. For some plans, it may be an administrative committee or a company’s board of directors. Employers often hire outside professionals, sometimes called third-party service providers, or use an internal administrative committee or human resources department to manage some or all of a plan’s day-to-day operations. Even if an employer hires third-party service providers or uses internal administrative committees to manage the plan, it still has fiduciary responsibilities. A key point to note is that fiduciary status is based on the functions the person performs for the plan, not just the person’s title. Using discretion in administering and managing a plan or controlling the plan’s assets makes that person a fiduciary to the extent of that discretion or control.

Is Managed Futures an Asset Class?

Posted on: June 17, 2011

Recently, a high-net-worth investor came to me for my portfolio review service. What caught my attention was that a large chunk of his money was allocated to various commodities trading advisors (CTAs).

CTAs are folks who are licensed to take your money and speculate with it in the futures markets. In 2008, managed futures reportedly returned a total of 14%, beating the equity market by 50%. Since then, CTAs have been heavily promoted by major Wall Street brokerages and wealth management firms as an alternative non-correlated asset class.

But is managed futures an asset class?

Irrevocable Life Insurance Trust

Posted on: June 16, 2011

[Guest post by Jeremy Bendler] Few people realize that, even though they may have a modest estate, their families may owe hundreds of thousands of dollars in estate taxes because they own a life insurance policy with a substantial death benefit. This is so because life insurance proceeds, while not subject to federal income tax, are considered part of your taxable estate and are subject to federal estate tax.

10. Top Wealth Management Google Ranking

9. Shall You Sell in May and Go Away?

8. Variable Annuity Fees You Don’t Know You Are Paying

7. The 2011 Estate Tax Changes

6. America’s Top Financial Advisors: How They Are Made?

5. Asset Allocation Return Report: 60/40 Portfolio Model

4. A Balanced Portfolio to Avoid (i): Annuities Are Not Safe Investments

2. Bonus Depreciation – Congress Wants Businesses to Invest in 2011

1. Profit From Harry Dent’s Prediction? Thank Again

Get informed about wealth building, sign up for The Investment Scientist newsletter

MZ Capital 50/50 Portfolio Model

This report shows the construct and performance of a 50/50 model portfolio.

Asset Classes and Fund Selection

There are six asset classes in this portfolio model. The asset allocation is implemented using DFA funds, as shown in the table 1. I explained why DFA funds are superior here.

There are six asset classes in this portfolio model. The asset allocation is implemented using DFA funds, as shown in the table 1. I explained why DFA funds are superior here.

| Table 1: Asset Class Funds | ||

| Asset Class | Percentage | Funds |

| US Equity | 20% | DFFVX – US Targeted Value Fund |

| International Equity | 10% | DISVX – International Small Cap Value Fund |

| Emerging Markets | 10% | DFEVX – Emerging Market Value Fund |

| REIT | 10% | DFREX – Real Estate Securities Fund |

| TIPS | 25% | DIPSX – Inflation-Protected Securities Fund |

| Treasuries | 25% | DFIHX – Short-Term Treasuries Fund |

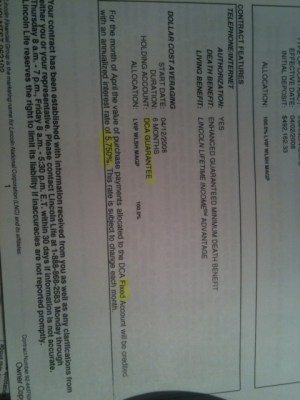

I was called a “wing nut” by a commenter for pointing out all the malpractices of insurance companies. Indeed, I could go nuts seeing how they mislead their customers into financial peril. They know full well that their customers are not going to read beyond the first few pages of their hundred-page contract, so they put all the goodies on the first page and keep the disclaimers on the back pages.

The following is an actual annuity contract a client of mine purchased a few years ago, much to his regret now.

On the first page of the contract, all the warm and fuzzy keywords are used: “GUARANTEE”, “fixed”, “annualized interest rate of 5.75%”. Pay attention to the following line though: This rate is subject to change each month.

[Repost from my contribution to Morningstar Advisor] LinkedIn LNKD rallied more than 100% in its first day of trading. The market is buzzing about its spectacular performance. Even I, a known advocate of passive investment among my friends and clients, got calls asking if it’s a good time to invest in this stock. It’s not, emphatically. Here are three reasons:

Insider Advantage

LinkedIn has been in business since 2003. Who decided that it should go public now, as opposed to March 2009? Surprise! It’s the management of the company, acting in the interest of its shareholders. In LinkedIn’s case, it’s Reid Hoffman, who is both CEO and a major shareholder. Did Reid do that so that you could buy his shares at an undervalued price? I bet not. And for that matter, he was willing to sell shares at a pricing range of $32 to $35. The pricing range was only raised to $42 to $45 after popular demand from investment bankers.

Tax Update: Charitable Expenses

Posted on: May 14, 2011

If you are a volunteer worker for a charity, you should be aware that your generosity may entitle you to some tax breaks.

Although no tax deduction is allowed for the value of services you perform for a charitable organization, some deductions are permitted for out-of-pocket costs you incur while performing the services (subject to the deduction limit that generally applies to charitable contributions). This includes items such as:

Shall You Sell in May and Go Away?

Posted on: May 10, 2011

By now, you may have heard the stock market folklore: “Sell in May and Go Away.”

Well, let’s look at the statistics, shall we? Most stock market returns are delivered during the winter season from November to May. In the summer (June to October), however, the market seems to take a vacation. Not only does it not deliver much return, it is also more volatile.

It’s not just the US market; some European markets manifest this tendency as well. See the chart below based on market data from the US, the UK, Germany, the Netherlands, and Belgium.

[Guest Post by Jeremy Bendler, CPA] Businesses with cash reserves sitting on the sidelines are being encouraged to invest some of those funds in equipment and improvements in 2011. Congress has passed a number of favorable tax breaks for the treatment of business purchases of equipment and leasehold improvements including expanded section 179 expensing of assets, bonus depreciation, and relaxed auto depreciation rules. These incentives to spend and invest are hoped to help push the economy forward by giving businesses an incentive to invest!

Charitable Giving and Estate Planning

Posted on: May 5, 2011

[Guest Post by Christopher Guest] Many people I work with to plan their estate want to make some type of charitable gift. Charitable giving through a person’s estate plan falls into three categories: a simple bequest through a will, a charitable remainder trust or a charitable lead trust1. Most people want to make an altruistic donation to some cause that holds a special place in their heart. However, for the more sophisticated estates, charitable giving can be a valuable estate tax planning tool.

The simplest and most popular form of charitable giving is a bequest through a will. Basically, there will be a clause in the will that says “I give X amount of money to charity Y.” If the estate plan is more sophisticated, the bequest could be based on a percentage of the estate’s value or a part of the residue of the estate2. Like all charitable bequests, it is tax deductible.

MZ Capital 60/40 Portfolio Model

This report shows the construct and performance of a 60/40 model portfolio.

Asset Classes and Fund Selection

There are six asset classes in this portfolio model. The asset allocation is implemented using DFA funds, as shown in the table 1. I explained why DFA funds are superior here. Read the rest of this entry »

There are six asset classes in this portfolio model. The asset allocation is implemented using DFA funds, as shown in the table 1. I explained why DFA funds are superior here. Read the rest of this entry »