Posts Tagged ‘economics’

Today I am writing about a paper by MIT professor and 2024 Economic Nobel Laureate Daron Acemoglu titled “The Simple Macroeconomics of AI”.

Unlike the bullish projections of AI’s transformative impact on economics, Acemoglu’s view is much more measured. Given the overwhelming media coverage favoring maximalist views on AI, his perspective offers a necessary counterpoint.

Acemoglu argues that over the next ten years, AI will likely automate only 5% of tasks and increase the GDP by about 1%. He explains that while AI excels in specific tasks with clear truths, most real-world jobs involve complex, tacit, contextual knowledge and social intelligence that AI can not easily replicate and replace.

His paper also makes these important points:

Read the rest of this entry »Triffin’s Dilemma: The Privilege and The Curse of the Dollar As World Currency

Posted on: March 28, 2025

Following our series about academic research, today I will write about Triffin’s Dilemma, a theory proposed by Dutch economist Robert Triffin in the 1960s.

The theory postulates that the country that owns the world’s reserve currency will inevitably face a persistent trade deficit that will imperil the confidence in that currency.

The theory was originally tied to the Bretton Woods Accord after World War II, where the US dollar was pegged to gold, and the rest of the world’s were pegged to the dollar. In 1971, President Nixon announced the de-pegging of the dollar from gold, effectively, making the dollar a fiat currency that the government could “print” as much of as they wanted.

This is an exorbitant privilege that other countries do not enjoy. By this, I mean that no matter what problems our country faces, we can print our way out of trouble. The oversupply of the dollar would normally cause hyperinflation in our country, but since ours is the world currency, we can export our surplus dollars to the rest of the world by running a trade deficit.

Exporting dollars is a great business to have, since instead of goods, which requires costly manufacturing, dollars can be created by simply adding an entry into the Fed’s computer system. However, a side effect is, that nobody wants to invest in manufacturing and no young people want to work in factories. All smart kids want to be in finance, the industry that is closely related to money creation, allocation, and management. This has led to overfinancialization and the gradual deindustrialization of the country (See chart below.)

Read the rest of this entry »Last week I published a newsletter article titled “Will The Stock Market Return to The Fundamental?” I have received a good number of responses, and as promised, today I will share my thoughts.

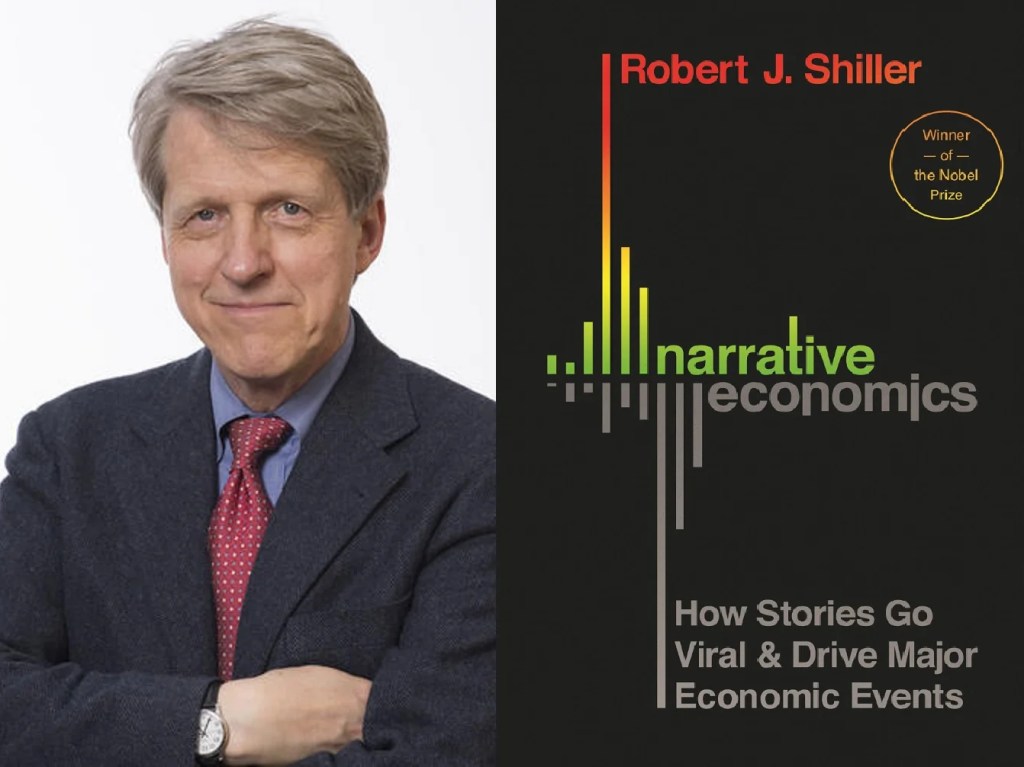

The traditional economic theory has always presumed that economic actors are calculating and rational. The application of this presumption in the investment field is the efficient market hypothesis, which basically says that investors rationally pay the prices for expected future earnings adjusted for risk. The biggest proponent of the efficient market hypothesis is Nobel Prize winner Eugene Fama.

The efficient market hypothesis has its biggest opponent in Robert Shiller, who years ago published his seminal work that illustrated how a 1% change in dividends can oftentimes result in a 15% change in the stock price. If investors are, in fact, calculating and rational, stock prices shouldn’t fluctuate so much relative to dividends.

Read the rest of this entry »America’s national debt is spiraling out of control. It’s at $34.4T right now and is increasing at a rate of $2T per year. Today I am going to prognosticate what will likely happen and what it will mean for us investors.

To make the projection, I will assume things will stay largely as they are:

- Inflation around 4%

- Interest rate about 5%

- Budge deficit around at $2T

At this rate, in five years, the total federal debt will be over $44T. At an average interest rate of 5%, the total interest payments in the federal budget will be $2.2T. In 2023, the total federal tax revenue came at only $4.6T. In other words, in five years or so, the interest payments alone will amount to nearly half of the federal tax revenue.

With a budgetary shortfall at that level, there will be no other option but to “print’ more dollars. Today I will not discuss the mechanism of printing money. Suffice to say that printing money will lead to inflation and inflation necessitates that the Fed keeps the Fed fund rate high.

Read the rest of this entry »Deficits, Debt and Market Returns

Posted on: March 10, 2011

[Adapted from Brian Harris of Dimensional Fund Advisors] As government spending hits record levels (see chart below) around the globe, some politicians, economists, and pundits are warning that rising indebtedness may drag down economies and financial markets. If you are concerned, you are not alone. I heard that over and over from my clients. So how does public debt affect economic growth and market returns? The evidence might surprise you. Let’s explore these issues by addressing a few popular questions about sovereign debt: So how does public debt affect economic growth and market returns? The evidence might surprise you. Let’s explore these issues by addressing a few popular questions about sovereign debt:

Read the rest of this entry » |