Posts Tagged ‘economy’

Yesterday, the price of gold dropped 10% in one day. Even with that decline, it is still up 12% this year and up 84% since the beginning of 2025. Today, I will write a bit about gold because I have built a small position for all of my clients since 2022, after the Russia-Ukraine conflict started.

Remember when the US and EU froze Russia’s foreign reserves? That move, which was intended to hit Russia hard, sent a chill through central banks everywhere, especially in the Global South. Until then, the US dollar had served as a reserve asset in many sovereign central banks, meaning that they needed to acquire US dollars before they could issue their own currencies.

The Great Dollar Diversification

Read the rest of this entry »

A client of mine asked me this question and I thought many of my readers might have the same question.

What Happened to the Dot-com Bubble?

When the dot-com bubble popped in March of 2000, the Nasdaq lost nearly 80% of its value over a two-year bear market stretch, and it took 15 years, that is, until 2015, for the Nasdaq to regain its previous high. As you can imagine, that was financially devastating for investors fully invested in the Nasdaq.

Are We in a Similar Bubble, Only Now Driven by AI?

It’s highly likely. As I write now, NVDIA’s market cap is over $5T. In other words, a company with + 36,000 employees is now valued higher than the entire GDP of Japan, an advanced country with a population of 140 million. If that’s not a sign of a bubble, what is?

Will It Pop Like the Dot-com Bubble and Wipe Out 80% of Its Value?

Read the rest of this entry »Triffin’s Dilemma: The Privilege and The Curse of the Dollar As World Currency

Posted on: March 28, 2025

Following our series about academic research, today I will write about Triffin’s Dilemma, a theory proposed by Dutch economist Robert Triffin in the 1960s.

The theory postulates that the country that owns the world’s reserve currency will inevitably face a persistent trade deficit that will imperil the confidence in that currency.

The theory was originally tied to the Bretton Woods Accord after World War II, where the US dollar was pegged to gold, and the rest of the world’s were pegged to the dollar. In 1971, President Nixon announced the de-pegging of the dollar from gold, effectively, making the dollar a fiat currency that the government could “print” as much of as they wanted.

This is an exorbitant privilege that other countries do not enjoy. By this, I mean that no matter what problems our country faces, we can print our way out of trouble. The oversupply of the dollar would normally cause hyperinflation in our country, but since ours is the world currency, we can export our surplus dollars to the rest of the world by running a trade deficit.

Exporting dollars is a great business to have, since instead of goods, which requires costly manufacturing, dollars can be created by simply adding an entry into the Fed’s computer system. However, a side effect is, that nobody wants to invest in manufacturing and no young people want to work in factories. All smart kids want to be in finance, the industry that is closely related to money creation, allocation, and management. This has led to overfinancialization and the gradual deindustrialization of the country (See chart below.)

Read the rest of this entry »Last week I published a newsletter article titled “Will The Stock Market Return to The Fundamental?” I have received a good number of responses, and as promised, today I will share my thoughts.

The traditional economic theory has always presumed that economic actors are calculating and rational. The application of this presumption in the investment field is the efficient market hypothesis, which basically says that investors rationally pay the prices for expected future earnings adjusted for risk. The biggest proponent of the efficient market hypothesis is Nobel Prize winner Eugene Fama.

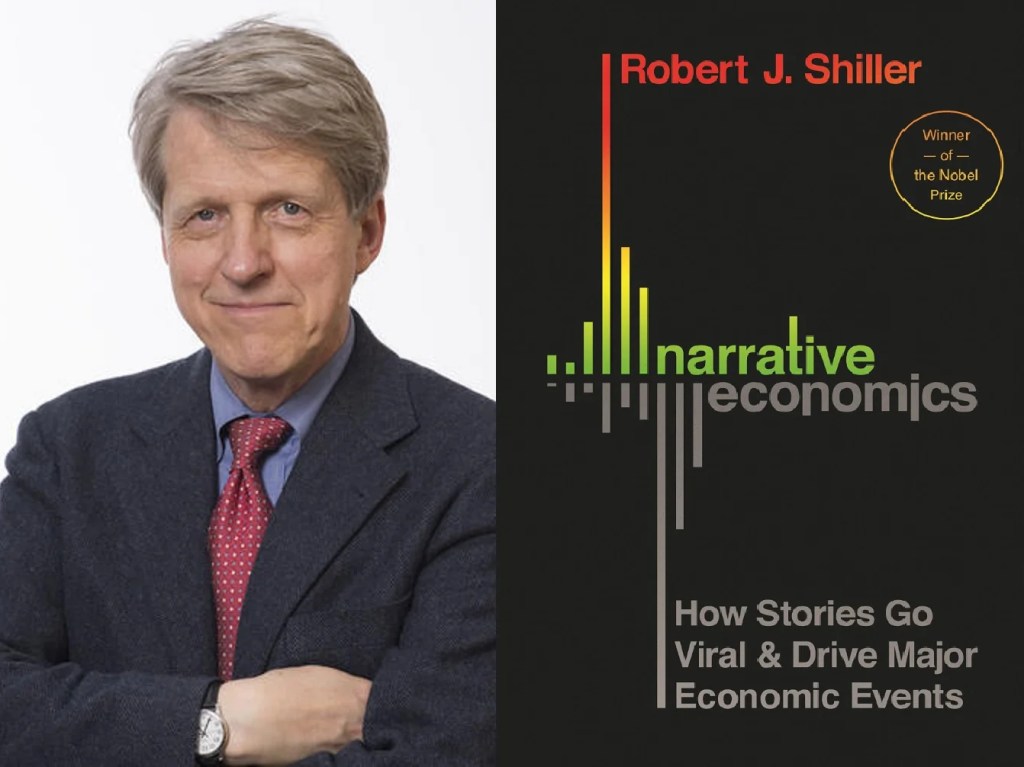

The efficient market hypothesis has its biggest opponent in Robert Shiller, who years ago published his seminal work that illustrated how a 1% change in dividends can oftentimes result in a 15% change in the stock price. If investors are, in fact, calculating and rational, stock prices shouldn’t fluctuate so much relative to dividends.

Read the rest of this entry »America’s national debt is spiraling out of control. It’s at $34.4T right now and is increasing at a rate of $2T per year. Today I am going to prognosticate what will likely happen and what it will mean for us investors.

To make the projection, I will assume things will stay largely as they are:

- Inflation around 4%

- Interest rate about 5%

- Budge deficit around at $2T

At this rate, in five years, the total federal debt will be over $44T. At an average interest rate of 5%, the total interest payments in the federal budget will be $2.2T. In 2023, the total federal tax revenue came at only $4.6T. In other words, in five years or so, the interest payments alone will amount to nearly half of the federal tax revenue.

With a budgetary shortfall at that level, there will be no other option but to “print’ more dollars. Today I will not discuss the mechanism of printing money. Suffice to say that printing money will lead to inflation and inflation necessitates that the Fed keeps the Fed fund rate high.

Read the rest of this entry »