Posts Tagged ‘finance’

Yesterday, the price of gold dropped 10% in one day. Even with that decline, it is still up 12% this year and up 84% since the beginning of 2025. Today, I will write a bit about gold because I have built a small position for all of my clients since 2022, after the Russia-Ukraine conflict started.

Remember when the US and EU froze Russia’s foreign reserves? That move, which was intended to hit Russia hard, sent a chill through central banks everywhere, especially in the Global South. Until then, the US dollar had served as a reserve asset in many sovereign central banks, meaning that they needed to acquire US dollars before they could issue their own currencies.

The Great Dollar Diversification

Read the rest of this entry »

A client of mine asked me this question and I thought many of my readers might have the same question.

What Happened to the Dot-com Bubble?

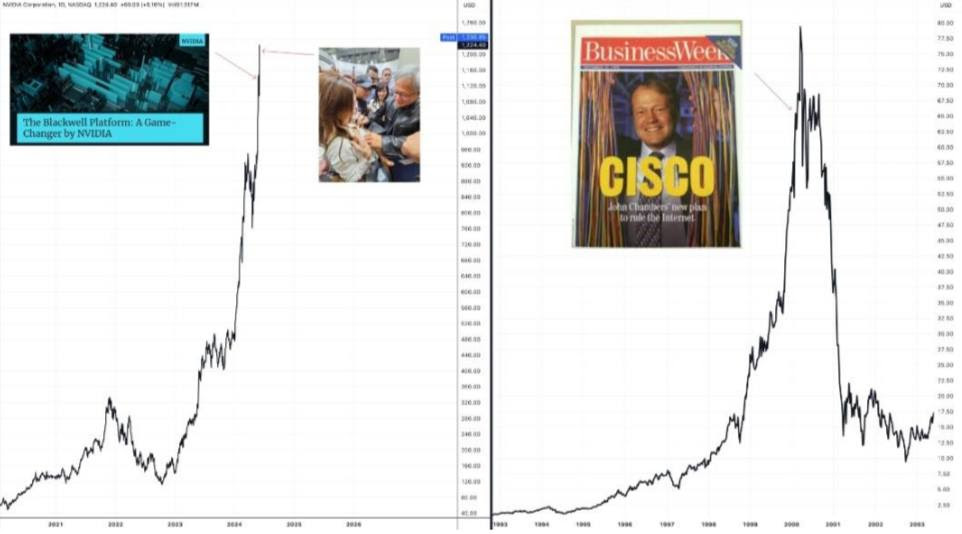

When the dot-com bubble popped in March of 2000, the Nasdaq lost nearly 80% of its value over a two-year bear market stretch, and it took 15 years, that is, until 2015, for the Nasdaq to regain its previous high. As you can imagine, that was financially devastating for investors fully invested in the Nasdaq.

Are We in a Similar Bubble, Only Now Driven by AI?

It’s highly likely. As I write now, NVDIA’s market cap is over $5T. In other words, a company with + 36,000 employees is now valued higher than the entire GDP of Japan, an advanced country with a population of 140 million. If that’s not a sign of a bubble, what is?

Will It Pop Like the Dot-com Bubble and Wipe Out 80% of Its Value?

Read the rest of this entry »

Recently, I’ve noticed a recurring theme in my conversations with clients and friends: economic anxiety, even among those who are financially well-off.

Take, for example, a friend of mine who works at Meta. With total compensation exceeding $350,000, she’s comfortably in the top tier of American income earners. Yet a large house, a luxury car, and costly extracurriculars for her children mean she’s living paycheck to paycheck.

On top of that, her work demands are immense. Not only does she work standard office hours, but late-night meetings with overseas suppliers are a daily occurrence, leaving her burnt out and longing for a less demanding role. However, the thought of a pay cut and the lifestyle changes it would bring prevent her from exploring alternatives, even as her health suffers.

She recently came to me for a second opinion financial review. While I didn’t magically solve her issues overnight, I did provide clear direction. The relief she experienced was so tangible that she shared her experience with several Meta colleagues, all of whom reached out for similar guidance.

Read the rest of this entry »

Many successful individuals, often those who’ve risen from humble beginnings, find themselves in a high tax bracket while their parents remain in lower income brackets. They feel a strong desire to provide financial assistance to their parents. This article outlines a strategic approach to help family members financially while simultaneously optimizing tax outcomes.

Understanding the Tax Advantage

For high-income earners, long-term capital gains are typically taxed at 20%, with an additional 3.8% net investment income tax (NIIT) on those gains. However, a significant tax advantage exists for individuals with lower taxable incomes. If your parents’ taxable income is below $98,000 annually (in 2025), their long-term capital gains tax rate is 0%. Furthermore, if their Modified Adjusted Gross Income (MAGI) is less than $250,000—a threshold easily met if they qualify for the 0% capital gains rate—they are also exempt from the net investment income tax.

The Strategy: Gifting Appreciated Stocks

Read the rest of this entry »Imagine giving your child a head start that could turn them into a millionaire by retirement—without relying on an inheritance or a lucky lottery ticket. Thanks to the new Trump Account, a federal savings initiative launched for children born between 2025 and 2028, this dream can become a reality for proactive parents.

What Is the Trump Account?

The Trump Account is a government-backed investment plan that automatically provides every eligible newborn a $1,000 seed deposit from the U.S. Treasury. Parents, relatives, and employers can then contribute up to $5,000 each year until the child turns 18. All contributions are invested in a low-cost, diversified U.S. stock index fund.

How Does It Work?

Read the rest of this entry »How to Deal With Big Market Drops

Posted on: April 7, 2025

Since April 2nd, the S&P 500 has dropped by 10.5%; and since its recent peak on February 19, it has fallen by 18.4%. How should we react to such significant market drops?

To answer this question, I want you to imagine that you bought all your clothes from Neiman Marcus and they are hanging (or sitting) in your wardrobe. Now imagine that Neiman Marcus announces an across-the-board 30% discount on all of their clothing items. Would you say “Damn, my clothes are now worthless” and sell them all at a flea market? You probably wouldn’t and might even make a trip to Neiman Marcus to buy a piece or two to add to your wardrobe.

Read the rest of this entry »Triffin’s Dilemma: The Privilege and The Curse of the Dollar As World Currency

Posted on: March 28, 2025

Following our series about academic research, today I will write about Triffin’s Dilemma, a theory proposed by Dutch economist Robert Triffin in the 1960s.

The theory postulates that the country that owns the world’s reserve currency will inevitably face a persistent trade deficit that will imperil the confidence in that currency.

The theory was originally tied to the Bretton Woods Accord after World War II, where the US dollar was pegged to gold, and the rest of the world’s were pegged to the dollar. In 1971, President Nixon announced the de-pegging of the dollar from gold, effectively, making the dollar a fiat currency that the government could “print” as much of as they wanted.

This is an exorbitant privilege that other countries do not enjoy. By this, I mean that no matter what problems our country faces, we can print our way out of trouble. The oversupply of the dollar would normally cause hyperinflation in our country, but since ours is the world currency, we can export our surplus dollars to the rest of the world by running a trade deficit.

Exporting dollars is a great business to have, since instead of goods, which requires costly manufacturing, dollars can be created by simply adding an entry into the Fed’s computer system. However, a side effect is, that nobody wants to invest in manufacturing and no young people want to work in factories. All smart kids want to be in finance, the industry that is closely related to money creation, allocation, and management. This has led to overfinancialization and the gradual deindustrialization of the country (See chart below.)

Read the rest of this entry »How To Pick Mutual Fund Winners

Posted on: January 27, 2025

In answer to my readers’ response to my survey last year, I will be writing a series of articles about academic research in the realm of finance, focusing on studies that are pertinent to us, the average investor.

Today, I am writing about the most cited research in the Journal of Finance. It’s written by Mark M. Carhart, and titled “On Persistence in Mutual Fund Performance”, published in 1997.

Why should you care?

Well, if the research were able to help us identify a few persistent winners among the more than 10,000 available funds, wouldn’t that make our investment life a lot simpler? We could hold only the winners and be done with it. Unfortunately, the research did not find any persistent winners. More precisely, other than a small momentum effect, the research found no evidence that any mutual fund has the ability to consistently outperform the market.

However, the research did find that mutual fund expenses and transaction costs are persistent predictors of underperformance. A 1% increase in expense ratio correlates to a 1.5% decrease in fund performance and a 1% increase in fund turnover results in a 0.95% decrease in fund performance.

Here are the three expenses or costs that you should especially watch out for.

Read the rest of this entry »How to Be A Resilient Investor

Posted on: January 12, 2025

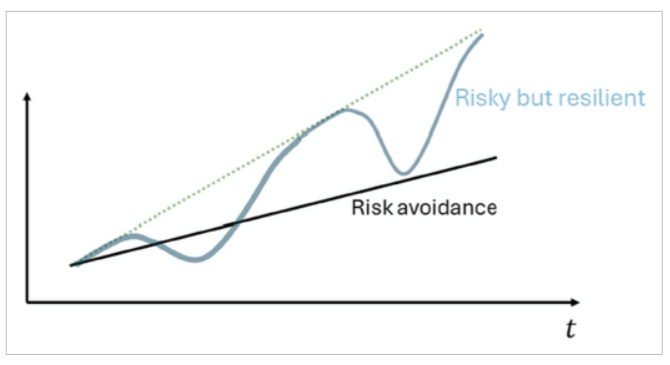

Recently, Markus Brunnermeier, the president of the American Finance Association, gave a presidential address titled “Macrofinance and Resilience”. In this address, he introduced the concept of resilience, which he distinguished from risk. He admonished finance researchers and practitioners to change their focus from risk management to resilience management.

He defined resilience as systematic positive reactions to negative economic shocks. He used the following chart to illustrate the effect of resilience vs. risk avoidance.

Put into layman’s terms, if you are financially resilient, you can potentially take on more risk and earn higher rewards.

The concept of resilience can be applied to many areas, from personal finance to investing. Today let’s focus on investing and ask ourselves what it takes to be a resilient investor. Financial resilience has a much broader scope and will be covered in my next article.

I’d like to suggest a four-point approach to being a resilient investor:

Read the rest of this entry »This article was forwarded to me by a client of mine. It was written by Mr. David Karp, who asked seven questions regarding one’s relationship with their advisor. These are excellent questions! I will repost Mr. Karp’s questions and responses, along with my own answers in red and bold.

Besides our family members and close friends, few relationships in life are as important as that of client and wealth advisor … and long lasting. After all, your wealth advisor is trusted with the financial well-being of you and your family, hopefully for generations to come. A good wealth advisor does much more than just manage your investments. He or she will get to know you and your family, your hopes and dreams and the legacy you want to leave. It’s a holistic approach that should be wholly based on the best interests of you and your family.

So how do you evaluate a wealth advisor to ensure you partner with someone who can provide the comprehensive, yet highly individualized set of solutions you need and deserve? Below are seven questions to ask prospective wealth advisors:

Read the rest of this entry »Last week I published a newsletter article titled “Will The Stock Market Return to The Fundamental?” I have received a good number of responses, and as promised, today I will share my thoughts.

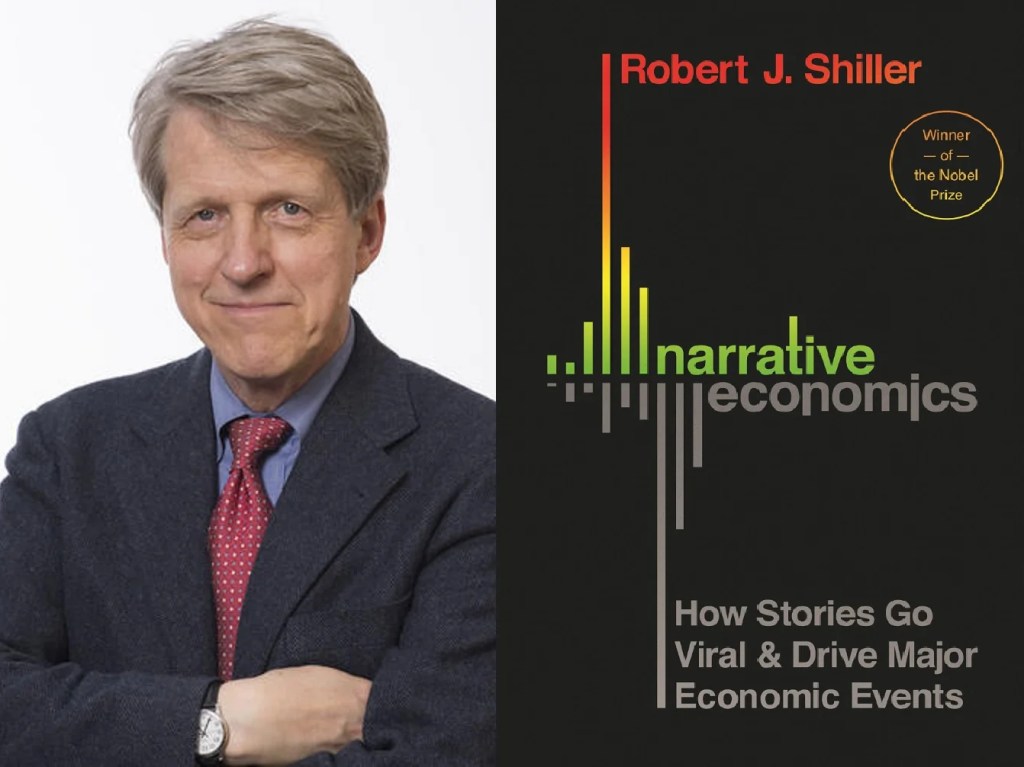

The traditional economic theory has always presumed that economic actors are calculating and rational. The application of this presumption in the investment field is the efficient market hypothesis, which basically says that investors rationally pay the prices for expected future earnings adjusted for risk. The biggest proponent of the efficient market hypothesis is Nobel Prize winner Eugene Fama.

The efficient market hypothesis has its biggest opponent in Robert Shiller, who years ago published his seminal work that illustrated how a 1% change in dividends can oftentimes result in a 15% change in the stock price. If investors are, in fact, calculating and rational, stock prices shouldn’t fluctuate so much relative to dividends.

Read the rest of this entry »The title of this article comes from a recent discussion I had with a client of mine. First, we should define what “the fundamental” means. It is best defined in Intelligent Investor, a book by Warren Buffet’s teacher Benjamin Graham. In short, his idea of a good investment is a stock with good earnings selling at a cheap price.

Graham’s insights were lately confirmed by Eugene Fama’s Nobel Prize-winning research, where Fama found that throughout history (until maybe 2015,) small-cap value stocks performed the best.

At present, the stock market in the US is definitely not following Ben Graham’s fundamentals. 70% of all returns are concentrated in the seven biggest tech stocks, all of which are very expensive. Nvidia for example, has a $3T valuation, which is 4 times the GDP of Taiwan, where its AI chips are made.

Read the rest of this entry »I asked you all this question yesterday, and today I will share select replies followed by my comments on the matter.

JG wrote: The joy ride will eventually end. The current price dictates an annual revenue growth of 10 percent per year for the next 100 years. This isn’t happening. Ultimately, the dream will fade, and many will lose their money.

JG also shared the chart below. What CSCO was for the internet age, NVDA is for the AI age, namely, an infrastructure provider. This picture is indeed worth a thousand words.

A few weeks ago, I told you about Jon, a long-time reader of my newsletter. His Edward Jones financial advisor was trying to sell him a Variable Universal Life (VUL) policy, and he asked me for my 2nd opinion. Instead of writing my opinion, however, I posted his question to my newsletter readers, and asked you guys to make an assessment.

A few of you came back with the answer of YES since the $2mm death benefit is huge, and the annual premium payment of $17k appears to be quite reasonable. On top of that, the buyer gets the flexibility to skip payments as well. I believe this view of the product is exactly what the insurance company wants but it is misguided.

To answer Jon’s question, I first talked to him to determine his family’s actual need for life insurance. He has two teenage kids and he and his wife already both have 20-year term life insurance policies, each with a $2mm death benefit. They clearly have no need for additional life insurance.

Now let’s look at the product itself. A VUL policy is a combination of two components – life insurance and investment. The product is not entirely under the oversight of the SEC, therefore there is a huge regulatory loophole that the insurance company can use to take advantage of the buyers.

Read the rest of this entry »Two weeks ago I wrote about the tax strategy to use during a sabbatical, career transitions, and early retirement. This week’s article is a continuation of that theme, focusing on tax gain harvesting.

This discussion stems from the fact that investment gains are taxed differently than our ordinary income. In fact, they have their own tax brackets. See below:

Let’s take Joe Doe for example. He is a lawyer and his usual taxable income is $600k. That puts him squarely in the 20% capital gains tax bracket. On top of that, based on his income, he must also pay the Obamacare surtax of 3.8%. That makes the tax rate on his investment gains (and qualified dividends) 23.8%.

Read the rest of this entry »America’s national debt is spiraling out of control. It’s at $34.4T right now and is increasing at a rate of $2T per year. Today I am going to prognosticate what will likely happen and what it will mean for us investors.

To make the projection, I will assume things will stay largely as they are:

- Inflation around 4%

- Interest rate about 5%

- Budge deficit around at $2T

At this rate, in five years, the total federal debt will be over $44T. At an average interest rate of 5%, the total interest payments in the federal budget will be $2.2T. In 2023, the total federal tax revenue came at only $4.6T. In other words, in five years or so, the interest payments alone will amount to nearly half of the federal tax revenue.

With a budgetary shortfall at that level, there will be no other option but to “print’ more dollars. Today I will not discuss the mechanism of printing money. Suffice to say that printing money will lead to inflation and inflation necessitates that the Fed keeps the Fed fund rate high.

Read the rest of this entry »