Tax Gain Harvesting: What’s That For?

Posted on: April 23, 2024

Two weeks ago I wrote about the tax strategy to use during a sabbatical, career transitions, and early retirement. This week’s article is a continuation of that theme, focusing on tax gain harvesting.

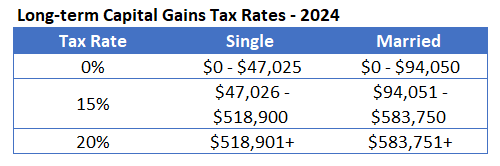

This discussion stems from the fact that investment gains are taxed differently than our ordinary income. In fact, they have their own tax brackets. See below:

Let’s take Joe Doe for example. He is a lawyer and his usual taxable income is $600k. That puts him squarely in the 20% capital gains tax bracket. On top of that, based on his income, he must also pay the Obamacare surtax of 3.8%. That makes the tax rate on his investment gains (and qualified dividends) 23.8%.

Now imagine he takes a year-long sabbatical from his work, and during that year his taxable income is only $30k. Because of his low income, his capital gains tax rate moves down to the lowest level and he does not need to pay the Obamacare investment tax either. That makes the tax rate on his investment gains 0%!!!!

The proper tax strategy for Joe is to take advantage of this opportunity to realize some gains, to the extent that this realization does not push him into the higher tax brackets. This maneuver is called tax gain harvesting.

This is also where tax-loss harvesting becomes valuable. Imagine that Joe Doe files his tax return as a single. With his $30k taxable income, he could easily be pushed into the 15% tax bracket when he realizes only $17,025 in capital gains. But if, in prior years, he has already realized $300k of tax losses, he can now realize up to $317,025 of capital gains and still stay in the 0% tax bracket. This would result in $317k*23.8% = $75.5k tax savings. Who wouldn’t want that?!

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment