Posts Tagged ‘personal finance’

Recently, I’ve noticed a recurring theme in my conversations with clients and friends: economic anxiety, even among those who are financially well-off.

Take, for example, a friend of mine who works at Meta. With total compensation exceeding $350,000, she’s comfortably in the top tier of American income earners. Yet a large house, a luxury car, and costly extracurriculars for her children mean she’s living paycheck to paycheck.

On top of that, her work demands are immense. Not only does she work standard office hours, but late-night meetings with overseas suppliers are a daily occurrence, leaving her burnt out and longing for a less demanding role. However, the thought of a pay cut and the lifestyle changes it would bring prevent her from exploring alternatives, even as her health suffers.

She recently came to me for a second opinion financial review. While I didn’t magically solve her issues overnight, I did provide clear direction. The relief she experienced was so tangible that she shared her experience with several Meta colleagues, all of whom reached out for similar guidance.

Read the rest of this entry »

Many successful individuals, often those who’ve risen from humble beginnings, find themselves in a high tax bracket while their parents remain in lower income brackets. They feel a strong desire to provide financial assistance to their parents. This article outlines a strategic approach to help family members financially while simultaneously optimizing tax outcomes.

Understanding the Tax Advantage

For high-income earners, long-term capital gains are typically taxed at 20%, with an additional 3.8% net investment income tax (NIIT) on those gains. However, a significant tax advantage exists for individuals with lower taxable incomes. If your parents’ taxable income is below $98,000 annually (in 2025), their long-term capital gains tax rate is 0%. Furthermore, if their Modified Adjusted Gross Income (MAGI) is less than $250,000—a threshold easily met if they qualify for the 0% capital gains rate—they are also exempt from the net investment income tax.

The Strategy: Gifting Appreciated Stocks

Read the rest of this entry »Imagine giving your child a head start that could turn them into a millionaire by retirement—without relying on an inheritance or a lucky lottery ticket. Thanks to the new Trump Account, a federal savings initiative launched for children born between 2025 and 2028, this dream can become a reality for proactive parents.

What Is the Trump Account?

The Trump Account is a government-backed investment plan that automatically provides every eligible newborn a $1,000 seed deposit from the U.S. Treasury. Parents, relatives, and employers can then contribute up to $5,000 each year until the child turns 18. All contributions are invested in a low-cost, diversified U.S. stock index fund.

How Does It Work?

Read the rest of this entry »How to Deal With Big Market Drops

Posted on: April 7, 2025

Since April 2nd, the S&P 500 has dropped by 10.5%; and since its recent peak on February 19, it has fallen by 18.4%. How should we react to such significant market drops?

To answer this question, I want you to imagine that you bought all your clothes from Neiman Marcus and they are hanging (or sitting) in your wardrobe. Now imagine that Neiman Marcus announces an across-the-board 30% discount on all of their clothing items. Would you say “Damn, my clothes are now worthless” and sell them all at a flea market? You probably wouldn’t and might even make a trip to Neiman Marcus to buy a piece or two to add to your wardrobe.

Read the rest of this entry »How To Pick Mutual Fund Winners

Posted on: January 27, 2025

In answer to my readers’ response to my survey last year, I will be writing a series of articles about academic research in the realm of finance, focusing on studies that are pertinent to us, the average investor.

Today, I am writing about the most cited research in the Journal of Finance. It’s written by Mark M. Carhart, and titled “On Persistence in Mutual Fund Performance”, published in 1997.

Why should you care?

Well, if the research were able to help us identify a few persistent winners among the more than 10,000 available funds, wouldn’t that make our investment life a lot simpler? We could hold only the winners and be done with it. Unfortunately, the research did not find any persistent winners. More precisely, other than a small momentum effect, the research found no evidence that any mutual fund has the ability to consistently outperform the market.

However, the research did find that mutual fund expenses and transaction costs are persistent predictors of underperformance. A 1% increase in expense ratio correlates to a 1.5% decrease in fund performance and a 1% increase in fund turnover results in a 0.95% decrease in fund performance.

Here are the three expenses or costs that you should especially watch out for.

Read the rest of this entry »How to Be A Resilient Investor

Posted on: January 12, 2025

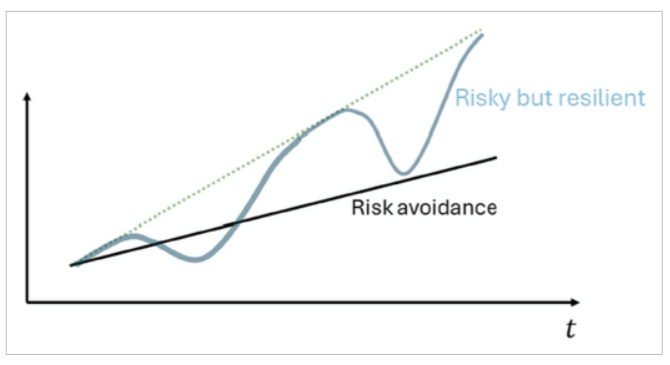

Recently, Markus Brunnermeier, the president of the American Finance Association, gave a presidential address titled “Macrofinance and Resilience”. In this address, he introduced the concept of resilience, which he distinguished from risk. He admonished finance researchers and practitioners to change their focus from risk management to resilience management.

He defined resilience as systematic positive reactions to negative economic shocks. He used the following chart to illustrate the effect of resilience vs. risk avoidance.

Put into layman’s terms, if you are financially resilient, you can potentially take on more risk and earn higher rewards.

The concept of resilience can be applied to many areas, from personal finance to investing. Today let’s focus on investing and ask ourselves what it takes to be a resilient investor. Financial resilience has a much broader scope and will be covered in my next article.

I’d like to suggest a four-point approach to being a resilient investor:

Read the rest of this entry »This article was forwarded to me by a client of mine. It was written by Mr. David Karp, who asked seven questions regarding one’s relationship with their advisor. These are excellent questions! I will repost Mr. Karp’s questions and responses, along with my own answers in red and bold.

Besides our family members and close friends, few relationships in life are as important as that of client and wealth advisor … and long lasting. After all, your wealth advisor is trusted with the financial well-being of you and your family, hopefully for generations to come. A good wealth advisor does much more than just manage your investments. He or she will get to know you and your family, your hopes and dreams and the legacy you want to leave. It’s a holistic approach that should be wholly based on the best interests of you and your family.

So how do you evaluate a wealth advisor to ensure you partner with someone who can provide the comprehensive, yet highly individualized set of solutions you need and deserve? Below are seven questions to ask prospective wealth advisors:

Read the rest of this entry »A few weeks ago, I told you about Jon, a long-time reader of my newsletter. His Edward Jones financial advisor was trying to sell him a Variable Universal Life (VUL) policy, and he asked me for my 2nd opinion. Instead of writing my opinion, however, I posted his question to my newsletter readers, and asked you guys to make an assessment.

A few of you came back with the answer of YES since the $2mm death benefit is huge, and the annual premium payment of $17k appears to be quite reasonable. On top of that, the buyer gets the flexibility to skip payments as well. I believe this view of the product is exactly what the insurance company wants but it is misguided.

To answer Jon’s question, I first talked to him to determine his family’s actual need for life insurance. He has two teenage kids and he and his wife already both have 20-year term life insurance policies, each with a $2mm death benefit. They clearly have no need for additional life insurance.

Now let’s look at the product itself. A VUL policy is a combination of two components – life insurance and investment. The product is not entirely under the oversight of the SEC, therefore there is a huge regulatory loophole that the insurance company can use to take advantage of the buyers.

Read the rest of this entry »Two weeks ago I wrote about the tax strategy to use during a sabbatical, career transitions, and early retirement. This week’s article is a continuation of that theme, focusing on tax gain harvesting.

This discussion stems from the fact that investment gains are taxed differently than our ordinary income. In fact, they have their own tax brackets. See below:

Let’s take Joe Doe for example. He is a lawyer and his usual taxable income is $600k. That puts him squarely in the 20% capital gains tax bracket. On top of that, based on his income, he must also pay the Obamacare surtax of 3.8%. That makes the tax rate on his investment gains (and qualified dividends) 23.8%.

Read the rest of this entry »I have done many portfolio reviews over the years and I’ve seen all kinds of mistakes people make with their investments. Starting today I will do a series of articles on this specific topic. Hopefully, you will learn from these examples and therefore avoid repeating them.

First let me clarify a couple of terms:

- Financial Advisor: the guy who gives you financial advice and tells you where (what funds) to invest your money. Most of them work for big brokerages like Merrill Lynch, Morgan Stanley, and others (therefore the conflict of interest), and most of them can direct your money.

- Fund Manager: the guy who works at a mutual fund who does not interact directly with you, but nevertheless decides what stocks and bonds or other funds your money should be invested in once your financial advisor has invested your money in his fund.

To review a portfolio, first and foremost, I examine the hidden costs:

Read the rest of this entry »Today, a client of mine invited me to his house for lunch. His son Kevin has just finished college and started a job. The lunch invitation was not just for a celebration, but also to give Kevin a quick financial education and set him up for future financial success.

Kevin is employed by a small company that pays him a $60k starting salary. As part of his employment benefits, he also gets a 401k plan with 3% employer match.

As I sat down with Kevin, I had a clear plan of what I wanted to convey to him in the form of questions that I would answer for him.

When should he start saving and investing?

Read the rest of this entry »The reward of a financial advisor

Posted on: January 7, 2013

Recently, a client of mine fell, broke his hip and ended up lying on the floor for 20 hours before he was rescued. I went to visit him in the hospital a couple of times. The good news is: he is out of immediate life-threatening danger. The bad news is: he may be wheelchair bound for the rest of his life.

Recently, a client of mine fell, broke his hip and ended up lying on the floor for 20 hours before he was rescued. I went to visit him in the hospital a couple of times. The good news is: he is out of immediate life-threatening danger. The bad news is: he may be wheelchair bound for the rest of his life.

When John first came to me to seek my help with his personal finance, I looked at his overall financial big picture and was pleased overall. He worked at federal and state jobs and enjoyed good pensions. On top of that, he had a decent investment account.

But there was a gaping hole in his retirement security: he was turning 70 then, was divorced, and his children lived far away. That meant if he were to get sick, nobody would be there to take care of him; he would need to hire caregivers. Right then, I insisted that he buy long-term care insurance.