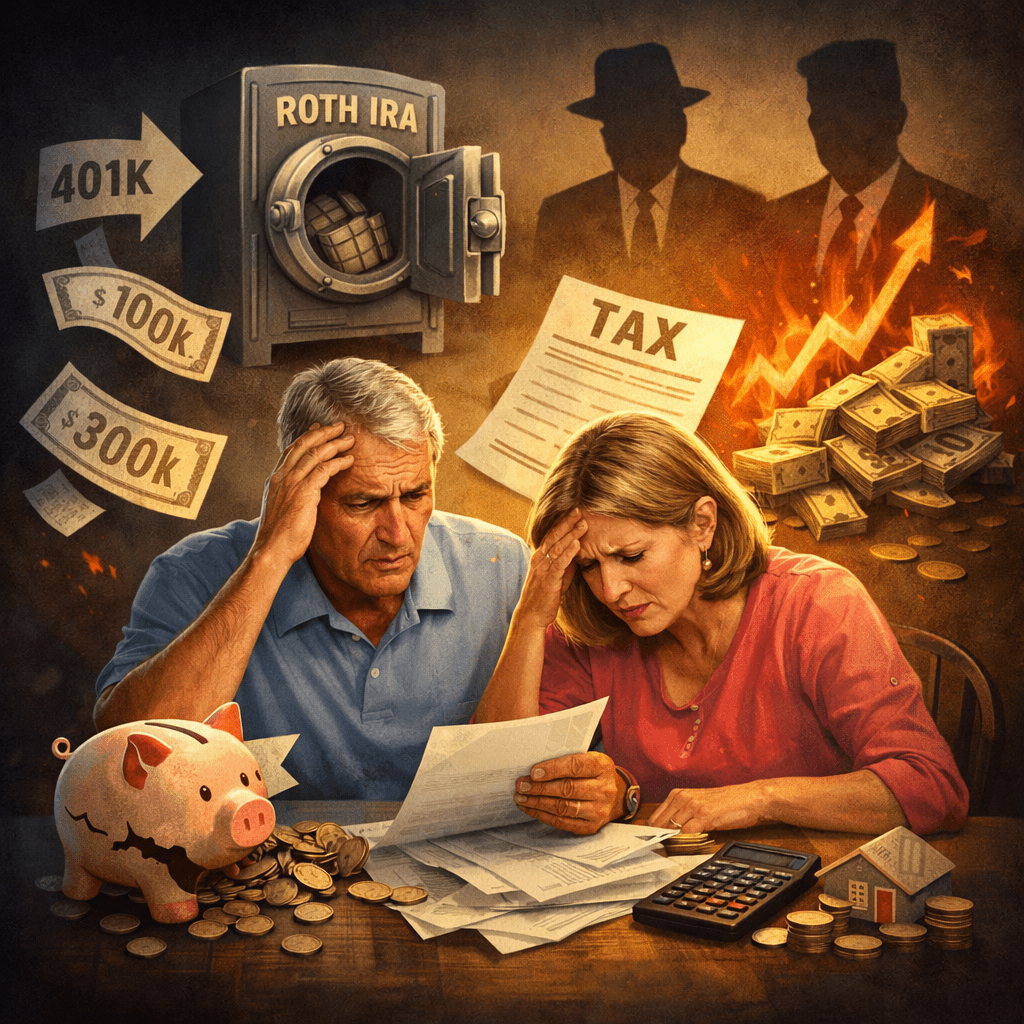

Don’t Make This Costly 401k Conversion Mistake

Posted on: February 4, 2026

A client of mine recently shared a real-life story from a friend – let’s call him John.

John recently retired from his long-time job and had accumulated $1mm in his 401k. He correctly recognized that, without his salary, he and his wife are now in a much lower tax bracket, maybe 12%. To take advantage of this, he converted all of his $1mm into a Roth IRA.

John was totally flabbergasted to learn that he owed more than $300k in federal tax and nearly $100k in state tax from this conversion. To raise money to pay these taxes, he was forced to sell some appreciated investments, which led to his owing even more tax. What went wrong?

The problem is that the $1mm Roth conversion is counted as income by the IRS and taxed accordingly. The amount pushed John and his wife into the highest tax bracket, not only at the federal level, but also at the state level.

The idea itself wasn’t wrong. When you are in retirement or on sabbatical, it makes sense to take advantage of your low tax bracket to convert to a Roth account, but only up to the amount that keeps you in that lower tax bracket.

My client lamented that he should have referred John to me for financial planning. Alas, it’s too late now. A few careless clicks of a button ended up costing nearly half a million dollars, plus the lost interest, dividends and capital gains on the money used to pay the taxes. Who would have thought?

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment