Should We Buy NVIDIA Stock? The Answers

Posted on: June 23, 2024

I asked you all this question yesterday, and today I will share select replies followed by my comments on the matter.

JG wrote: The joy ride will eventually end. The current price dictates an annual revenue growth of 10 percent per year for the next 100 years. This isn’t happening. Ultimately, the dream will fade, and many will lose their money.

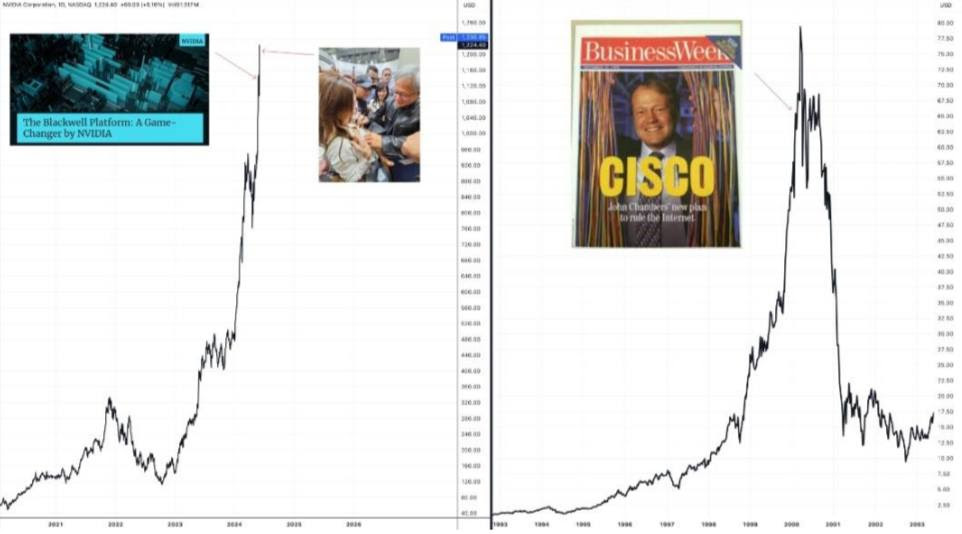

JG also shared the chart below. What CSCO was for the internet age, NVDA is for the AI age, namely, an infrastructure provider. This picture is indeed worth a thousand words.

BG wrote: There is something in my gut that says, “when every financial headline is obsessed with one stock, that’s probably not the time to buy it.” But if I was so smart, I would have bought it 5 years ago!

Nobody is smart enough to predict the winning stock definitively five years in advance, but such gut feelings can help prevent costly mistakes.

CC wrote: I’ve learned that my judgment on individual stocks was not good. One example is purchasing ZM at peak price ~ $500 in 2020 & 2021 and now look at it! ~ $60. Huge loss.

It’s never a winning strategy to buy into hysteria. It’s true, the stock market being what it is, we can’t know how much higher NVDA will go. But it’s useful to ask yourself: are you driven by FOMO – fear of missing out? If the answer is yes, you are almost surely caught up in the hysteria.

DW wrote: It’s been in the QQQ this whole time!;)

TW wrote: It’s already in my global equity portfolio.

This is what I wrote to my clients who are also interested in NVDA: For the US equity allocation, we use both the Nasdaq and e S&P indexes. NVDA accounts for 8.7% of the Nasdaq and 6% of the S&P. In fact, in the last 12 months alone, NVDA accounted for 30% of all market gain in the US. If you have a well-diversified portfolio, you are not missing out on anything.

Here is my final analysis. As it is now, NVDA is more valuable than the entire stock market valuation of Germany, which is the fourth largest economy in the world with a population of 87mm. NVDA has fewer than 30k employees. Is it a little over the top that NVDA should fetch this level of valuation? Is NVDA’s business so unique and unassailable?

I asked a friend of mine who used to work at Google. He said that NVDA doesn’t actually even make its own wares. It designs AI chips to be manufactured by TSM and sells them to MSFT, GOOG, AMZN and AAPL. But once these chips become too expensive, nothing will stop those companies from designing their own chips.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment