Author Archive

I wrote about our rental property investment six months ago. We purchased the property for $180k, and we are earning a monthly rent of $1,750. That’s a great investment, with cash-on-cash return of 8% after taxes and HOA fees.

All was hunky dory until recently when we got a call from our tenant, who told us he lost his job and he was only able to scrape together $875 to pay for half of the rent.

We told him we appreciated his effort, and we hoped he would get another job soon. Deep down, we are really not sure how long our rental property will be nonperforming.

I received this question from a subscriber to my monthly newsletter. To answer it, I must take a detour to our human brain structure.

We actually have three brains in our head!

In the center is the reptilian brain that we share with fishes, birds, and reptiles. It deals mostly with “housekeeping” and instinct, such as body temperature and hunger. The fight-flight-freeze fear response is handled here as well.

Potential Changes to Estate and Gift Rules May Result in Severe 2013 Tax Consequences: My Read

Posted on: July 21, 2012

I received a marketing piece from a major CPA firm this morning. Let me tell you what I think about its key points.

Due to the expiration of certain tax provisions, 2012 may be the last year that taxpayers will be able to utilize the gift and estate tax exemption under the Temporary Tax Relief Act of 2010 – an exemption that generally allows taxpayers to exempt up to $5,120,000 from estate and gift taxes.

This is good to know…

Little-known Secrets of How Small Business Owners Pay for their Kids’ Education

Posted on: July 18, 2012

Being a small business owner comes with risk, responsibilities, and advantages.

This week I went to a seminar called “Little-known Secrets of Paying for College”.

My biggest take away was that everything being equal, being a small business owner makes it easier for your kids to qualify for financial aid. Let me explain.

Universities and colleges determine the financial aid eligibility of a student by the following formula: COA – EFC, where COA stands for cost of attendance and EFC stands for expected family contribution. COA is fixed, so the lower the EFC, the higher the amount of aid the student is eligible for.

Posted on: July 16, 2012

I have a new client who suffers from the same problem: her retirement accounts are choked full of Allianz’ variable annuity products very similar to this Lincoln product I reviewed a year ago. They are not as deviant as the Lincoln product in term of hiding fees, but they are nowhere close to being a keeper.

Recently, I was approached by a prospective client named John, who has all of his retirement in one annuity.

I have always been intrigued by how annuities and life insurance are sold. Listening to John explain his decision-making process and reading through the annuity contract is like turning on the light bulb in my head.

It turns out that the unique selling point of this product is the “200% Step-Up of the Guarantee Amount (GA).” The way John puts in, if he just keeps the annuity for 10 years, he will get back 200% of what he put in. What is there not to like about that! After all, he gets guaranteed upside with absolutely no downside risk.

View original post 280 more words

What prompted me to write about financial peace of mind is actually something that happened to me recently that had nothing directly to do with the topic.

My iPhone failed to sync with my desktop calendar; as the result, I missed an important client meeting.

For a whole day and whole night, I had this nagging feeling that I missed something but couldn’t quite be sure what it was. Did I leave my keys in the gym? No.

Then, I woke up in the middle of the night and remembered the appointment that did not show up on my iPhone! Apparently, some part of my mind was not resting during sleep.

[Guest Post by Anthony S. Carducci]

1. Failure to leave any written documentation of your assets, including a list of your online accounts and passwords

2. Failure to let family members know where to find important estate planning documents

3. Failure to name a guardian for minor children or choosing a guardian who lives far away without planning for temporary, local guardianship (solved with a comprehensive Kids Protection Plan®)

4. Failure to name recipients for your personal possessions

5. Failure to designate beneficiaries for retirement and other financial accounts

While reading USA Today at Panera Bread, I came across an article with a headline that blared: “Managed commodities can counter volatility.” You should have seen the chagrin on my face; you would have thought I was a facial contortionist.

How could such an uninformed article ever get published by a major newspaper? Just imagine the large number of people who will be misled by this article to put money into a financial product they don’t understand.

The claim of this article is based on a comparison of a managed futures index and the S&P 500 index. The managed futures index was compiled by a private firm called Barclay Hedge, basically a marketing arm of the managed futures industry. Read the rest of this entry »

Recently, I went to the monthly meeting of the Chicago Booth Entrepreneur Advisory Group. The group is made up primarily of University of Chicago alumni, and it provides a forum for entrepreneurs to share their issues.

I was blown away by one entrepreneur’s unbridled optimism. He invented a technology that makes changing TV channels on a PC feel as fast as on a real TV. He plans to challenge the cable companies by convincing all of us to watch TV on our PCs.

Yes, cable companies charge us an arm and a leg for their channels, many of which we don’t watch. And nobody loves their cable company. But they have been in business for years. How could a solo entrepreneur working in his bedroom take them on?

10. Small Cap Value: Risk and Returns

9. When Do You Need Annuities and Life Insurance?

8. Recession and stock market performance

7. Physicians are Not in Real Estate Business

6. Variable Annuity Fees You Don’t Know You are Paying

5. An Investment Rule for Young People

4. Why Asset Class Diversification is Superior

2. Bill Gates: 11 Things You Don’t Learn in School

1. Profit from Harry Dent’s predictions? Think again

Also see Top 10 last month.

Get informed about wealth building, sign up for The Investment Scientist newsletter

[Guest Post by Christopher Guest] On December 17, 2010, President Obama signed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, or TRUIRJCA, but I will call it the “tax compromise.” The tax compromise impacted federal estate taxes in a number of ways. One of the more surprising changes was including “portability” of a married couple’s federal estate tax exemption between the married couple. I say “surprising” because all the other changes to estate taxes were some version of current estate tax procedures while “portability” was brand new.

A business owner came to me for help in untangling a “dynasty trust” he has regretted setting up.

I sat down with him for a discovery meeting.

Now I am no expert in trust law and estate tax matters.

Still, after asking a few pointed questions, I found the trust arrangement problematic.

Here is a record of the question and answer session I held with him.

A recent doctor client of mine told me that he just did a refi through one of his patients who happened to be a mortgage broker.

I asked him what the rate was and he answered: 5% for an 8-year mortgage. This immediately raised a red flag: currently a 15-year mortgage is 3.02%, and a 5-year ARM is even lower at 2.67%. If anything, an 8-year mortgage should have a rate less than 3%.

So every year, he will pay 2% extra in mortgage interest. With a loan of $500k, that’s $10k extra a year. How would you feel if someone stole $10k from you every year? Read the rest of this entry »

I recently met with a physician couple who became clients of mine.

Their investment portfolio is chock-full of annuities and life insurance; even their qualified retirement plans are not exempt.

They told me that they went to financial seminars and were convinced that these products were good wealth accumulation vehicles. In fact, they are anything but.

These insurance products have nothing with do with wealth accumulation (except for insurance agents).

Stocks On Sales

Posted on: June 6, 2012

This is a client communication letter I wrote on June 1st. One week after i wrote this, the market closed out its best week in 2012.

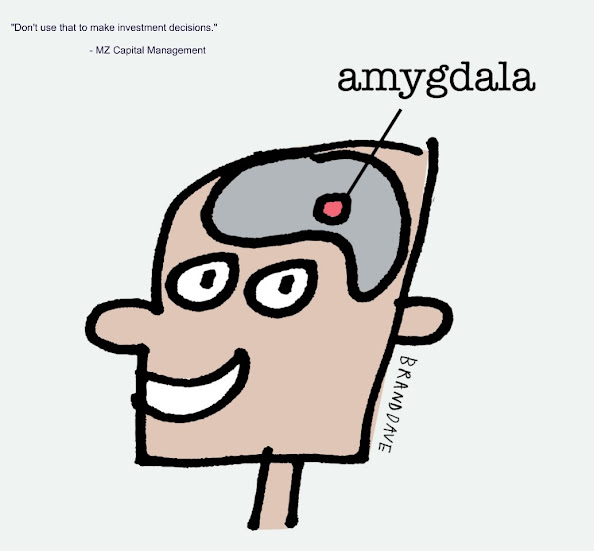

Don’t Use Amygdala to Make Investment Decisions

As I am writing this, the markets are falling like a rock. The Dow has entered negative territory for the first time this year; Nasdaq, which was up 20% a mere two months ago, is up only 5% for the year. The S&P 500 has lost close to 10% of its value since its April 1 peak.

I wrote the above paragraph using typical financial press lingo. This type of language has the tendency to cause amygdala hijack.

The amygdala is a part of our brain that processes threats. When we perceive a threat, the amygdala takes over the whole brain. fMRI scans show that blood supplies are literally commandeered from other parts of the brain for the amygdale. The amygdala is not sophisticated; it only knows three responses: fight, flight, or freeze.

This is an article I wrote in middle of May that was published on Morningstar.

Half way into May, major market indexes have all fallen more than 5% from their peaks reached in late March. The Nasdaq has fallen close to 10%. It looks like the ancient stock market folklore “Sell in May and go away” is quietly unfolding right before our eyes.

To get a better understanding of this phenomenon, I did two things recently: 1) I studied the historical returns between May 1 and Sept. 30 and 2) I pondered a plausible explanation of stock market seasonality and its implication on investment. Today, I will report to you the results of my intellectual exercises.<

Historical returns

Using data retrieved from Yahoo.com, I calculated the average S&P 500 index return between May 1 and Sept. 30 to be -0.3% over the past 20 years. As a comparison, the average index return between Oct 1 and April 30 is 7.2%. Clearly the five months starting in May are unproductive for stock investment, historically.