The Durable Asset: My Answer

Posted on: October 16, 2022

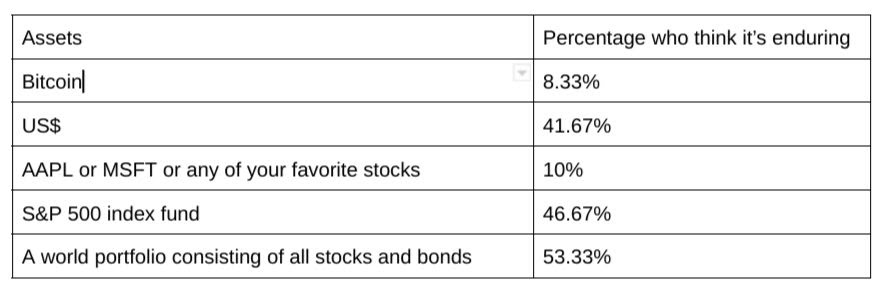

Thank you for all the responses to my last survey. Here is the breakdown of your answers – the table below shows the percentage of you who think the specific asset is an enduring asset.

Bitcoin is not an enduring asset. The so-called cryptocurrency is neither used for any meaningful exchange, the primary function of a currency, nor is it safe from hacking or outright bans from governments.

The US Dollar is not an enduring asset because our government is prone to print more of it to solve whatever problem we might have. Printing money is an easy way out, and it’s human nature to seek the easy way out. This is not a judgment about the political system or the political parties, rather it’s an admission of human nature.

AAPL or MSFT or any of your favorite stocks are not an enduring asset because any business, no matter how successful they might be at present, can go broke. The road to wealth is littered with corpses of once mighty companies. (For instance, Yahoo, Enron, GE and Boeing.) Even the almighty Apple had a brush with bankruptcy.

The S&P 500 index fund is almost an enduring asset. It represents about 80% of the US economy, which itself is slightly less than 25% of the world economy. In other words, the index represents 20% of the world economy. As long as the world endures, 20% of the world economy will endure. However, the US share of the world economy did decline from nearly 60% after the Second World War, and this trend will likely continue.

A world portfolio consisting of all stocks and bonds is an enduring asset. Owning such a portfolio is like owning all the (publicly traded) businesses in the world. As long as we humans multiply and demand higher standards of living, the combined value of all the businesses in the world will surely increase. Of course, it could still go to zero if humanity perishes. In that case, we certainly wouldn’t need the portfolio anymore.

The purpose of wealth accumulation is to convert our human capital (earned income) to as many enduring assets as possible.

Schedule a 2nd opinion financial review, buy my wealth mgmt books on Amazon.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment