The January Effect: What Does It Bode For The Market in 2023?

Posted on: January 31, 2023

“The January Effect” refers to two phenomena in the stock market that elude good explanation:

- The market tends to perform exceptionally well in January.

- The market’s January return tends to predict the rest of the year. That is, if we have a good return in January, it is more than likely that we will have a good return for the whole year.

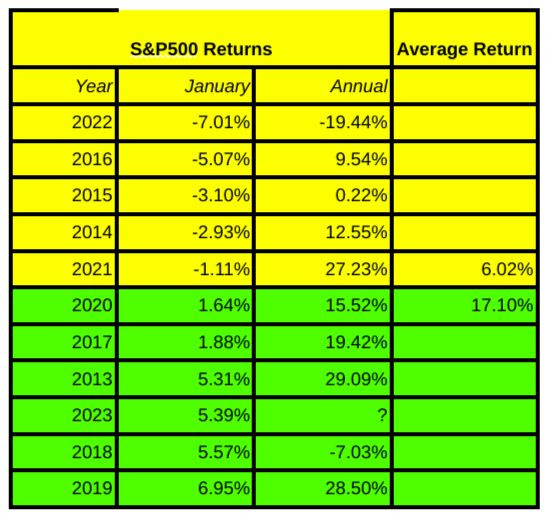

In recent years, however, people have been saying that the January Effect is weakening. So today I am going to revisit these two phenomena using the S&P 500 return data from the last 10 years. In the table below, I calculated the January returns (and the annual returns) from 2013 to 2022 and arranged them from the lowest to the highest.

Here are my observations:

- The market had negative returns in five of the last ten years. The average January return was only 0.74%. So the first supposition of the January Effect, that the market performs exceptionally well in January, did not seem to hold over the last ten years.

- However, the second part of the January Effect seems to still hold very strongly. In the years that the January returns were negative, the average annual return was only 6.02%. But in the years that the January returns were positive, the average annual return was 17.10%!

So far this year, the January return has been 5.39%. What do you expect the full-year return to be?

Schedule a 2nd opinion financial review, buy my wealth mgmt books on Amazon.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment