Author Archive

US Elections and Stock Returns

Posted on: November 3, 2024

Some readers of my newsletter asked me how to position their investments for the upcoming election.

I did a survey of academic journals on this topic, however there are basically no research papers available. There is an article published in the Journal of Financial Analysis, but this journal is not considered a top-tier academic journal. The lack of research could either mean that this topic is not viewed as a serious academic topic, or that there is simply not enough data to establish any validity.

I then went on to research industrial publications and found an interesting chart to show to you, my readers, that will drive home an important point that is dear to me, specifically, that you shouldn’t try to outsmart the market based on presidential politics.

See the chart below, during the Trump administration, renewal energy stocks outperformed traditional energy stocks by 43%; during the Biden administration, renewal energy stocks underperformed traditional energy stocks by 53%. If you had picked stocks based on presidential preferences, you would have been screwed left and right, literally.

Read the rest of this entry »- In: Life

- Leave a Comment

Thank you so much to everyone who responded to my recent request for your opinions. Let me cut to the chase: 45% of you want me to write about the latest academic research; 36% want to hear about cautionary tales, and 19% want both – one person even suggested that I should be able to combine the insights from academic research with cautionary tales.

Cautionary tales are relatively easy to write since they are direct results of f my work with my clients. I often deal with things they did before I started working with them or things I wish they had discussed with me before acting.

It is much more challenging to write about academic research. Most academic papers are very abstract and they are scattered throughout various journals. I must first survey these journals and extract useful insights from them.

If writing a cautionary tale is an 1-hour job, writing about academic research could take 10 hours. But I will do that since that’s what you have asked me to do. And, quite frankly, writing about these studies will help me better manage my clients’ wealth.

Here are the journals that I will survey:

Read the rest of this entry »Loyal readers of my newsletter may have noticed that I haven’t written a newsletter article for over a month. This pause has given me time to think about what I should write about the remainder of this year and next year. It has come down to two broad topics, and I’d like my readers to help me decide.

Some of you may know that I have published two books. The first one, Physician Wealth Management Made Easy, was published in 2017, the second one, Entrepreneur Wealth Management Made Easy, in 2019. In these books, I use real-life cautionary tales to teach useful financial lessons. Since the publication of these two books, I have heard five more years worth of cautionary tales from folks who came to me for advice. I think my readers can learn a lot from these tales. What do you think?

Read the rest of this entry »If your Financial Advisor has Conflicts of Interest: Three Quick Ways to Determine

Posted on: September 6, 2024

In my last newsletter, I wrote about finding $50k+ worth of hidden costs due to conflicts of interest, and a reader asked me if there is a quick way to check if her financial advisor has such conflicts. Her question inspired my article today.

Before we dive into that, I must first give you a quick overview of the legal environment in which financial advisors operate. There is the Securities Exchange Act that regulates brokers and does NOT require them to act in the best interest of their clients, and there is the Investment Adviser Act that regulates RIAs (registered investment advisors) which does require them to act in the best interest of their clients.

Your financial advisor can be a broker, an RIA, or even dually registered. Those dually-registered ones can be especially deceptive. Here is an actual example – the last few lines of a financial advisory firm’s website:

Read the rest of this entry »This morning, I did a portfolio review for a 2nd Opinion Review customer. It is a portfolio worth just under $4mm and I found $56k of hidden costs per year.

Load is the least hidden of all hidden costs, it is a one-time charge that happens when the broker (“financial advisor”) puts your money in a mutual fund. The mutual fund immediately takes a percentage of your money and gives it to the broker as commission. Since this is too obvious, few brokers are that blatant these days.

Expense ratio is the percentage the fund deducts from your investment, and part of this deduction is given to the broker as a kickback. It is even more costly since it occurs every year. It creates an adverse incentive, since the broker is more inclined to put your money in funds that give them a higher kickback. The gold standard of expense ratio is 0.05%. Note that many funds in this analysis have an expense ratio over 1%, over twenty times more expensive than the gold standard.

Turnover measures how frequently the fund manager churns your investments. The more frequent the churn, the more money you lose and the more money the brokerage that handles the trades makes. The gold standard of turnover is less than 10%. If a fund has more than 100% turnover, it belongs in the category of horrible, since 100% equates about 1.2% loss of return.

See below the result of the portfolio review. Numbers in yellow are bad, numbers in red are outright horrible. Compare these numbers to the numbers in green, which is our gold standard.

Read the rest of this entry »What has happened in the last few days was a mad dash out of the door of all US dollar-dominated assets to buy back Japanese Yen. Why so? I have to start by explaining the Yen carry trade.

For a long time, Japan’s Central Bank has maintained an extremely low interest rate policy of between 0% and 0.1%. If you were smart money with the right access, what would you have done to earn effortless money? You would borrow Japanese Yen and convert it to US dollars. By just investing the money in US treasuries, you could immediately earn more than 5%. This is called the Yen carry trade, essentially an arbitrage of the interest rate differentials of the US and the Japanese Central banks.

In any event, the result of the Yen carry trade has been the almost endless depreciation of the Japanese Yen, the appreciation of the US dollar, and an endless supply of additional liquidity to the US stock market despite the Fed’s tight money policy. This additional liquidity pushed up all manner of asset prices. But alas, all good trade has to come to an end.

Read the rest of this entry »Last week I published a newsletter article titled “Will The Stock Market Return to The Fundamental?” I have received a good number of responses, and as promised, today I will share my thoughts.

The traditional economic theory has always presumed that economic actors are calculating and rational. The application of this presumption in the investment field is the efficient market hypothesis, which basically says that investors rationally pay the prices for expected future earnings adjusted for risk. The biggest proponent of the efficient market hypothesis is Nobel Prize winner Eugene Fama.

The efficient market hypothesis has its biggest opponent in Robert Shiller, who years ago published his seminal work that illustrated how a 1% change in dividends can oftentimes result in a 15% change in the stock price. If investors are, in fact, calculating and rational, stock prices shouldn’t fluctuate so much relative to dividends.

Read the rest of this entry »The title of this article comes from a recent discussion I had with a client of mine. First, we should define what “the fundamental” means. It is best defined in Intelligent Investor, a book by Warren Buffet’s teacher Benjamin Graham. In short, his idea of a good investment is a stock with good earnings selling at a cheap price.

Graham’s insights were lately confirmed by Eugene Fama’s Nobel Prize-winning research, where Fama found that throughout history (until maybe 2015,) small-cap value stocks performed the best.

At present, the stock market in the US is definitely not following Ben Graham’s fundamentals. 70% of all returns are concentrated in the seven biggest tech stocks, all of which are very expensive. Nvidia for example, has a $3T valuation, which is 4 times the GDP of Taiwan, where its AI chips are made.

Read the rest of this entry »I asked you all this question yesterday, and today I will share select replies followed by my comments on the matter.

JG wrote: The joy ride will eventually end. The current price dictates an annual revenue growth of 10 percent per year for the next 100 years. This isn’t happening. Ultimately, the dream will fade, and many will lose their money.

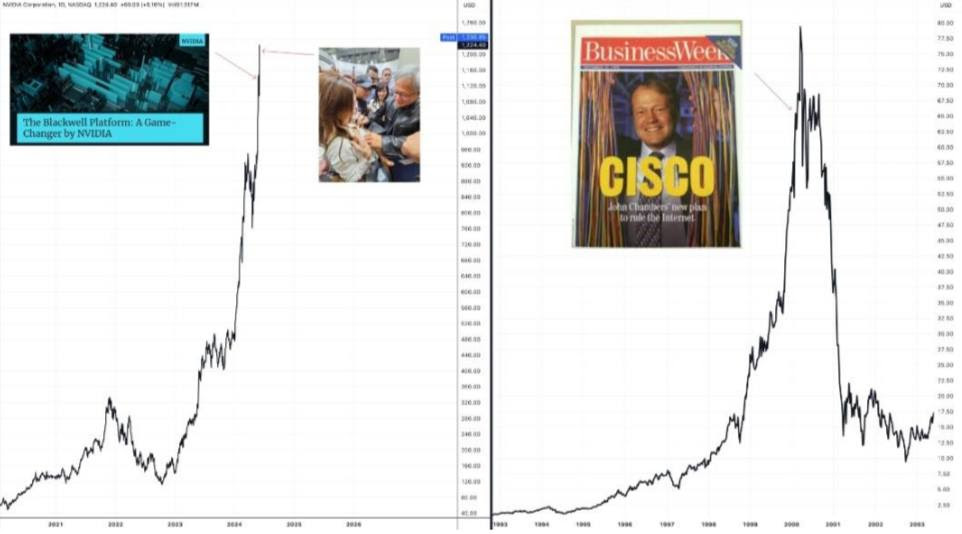

JG also shared the chart below. What CSCO was for the internet age, NVDA is for the AI age, namely, an infrastructure provider. This picture is indeed worth a thousand words.

Should We Buy NVIDIA Stock?

Posted on: June 23, 2024

In the last few days, I have gotten a few client calls about this. On top of that, my teenage son asked me the same question, telling me a classmate of his had bought this stock and made a few thousand dollars. Instead of answering this question outright, I’d like to hear your views. Please reply to this email, tell me what you think and give me your explanation.

In the next email, I will share with you not only my thoughts but also give you a summary of how you, my newsletter subscribers, responded.

Get informed about wealth building, sign up for The Investment Scientist newsletter

A few weeks ago, I told you about Jon, a long-time reader of my newsletter. His Edward Jones financial advisor was trying to sell him a Variable Universal Life (VUL) policy, and he asked me for my 2nd opinion. Instead of writing my opinion, however, I posted his question to my newsletter readers, and asked you guys to make an assessment.

A few of you came back with the answer of YES since the $2mm death benefit is huge, and the annual premium payment of $17k appears to be quite reasonable. On top of that, the buyer gets the flexibility to skip payments as well. I believe this view of the product is exactly what the insurance company wants but it is misguided.

To answer Jon’s question, I first talked to him to determine his family’s actual need for life insurance. He has two teenage kids and he and his wife already both have 20-year term life insurance policies, each with a $2mm death benefit. They clearly have no need for additional life insurance.

Now let’s look at the product itself. A VUL policy is a combination of two components – life insurance and investment. The product is not entirely under the oversight of the SEC, therefore there is a huge regulatory loophole that the insurance company can use to take advantage of the buyers.

Read the rest of this entry »Recently, a long-time reader of my newsletter came to me for a second opinion financial review. His current financial advisor from Edward Jones had highly recommended a Variable Universal Life Insurance policy as an awesome investment vehicle for his family.

This reader of mine, I’ll call him Jon, is married with two teenagers. Both are very healthy and will go to college in a few years.

The pitch his advisor made for this product includes: 1) it is very flexible, you can decide when and how much to make the premium payments; 2) you can invest in the stock market through various mutual funds to build up cash value, and 3) with this product, you can achieve tax-free growth of the cash value.

I went over the list of available mutual funds and the one with the lowest expense ratio is the Fidelity VIP 500 Index Fund at 0.35%. About one-third of the funds have an expense ratio higher than 1% however.

For this policy that pays a death benefit of $2mm, Jon needs to pay about $17k per year until he is 70, after that, he can stop paying and the policy will remain valid, according to the policy illustration.

Do you think Jon should buy this VUL policy as an investment or not? If you think the answer is yes, reply and give me three reasons. If it’s no, also give me three reasons. Next week I will share my thoughts.

Get informed about wealth building, sign up for The Investment Scientist newsletter

I was invited to a dinner by a client couple of mine. Their youngest daughter has been accepted to three universities and they are having a hard time picking the right one and they wanted my help.

Universities A and B are both out-of-state Ivy League universities that cost more than $60k a year in tuition. University C is an in-state university that costs only $15k. I listened to their reasoning as to why it is so hard to make a decision. They really want to give the best to their daughter and besides, an Ivy League university would give them a lot of face (there you know they are a Chinese American family) since their peer families all brag about their children’s academic achievements and they feel pressured to keep up.

Before I said anything, I forewarned them that the choice of university is a very personal one for them and their child so they should take my words only as my observations and not as my professional advice.

First, since universities A and B are four times as expensive as university C, do they provide four times more value? By this I mean, would their child acquire four times as much knowledge or earn four times as much after graduation? (I will get to this point later.) If not, they would be paying the extra just for the bragging rights.

Second, what financial values do they want to impart on their children? That they should borrow money to pay for something they can’t afford just for vanity? Would such a value system not lead to financial ruin for their children down the road?

Read the rest of this entry »Two weeks ago I wrote about the tax strategy to use during a sabbatical, career transitions, and early retirement. This week’s article is a continuation of that theme, focusing on tax gain harvesting.

This discussion stems from the fact that investment gains are taxed differently than our ordinary income. In fact, they have their own tax brackets. See below:

Let’s take Joe Doe for example. He is a lawyer and his usual taxable income is $600k. That puts him squarely in the 20% capital gains tax bracket. On top of that, based on his income, he must also pay the Obamacare surtax of 3.8%. That makes the tax rate on his investment gains (and qualified dividends) 23.8%.

Read the rest of this entry »Tax Saving Strategies for Sabbaticals, Career Transitions or Early Retirement

Posted on: April 10, 2024

I have a client who is planning to take a year off to take care of her mother, another one who has quit his job to launch a new business, and yet another one who has retired early and needs to wait a few years to receive her pension and social security.

What they all have in common is that they will have at least one year during which they will have very low or even no income. I have been thinking about how they can take advantage of their situations to increase their lifetime wealth-being, or more specifically to reduce their lifetime tax liabilities. Here are two strategiesI came up with: 1) Roth Converstion and 2) Tax Gain Harvesting.

Folks who save money for retirement usually stash their money in three types of accounts: taxable accounts like banks and brokerages; tax-deferred accounts like IRAs, SEPs and 401ks, or tax-exempt accounts like Roth IRAs and HSAs.

With tax-deferred accounts, once you are over 71 years old, there will be a RMD (required minimum distribution) that will increase as you age. If you invest well, eventually this RMD will push you into the higher tax brackets like 35% or even 37%. Here is a table of tax brackets for 2024.

Read the rest of this entry »America’s national debt is spiraling out of control. It’s at $34.4T right now and is increasing at a rate of $2T per year. Today I am going to prognosticate what will likely happen and what it will mean for us investors.

To make the projection, I will assume things will stay largely as they are:

- Inflation around 4%

- Interest rate about 5%

- Budge deficit around at $2T

At this rate, in five years, the total federal debt will be over $44T. At an average interest rate of 5%, the total interest payments in the federal budget will be $2.2T. In 2023, the total federal tax revenue came at only $4.6T. In other words, in five years or so, the interest payments alone will amount to nearly half of the federal tax revenue.

With a budgetary shortfall at that level, there will be no other option but to “print’ more dollars. Today I will not discuss the mechanism of printing money. Suffice to say that printing money will lead to inflation and inflation necessitates that the Fed keeps the Fed fund rate high.

Read the rest of this entry »