Archive for the ‘Wealth Management’ Category

A client of mine recently shared a real-life story from a friend – let’s call him John.

John recently retired from his long-time job and had accumulated $1mm in his 401k. He correctly recognized that, without his salary, he and his wife are now in a much lower tax bracket, maybe 12%. To take advantage of this, he converted all of his $1mm into a Roth IRA.

John was totally flabbergasted to learn that he owed more than $300k in federal tax and nearly $100k in state tax from this conversion. To raise money to pay these taxes, he was forced to sell some appreciated investments, which led to his owing even more tax. What went wrong?

Read the rest of this entry »Imagine giving your child a head start that could turn them into a millionaire by retirement—without relying on an inheritance or a lucky lottery ticket. Thanks to the new Trump Account, a federal savings initiative launched for children born between 2025 and 2028, this dream can become a reality for proactive parents.

What Is the Trump Account?

The Trump Account is a government-backed investment plan that automatically provides every eligible newborn a $1,000 seed deposit from the U.S. Treasury. Parents, relatives, and employers can then contribute up to $5,000 each year until the child turns 18. All contributions are invested in a low-cost, diversified U.S. stock index fund.

How Does It Work?

Read the rest of this entry »How To Pick Mutual Fund Winners

Posted on: January 27, 2025

In answer to my readers’ response to my survey last year, I will be writing a series of articles about academic research in the realm of finance, focusing on studies that are pertinent to us, the average investor.

Today, I am writing about the most cited research in the Journal of Finance. It’s written by Mark M. Carhart, and titled “On Persistence in Mutual Fund Performance”, published in 1997.

Why should you care?

Well, if the research were able to help us identify a few persistent winners among the more than 10,000 available funds, wouldn’t that make our investment life a lot simpler? We could hold only the winners and be done with it. Unfortunately, the research did not find any persistent winners. More precisely, other than a small momentum effect, the research found no evidence that any mutual fund has the ability to consistently outperform the market.

However, the research did find that mutual fund expenses and transaction costs are persistent predictors of underperformance. A 1% increase in expense ratio correlates to a 1.5% decrease in fund performance and a 1% increase in fund turnover results in a 0.95% decrease in fund performance.

Here are the three expenses or costs that you should especially watch out for.

Read the rest of this entry »Loyal readers of my newsletter may have noticed that I haven’t written a newsletter article for over a month. This pause has given me time to think about what I should write about the remainder of this year and next year. It has come down to two broad topics, and I’d like my readers to help me decide.

Some of you may know that I have published two books. The first one, Physician Wealth Management Made Easy, was published in 2017, the second one, Entrepreneur Wealth Management Made Easy, in 2019. In these books, I use real-life cautionary tales to teach useful financial lessons. Since the publication of these two books, I have heard five more years worth of cautionary tales from folks who came to me for advice. I think my readers can learn a lot from these tales. What do you think?

Read the rest of this entry »I have done many portfolio reviews over the years and I’ve seen all kinds of mistakes people make with their investments. Starting today I will do a series of articles on this specific topic. Hopefully, you will learn from these examples and therefore avoid repeating them.

First let me clarify a couple of terms:

- Financial Advisor: the guy who gives you financial advice and tells you where (what funds) to invest your money. Most of them work for big brokerages like Merrill Lynch, Morgan Stanley, and others (therefore the conflict of interest), and most of them can direct your money.

- Fund Manager: the guy who works at a mutual fund who does not interact directly with you, but nevertheless decides what stocks and bonds or other funds your money should be invested in once your financial advisor has invested your money in his fund.

To review a portfolio, first and foremost, I examine the hidden costs:

Read the rest of this entry »Today, a client of mine invited me to his house for lunch. His son Kevin has just finished college and started a job. The lunch invitation was not just for a celebration, but also to give Kevin a quick financial education and set him up for future financial success.

Kevin is employed by a small company that pays him a $60k starting salary. As part of his employment benefits, he also gets a 401k plan with 3% employer match.

As I sat down with Kevin, I had a clear plan of what I wanted to convey to him in the form of questions that I would answer for him.

When should he start saving and investing?

Read the rest of this entry »There is so much to write about the Silicon Valley Bank (SVB) collapse and the subsequent government rescue plan. Let me start by saying that I do agree that the government’s action has arrested a panic that could lead to a domino of bank collapses. In today’s article, I’d like to present my thought that the rescue mechanism as it is now could lead to more problems down the road that one day might become an even bigger crisis.

Read the rest of this entry »Two months ago I wrote about the top ten reasons that Equity Index Annuities are ripoffs, but apparently I did not exhaust all possible ways an insurance company can get at your money. Recently, a client of mine asked me to review an EIA he bought two years ago. Oh my goodness! I have had my eyes opened and my heart disgusted once again!

The contract I looked at for my client put his money in a so-called “1 Year Average Participation Index Account” with an initial participation rate of 30% and a minimum participation rate of 10%.

Injury #1: With all EIAs, you give up the dividend, which is about 2% a year. So you need to plan to give up 20% in ten years and 40% in 20 years.

Injury #2: This injury stems from the word “average.” Let’s say in a given year, the market goes up 10%, you are not getting this 10% growth, you are getting the “average” growth. You have to read the whole contract to understand what a ripoff this term is. Let’s assume that in January, the market goes down 1%, and in subsequent months, the market goes up 1%. So adding all the gains together, for the whole year the market goes up 10%. The way they do the average is this: for every month, they will calculate the Year to Month Return, and then average them. The effect of this is to cut the annual return number by half. In a year the annual return of the market is 10%, after the insurance company applies their “average”, the return becomes 5%. See the table below for an illustration.

Read the rest of this entry »“The January Effect” refers to two phenomena in the stock market that elude good explanation:

- The market tends to perform exceptionally well in January.

- The market’s January return tends to predict the rest of the year. That is, if we have a good return in January, it is more than likely that we will have a good return for the whole year.

In recent years, however, people have been saying that the January Effect is weakening. So today I am going to revisit these two phenomena using the S&P 500 return data from the last 10 years. In the table below, I calculated the January returns (and the annual returns) from 2013 to 2022 and arranged them from the lowest to the highest.

Read the rest of this entry »I am talking about an HSA – the Health Saving Account. Why is it the best? Because it is the only saving vehicle that gives you triple tax benefits. The money goes into the account pre-tax, the money inside can grow tax-free, and all health-related qualified withdrawals are tax-exempt.

However, not everybody is qualified to open such an account. Only folks who have an HDHP – High Deductible Health Plan can contribute to such an account, and the contribution limits are relatively low. For 2022, the limits are $3650 for an individual or $7300 for a family; for 2023, the limits are $3850 and $7750 respectively.

Who should have an HDHP in order to have an HSA? Folks who are young or very healthy. In my case, I am not that young, but I am super healthy and I plan to live a long life, so an HDHP makes sense for me. Not only can I pay a lower health insurance premium, but I can also open an HSA and begin to save for my future healthcare needs.

Read the rest of this entry »I have a 14-year-old son who has done some odd jobs for my business this year. What he did not know until now is that I actually paid him about $7000 in 2022 and put $6000 of that into a kiddy Roth IRA that I opened for him.

This is how I told him. I pulled him aside and announced: “Son, I just made you a millionaire!” That got his attention away from playing video games! He asked: “How so?”

“Daddy just put $6000 into your Roth IRA. In a few days, when it’s 2023, daddy will put another $6500 into your Roth IRA. This type of account lets your money grow tax-free, and when you retire, lets you withdraw the money tax-free. Let’s say you have a very productive life and retire at 74. If you don’t touch the money until then, how much money will you have assuming the money grows at 8%?”

Being the smart boy that he is, my son quickly figured out he should use the compounding formula: 8% per year, compounding over (74-14) = 60 years will make the money 1.08^60 = 101 times over. Since he gets $6000+$6500 = $13,500 from daddy (actually by his own work.) $13,500*101 = $1,363,500! He broke out in a smile!

I smiled as well since I taught him a lesson about investing: start early, stay disciplined and let compounding work its magic.

Read the rest of this entry »It has been a few months since I decided to write a newsletter about Health. As I get older, it is becoming clearer and clearer to me that health is the ultimate wealth and one can not talk about wealth in isolation of health.

However, I don’t know where to start. My own awareness of the importance of health has been a slow and gradual process. After I first became cognizant of its importance, there was a long process of knowledge acquisition as well as plenty of trial and error on myself. Following that, there was yet another long process of habit formation. Truth be told, there was no “aha” moment and there was definitely no instant success. Instead, it has been a constant learning and many micro-adjustments over many years.

Read the rest of this entry »A client of mine came to me very worried because at this time last year, his account was $1.35mm and now it’s only $1.19mm. That’s a “loss” of nearly 12% in one year. “At this rate, am I gonna lose everything in 8 years?” he asked.

I showed him a number buried deep in his statement, and he immediately regained confidence that he is not losing, he is, in fact, gaining. What number did I show him? Just stop reading for a minute to think about that. After one minute you can read on.

….

Read the rest of this entry »Here are your answers to the survey question: “What You Learn The Most From Warren Buffett and Charlie Munger?” Most people pick “They are patient” as their top take-away, followed by “They are value-oriented”.

If I had been asked the same question ten years ago, I would have picked these two as well. However, today I want to discuss the point that came in third, that they stay alive and sharp.

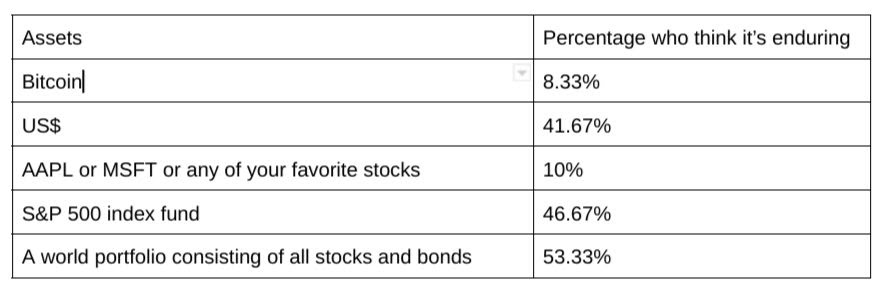

Read the rest of this entry »The Durable Asset: My Answer

Posted on: October 16, 2022

Thank you for all the responses to my last survey. Here is the breakdown of your answers – the table below shows the percentage of you who think the specific asset is an enduring asset.

Bitcoin is not an enduring asset. The so-called cryptocurrency is neither used for any meaningful exchange, the primary function of a currency, nor is it safe from hacking or outright bans from governments.

Read the rest of this entry »My last newsletter illustrated an actual example of a client portfolio that had fallen 17% in value over the previous 12 months. Despite that, the portfolio’s projected income had increased by 10%.

This client’s portfolio is a 50/50 portfolio, with 50% in bond funds and 50% in stock funds. The same factor that drives the portfolio value’s fall also drives the increase in income. The factor I’m talking about is the long-term interest rates.

Don’t mistake this for the Fed’s interest rate hike. The Fed only controls the overnight Fed fund rate, it does not control the long rates like the 5-year rate, 10-year rate, etc. It is the market that sets the long rates. When the market believes that the Fed needs to tighten up a lot more to control inflation, long rates increase across the board, causing both stock and bond values to fall. (If the central bank will pay high overnight interest long into the future, all existing investments become less valuable.)

Read the rest of this entry »