Archive for the ‘Wealth Management’ Category

June Wealth Management Roundup

Posted on: June 30, 2011

Why Physicians Are Not Wealthy my latest contribution to KevinMD.com

How Complex Derivative Products Imperils Seniors’ Retirement Security by John Wasik

Financial Wealth – It’s Time, Not Money by Allan Roth at MoneyWatch.com

CME Pushes Managed Futures: Wealth With Little Risk by Allan Roth at MoneyWatch.com

Why the Economic Recovery is Lagging by Richard Posner

Three Reasons to Avoid Corporate Bonds by Larry Swedroe at MoneyWatch.com

Will FINRA Stop the Structure Product Insanity? by Seth Lipner at Forbes.com

Random Views on US Default by Menzie Chinn at EconoBrowser.com

Forecasting Commodity Prices by Menzie Chinn at EconoBrowser.com

Get informed about wealth building, sign up for The Investment Scientist newsletter

10. Top Wealth Management Google Ranking

9. Shall You Sell in May and Go Away?

8. Variable Annuity Fees You Don’t Know You Are Paying

7. The 2011 Estate Tax Changes

6. America’s Top Financial Advisors: How They Are Made?

5. Asset Allocation Return Report: 60/40 Portfolio Model

4. A Balanced Portfolio to Avoid (i): Annuities Are Not Safe Investments

2. Bonus Depreciation – Congress Wants Businesses to Invest in 2011

1. Profit From Harry Dent’s Prediction? Thank Again

Get informed about wealth building, sign up for The Investment Scientist newsletter

MZ Capital 50/50 Portfolio Model

This report shows the construct and performance of a 50/50 model portfolio.

Asset Classes and Fund Selection

There are six asset classes in this portfolio model. The asset allocation is implemented using DFA funds, as shown in the table 1. I explained why DFA funds are superior here.

There are six asset classes in this portfolio model. The asset allocation is implemented using DFA funds, as shown in the table 1. I explained why DFA funds are superior here.

| Table 1: Asset Class Funds | ||

| Asset Class | Percentage | Funds |

| US Equity | 20% | DFFVX – US Targeted Value Fund |

| International Equity | 10% | DISVX – International Small Cap Value Fund |

| Emerging Markets | 10% | DFEVX – Emerging Market Value Fund |

| REIT | 10% | DFREX – Real Estate Securities Fund |

| TIPS | 25% | DIPSX – Inflation-Protected Securities Fund |

| Treasuries | 25% | DFIHX – Short-Term Treasuries Fund |

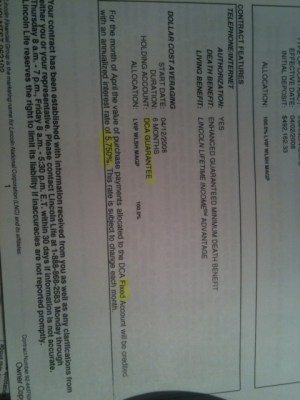

I was called a “wing nut” by a commenter for pointing out all the malpractices of insurance companies. Indeed, I could go nuts seeing how they mislead their customers into financial peril. They know full well that their customers are not going to read beyond the first few pages of their hundred-page contract, so they put all the goodies on the first page and keep the disclaimers on the back pages.

The following is an actual annuity contract a client of mine purchased a few years ago, much to his regret now.

On the first page of the contract, all the warm and fuzzy keywords are used: “GUARANTEE”, “fixed”, “annualized interest rate of 5.75%”. Pay attention to the following line though: This rate is subject to change each month.

Shall You Sell in May and Go Away?

Posted on: May 10, 2011

By now, you may have heard the stock market folklore: “Sell in May and Go Away.”

Well, let’s look at the statistics, shall we? Most stock market returns are delivered during the winter season from November to May. In the summer (June to October), however, the market seems to take a vacation. Not only does it not deliver much return, it is also more volatile.

It’s not just the US market; some European markets manifest this tendency as well. See the chart below based on market data from the US, the UK, Germany, the Netherlands, and Belgium.

A Balanced Portfolio to Avoid (III): Most Financial Advisors Are Not Fiduciaries!

Posted on: April 30, 2011

My friend is a savvy businessman. However, like most Americans, he has a misconception: he thinks financial advisors are legally bound to put clients’ interests first. This can not be further from the truth. Everybody and his grandma can be a “financial advisor.” Unlike being a “physician”, there are neither legal requirements no educational qualifications. Whether a certain financial advisor is bounded legally to act in his client’s best interests all depends on his true profession. Here is an ad hoc summary:

| Professional Title | Fiduciary? |

| Attorney | Yes |

| Certified Public Accountant (CPA) | Yes |

| Registered Investment Advisor (RIA) | Yes |

| Financial Planner | Maybe |

| Certified Financial Planner (CFP) | Maybe |

| Wealth Manager | Maybe |

| Insurance Agent | No |

| Registered Representative | No |

| Stock Broker | No |

A Balanced Portfolio to Avoid (II): Hedge Funds Don’t Deliver Outstanding Returns

Posted on: April 28, 2011

Hedge funds are often peddled as a unique asset class that has outstanding returns that are uncorrelated with the market. In reality, hedge funds are as much an asset class as Las Vegas is.

Hedge funds are a general description of private investment companies that are organized as limited partnerships with fund managers as the general partners and investors as limited partners. The keyword here is private. By law they are not supposed to be sold to the public; therefore, they are exempted from government oversight. But sold to the public they are! It is not the first time unscrupulous “financial advisors” have pushed the limit of the law, while the SEC looks the other way.

I recently met an entrepreneur friend of mine. I was pleasantly surprised to learn that he had sold his business and was now looking forward to retirement. He has about $1mm in his 401k plan. As any shameless financial advisor would do, I asked him if he had someone helping him manage his money.

“As a matter of fact, yes!” he answered. “A friend of mine is also a financial advisor, and he helped me create a balanced portfolio.”

He related that “50% of the money will be in safe investment—a (deferred) annuity that has a guaranteed yield of 5%; the other 50% will be in alternative investments for higher performance.”

To say that I was flabbergasted is a serious understatement. With a friend like that, who needs enemies?

Roth 401k vs Traditional 401k

Posted on: April 14, 2011

Many companies now offer employees the option to contribute to a Roth or traditional 401k. For a long while, I have advised my clients to go for the traditional 401k; they are all high-income earners and the tax deductions can be substantial. Besides, what’s not to like about taking money out of the clutches of the IRS?

Many companies now offer employees the option to contribute to a Roth or traditional 401k. For a long while, I have advised my clients to go for the traditional 401k; they are all high-income earners and the tax deductions can be substantial. Besides, what’s not to like about taking money out of the clutches of the IRS?

The other day I googled “US tax rate history.” I was shocked to learn that out of the last 100 years, there were 48 years when the top rate was above 70%. There was even a period when the top rate was 94%! For heaven’s sake, that’s not taxation, that’s deprivation!

Today, my friend Jiefei Yuan of Givology.org passed on to me a message asking for help. The message was from Nasrine, who runs an inspiring women’s organization in Afghanistan called Kabultec that is the training ground for women’s rights, studies and education. The message starts like this

As many of you know, every year my non-profit organization, Kabultec, assists ten needy schools and three orphanages in Afghanistan. We gather goods (mainly used) here in the US, ship them to Afghanistan, and distribute them to schools and orphanages across the country. The goods are raised through donations like the drive some of you helped with last year.

A Fretless Life

Posted on: March 31, 2011

[Guest Post by Tom Warburton of Tulsa, OK] So…a life-long buddy walks into my office. We exchange pleasantries until the inevitable ‘philosophizing’ begins. We normally begin with complex issues like ‘what’s the meaning of life’ and as the afternoon progresses we wallow in less mundane initiatives such as ‘why does my wife think I’m crazy’

At a rare quiet moment my buddy states “he is living a fretless life”.

A Fretless Life!

What a nice thought…this sounds ideal.

Suze Orman Talk Money at Google

Posted on: March 30, 2011

My friend DIY Investor found this pearl. I thought it contains incredibly good advice for young investors.

I personally had a few encounters with Google employees (to do their financial review.) In the end, I had to tell them they are fine on their own, they don’t need my help by and large. This is owing to three factors:

- Google provides strong continuous education on money, like this Suze Orman talk.

- They have a vibrant discussion forum about money inside Google.

- Their 401k plan is with Vanguard.

About Suze Orman, her show is the only show on CNBC that actually gives good information. Enough said. Enjoy the talk!

Get informed about wealth building, sign up for The Investment Scientist newsletter

The 2011 Estate Tax Changes

Posted on: March 21, 2011

[Guest Post by Christopher Guest] I guess I was slightly off on my prediction on what the 2011 estate tax environment would look like. On December 17, 2010, President Obama signed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, or TRUIRJCA, but I will call it the “tax compromise.” One thing I will discuss is that this estate tax regime only exists for 2011 and 2012 and the “old” 2011 rules that had many people indecisive in 2009 and 2010 returns in 2013.

Exemption Level and Rate

Invest in a Variable Annuity

Recently, a client of mine brought me the variable annuity he bought a few years ago.

Prominently displayed on the first page are the benefits of the annuity:

Death Benefit: Enhanced Guaranteed Minimum Death Benefit

Living Benefit: Lincoln Lifetime Income Advantage

as well as the fact that the money will earn an fixed annualized rate of 5.75%. Under the bold ACCOUNT FEE subtitle, it states: Account fee is $35 per contract year.

A physician client of mine passed on to me this list, from Bill Gates’ talk in a high school. There is a good bit of wisdom there. If you have kids in high school, pass this on to them.