The Unpredictability of Return Premiums

Posted on: June 18, 2018

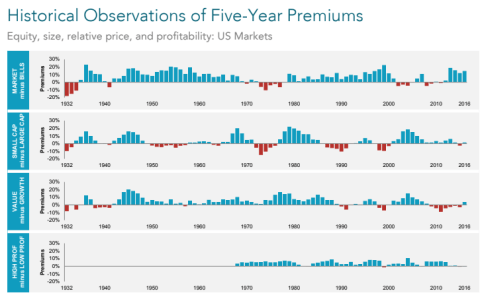

In my last newsletter I discussed the profitability premium. It, along with the small cap premium and value premium, form the three established directions whereby investors can improve their expected returns on their stock investments.

To be more specific, to improve expected returns, an investor should tilt their portfolio towards profitable companies, small cap stocks and value stocks.

However, one must keep in mind that return premiums are not certainties. There will be periods, sometimes rather extended periods, during which:

- Small cap stocks underperform large cap stocks

- Value stock underperform growth stocks and

- Profitable stocks underperform unprofitable stocks

The chart below gives a visual illustration of the unpredictability of return premiums.

So what do you do when one or even all of the return premiums are not producing? My answer is very simple: stay the course! That’s the only way you will maximize your odds of getting higher returns in the future.

(Feel free to share if you find it insightful.)

Schedule a Discovery review with me, or get my white paper for free: The Informed Investor: 5 Key Concepts for Financial Success.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment