An Empirical Study of A Client’s Equity Index Annuity Returns

Posted on: June 29, 2014

Financial author Allan Roth once wrote an article called “Investment Trick – Annuity Style” where he asks a rhetorical question, “If the S&P 500’s total return is 12% in a given year, what do you think your equity index annuity (that is supposed to track the S&P 500) would return”?

- 10%

- 8%

- 5.4%

- 3.4%

Allan Roth goes on to explain why the correct answer is 3.4%. Boy, was he wrong!

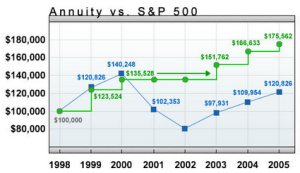

Recently, a new client of mine provided me with the opportunity to study this subject empirically. She has many equity index annuities which she bought over the years. So the table below shows the purchase date of each of her annuities and its TOTAL RETURN from inception, compared to an S&P 500 index fund purchased at the same date.

| Purchase Date | Equity Index Annuity/Total (Annualized) Return | S&P 500 Index Fund Total (Annualized) Return | Total Return/Total (Annualized) Gap |

| 7/25/2005 | 16.2% (1.89%) | 90.2% (7.39%) | 80% (5.4%) |

| 3/28/2006 | 18.8% (2.18%) | 78.1% (7.29%) | 59.3% (5.11%) |

| 5/15/2007 | 11.8% (1.62%) | 49.9% (5.87%) | 38.1% (4.25%) |

| 9/26/2007 | 15.9% (1.86%) | 48.8% (5.95%) | 32.9% (4.09%) |

| 5/12/2009 | 8.9% (1.72%) | 138.9% (18.6%) | 136.6% (16.9%) |

| 6/4/2010 | -9.2% (-4.7%) | 92.7% (17.9%) | 99.9% (22.6%) |

When calculating total returns, I use cash surrender values as opposed to contract values. If I used contract values, then the return numbers would be a bit higher. But even the earlier contracts still have surrender charges.

Let me make a few other observations:

- I have no idea why the 2010 contract has a negative total return. Aren’t equity index annuities guaranteed to not lose money? I guess it all depends on the fine print, which is over 300 pages long, mind you!

- You can see that the two 2007 contracts were bought at just the right time, directly before the market crashed. See what they have returned compared to the index fund? Pretty abysmal!

- The 2009 contract was bought at the bottom of the market, and it has not risen much even though the S&P 500 index has more than doubled itself. Aren’t these contracts supposed to participate in the market when it rises?

Judging by these return numbers, Allan Roth’s 3.4% return is looking like a whitewash of equity index annuity. To his credit, he has a paragraph called “It Gets Worse.” Sure enough! For reasons why equity index annuity is so bad, go read Allan’s original article.

If you want to find out how I can help you, schedule a Discovery review with me. If you are not ready, you can still get my white paper for free: The Informed Investor: 5 Key Concepts for Financial Success.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment