A Federal Budgetary Hell?

Posted on: October 4, 2023

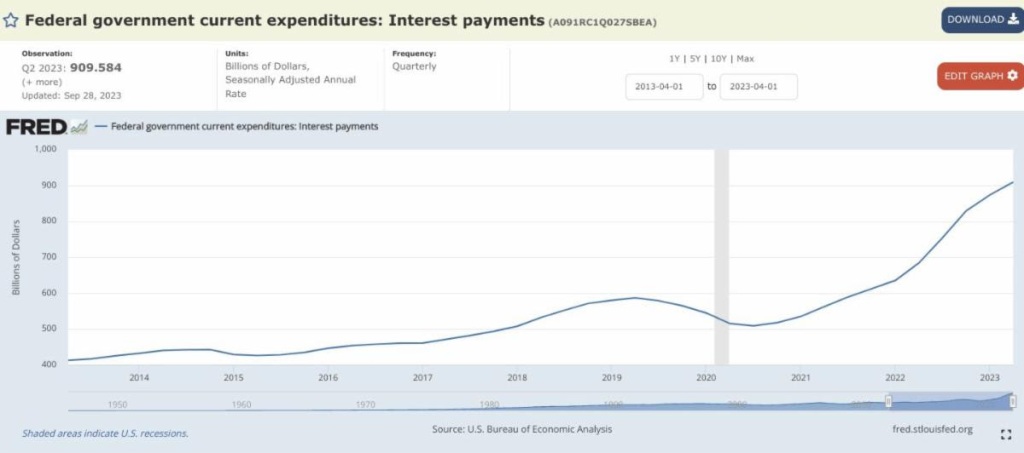

Two weeks ago, I wrote about the retirement income nirvana that is allowing retirees to finally get some serious income from their savings, starting with Treasury bills. The money that goes into retirees’ pockets has to come from somewhere, so let’s look at this chart produced by the Saint Louis Fed.

It shows the interest payments the federal government has made every year up to 2023. One can see that, ten years ago, the interest payments came to about $400 Billion. Today, it’s over $900 Billion! Now, it’s true that some of these payments are to other government agencies like the Social Security trust fund or the Medicare trust fund. Even after adjusting for that, the NET interest payments by the federal government rose from about $225b in 2014 to $700b in 2023.

The federal budget is a trainwreck waiting to happen – a disaster that would make the current government shutdown drama look like child’s play.

In 2023, the actual federal revenue is $4.3 Trillion, but the federal expenditures total $6.2 Trillion, resulting in a budget deficit of nearly $2 Trillion. Since the government is short of this money, they have to borrow it.

How does the government spend money?

Medicare/Medicaid is $1.6+ Trillion, Social Security is $1.3+ Trillion. Together, these two non-discretionaries add up to almost $3 Trillion. Then the military needs another $800b. After these are paid for, there are less than $500 Billion left, not even enough to pay the interest due, let alone other government functions. Thus the huge amount that needs to be borrowed, a big chunk of which is to just pay interest owed on older debts!

Let’s optimistically assume that the federal budget deficit will not increase much in the next five years and stay at around $2 Trillion per year. In five years, the total federal debt will increase from the current $33 Trillion to $43 Trillion. How much interest will the federal government have to pay at the current prevailing rates of 4.5% to 5.5%? If you just assume that the interest rate is 5%, the net interest payments will amount to $2.1 Trillion! This will become the biggest budget item! The federal government will be in a hell of pain.

We savers, however, will be in an advantageous position. There are only two ways to raise that amount of money: either the federal government has to pay higher interests to compete for the money, or the Fed (central bank) will have to print money to lend to the federal government. The latter approach is inflationary, so the Fed will have to raise interest rates simultaneously to recycle the money they just printed. Either way, the retirement income nirvana I wrote about in my previous article will likely persist.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Leave a comment