Teaching My Kids About Money

Posted on: July 3, 2015

If you are a client of mine, you would have received a snail mail newsletter from me about two weeks ago that does not look quite right: The letter may look like it was folded clumsily, there might even be some water stains on the letter, the stamp may not be placed squarely on the upper left corner of the envelop. I let these unprofessional newsletters go out, because they were stuffed by my two sons: one six year old, the other mere three.

I want to teach them a lesson about money, so I promised I would pay them once they get the job done. The two boys were super excited since this was the first time they made money. The older one listened very intently as I instructed him what do. What impressed me is that he then created a work process and splited the tasks between himself and his younger brother. He also made himself a little manager by making sure the younger brother follow his process.

After the job was done, I gave the older one a $5 bill and younger one a $1 bill. The older one immediately tried to figure how long it would take for him to afford his own iPad. The younger one apparently did not know the difference between $5 and $1 and he was just happy he was getting as much as his older brother.

What If the Market Falls 30%?

Posted on: June 19, 2015

Ever since it touched bottom on March 9th, 2009, the market has been going up and up and up with barely any hiccup. That’s dangerous! Because our minds could get complacent. That’s why I want to do a mental exercise with all of you: What would you do if the market fall 30%?

Ever since it touched bottom on March 9th, 2009, the market has been going up and up and up with barely any hiccup. That’s dangerous! Because our minds could get complacent. That’s why I want to do a mental exercise with all of you: What would you do if the market fall 30%?

First of all, recognize these two important facts:

- Market fall of 30% and above happened every ten years or so. If we use history as a guide, we should expect a 10% odds of that happening over the next 12 months. (So don’t be surprised.)

- All market tumbles of that magnitude were recovered within 18 months in the US. (So don’t despair.) Read the rest of this entry »

Six Costly Investment Behavior

Posted on: June 1, 2015

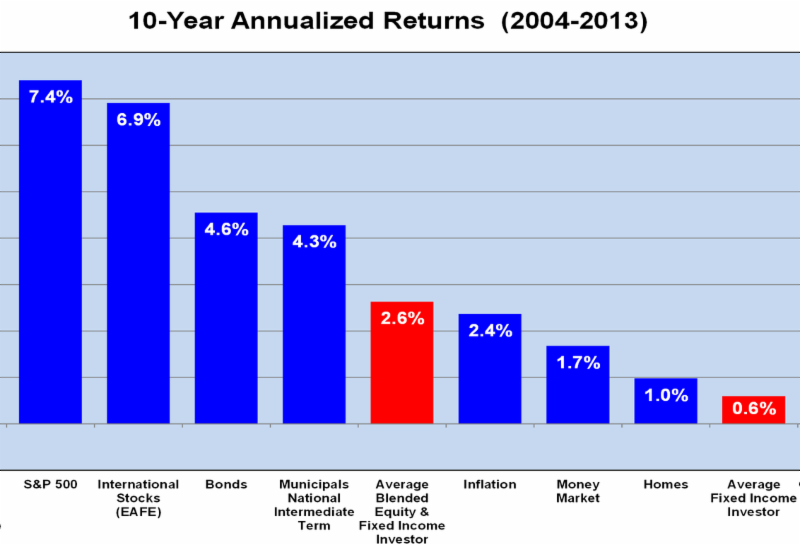

Most investors are very good at hurting themselves financially. According to latest release of Dalbar’s Quantitative Analysis of Investor Behavior (QAIB), the average investor has a return of only 2.6% over the last ten years. That’s pathetic compared to what the markets gave. See the chart below, over the same period, the S&P 500 gave an annualized return of 7.4% and the bond market gave 4.6%.

Jim Ludwick’s Tweets for the Month

Posted on: May 1, 2015

For those who are hard core about learning personal finance, I have this to share with you – Jim Ludwick’s Tweets for the Month. Jim is a hourly fee-only financial planner I respect a lot. His tweets cover a wide range of issues …

For those who are hard core about learning personal finance, I have this to share with you – Jim Ludwick’s Tweets for the Month. Jim is a hourly fee-only financial planner I respect a lot. His tweets cover a wide range of issues …

- Things people in the Finance business don’t want you to know from @awealthofcs: http://t.co/xptc6UzSs011:40AM

- Tax season is over but we’re still working for Uncle Sam say Dan Caplinger via @TheMotleyFool: http://t.co/FyttD7jHhy6:45AM

- @Dull_Investing compiles list of 10 financial tips for kids from top experts and himself via @AARP: http://t.co/WQiZFMY4gQ11:40AM

- @RickFerri argues that ETFs are not the total solution to passive investing in his latest blog: http://t.co/x9R91M5kcr8:34AM

Why I do what I do …

Posted on: April 22, 2015

Recently I have a new client. As part of the onboarding process, I examined her old portfolio and found something I don’t recognize:

| Cusip | Symbol | Description | Return |

| 25190A104 | N/A | Deutsche Bk AG London BRH Ret Opt Secs Lkd Ishare MSCI Mexico Capped | -21.15% |

| 25190A203 | N/A | Deutsche Bk AG London BRH Ret Opt Secs Lkd Ishare Euro STOXX 50 Idx | -26.60% |

| 90273L815 | N/A | USB AG London BRH Notes Five 15 | -22.30% |

What they have in common is they don’t have a symbol, meaning they are not publicly traded securities, they have weird descriptions and they all lost a lot of money.

Six years after the collapse of the stock market, I must say I begin to see signs that people are forgetting the lesson:

- Some of my clients are pressuring me to increase allocation to stocks.

- The US stock market has done better than others, and some of my clients are questioning why bother with global diversification.

- I have seen portfolios (not managed by me of course) where 90% of money is allocated to US growth stocks.

Recently, Independence Advisor, LLC produces a fabulous video explaining the behavior of investment returns. It’s only five minutes long. Whether you are my clients or not, please watch it in its entirety, then you will understand why I always act as a dampener of emotions. Whether it’s fear or enthusiasm, I would always counsel not to get carried away.

If you want to find out how I can help you, schedule a Discovery review with me. If you are not ready, you can still get my white paper for free: The Informed Investor: 5 Key Concepts for Financial Success.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Remember When Everybody Wants to Be in Gold?

At the turn of the year, a few clients asked me a very good question: “Why my portfolio is not doing as well as the S&P 500 index? Shouldn’t we invest more in US stocks?”

The answer is very simple, US equity is only one component of the portfolio, it happened to do the best last year. The best component of the portfolio will always do better than the whole portfolio. That does not mean we should not diversify.

In fact, I got similar questions every year. Four years ago, it was like “Why didn’t we invest more in emerging markets? there’s no way the US market will do better than emerging markets.” Two years ago, it was like “Why shouldn’t we put everything in gold? all of my friends are investing in gold.”

When Tragedy Strikes

Posted on: January 3, 2015

A few weeks ago, I got a call from a client of mine. She told me with great sadness in her voice that her husband just passed away unexpectedly.

A few weeks ago, I got a call from a client of mine. She told me with great sadness in her voice that her husband just passed away unexpectedly.

Without much thought to my schedule, I told her I would visit her on Friday, a mere three days away. During the next two days, I moved my appointments around to clear up a whole day, and then I booked a round trip ticket and a rental car.

On Friday, I set out early on the trip and got to her place by noon. When I met her, I saw a middle-aged woman in deep grief and distress. I couldn’t help but give her a big hug, and she wept on my shoulder for a while.

Year End Moves for Tax Savings

Posted on: December 4, 2014

As 2014 draws to a close, my wife and I have sprung into action to save on our 2014 taxes. Here are a few things we do. We are no CPAs, so what we do is pretty easy to mimic.

As 2014 draws to a close, my wife and I have sprung into action to save on our 2014 taxes. Here are a few things we do. We are no CPAs, so what we do is pretty easy to mimic.

Donate all the garbage. I couldn’t believe how many items in my household we literally didn’t touch, not even once, in the whole of 2014. Things like that are immediate candidates for donation. Things that fall into this category could be electronics, furniture, books, clothes, kitchenware, bedroom sets, used toothbrushes, etc. Ok, maybe not used toothbrushes, but just about anything you don’t use, you can find a better home for, and get a tax deduction for doing so. In some years, we’ve gotten $10,000 worth of deductions. Read the rest of this entry »

I asked my assistant to do an updated stock market seasonality study.

The data we used was the S&P 500 index from 1927 which we found in Nobel Prize winner Robert Shiller’s database.

We assumed that at the beginning of each year we invested $1 in the index, and we observed how the investment fluctuated over the year. Then we took the average over three different periods of time: the last 20 years, the last 50 years, and the last 86 years.

Here is the chart we got: Read the rest of this entry »

Life Lessons From Improv

Posted on: September 10, 2014

Some of you may have already known that my hobby is improv comedy. Here is what happens during a performance. I go on stage with my fellow actors, we ask for a suggestion from the audience, and then we create a comedy play from scratch using that suggestion.

Some of you may have already known that my hobby is improv comedy. Here is what happens during a performance. I go on stage with my fellow actors, we ask for a suggestion from the audience, and then we create a comedy play from scratch using that suggestion.

It just so turns out that many lessons I learn in improv are totally applicable to real life. Since after all, life is a just a big improv show. Nobody wakes up with a script in hand for how to live the day.

So allow me to summarize the top three lessons I’ve learned.

- First things first; be a great listener.

Is A Market Crash Imminent?

Posted on: July 30, 2014

Yesterday I received an email from a doctor client of mine telling me how he had a conversation with some fellow doctors, and all of them are pulling their money out of stocks because they feel that with the market breaking new high after new high, a crash is imminent. He wanted my opinion.

Yesterday I received an email from a doctor client of mine telling me how he had a conversation with some fellow doctors, and all of them are pulling their money out of stocks because they feel that with the market breaking new high after new high, a crash is imminent. He wanted my opinion.

First of all, while all of his doctor friends might feel a market crash is imminent and certain, there is simply no such thing as certainty in the stock market. All we can work with are odds. The following are the odds of market corrections:

| Magnitude of market decline | Frequency of occurrence (out of 64 years from 1950-2013) |

| >5% | Every year (94%) |

| >10% | Every two years (58%) |

| >20% | Every five years (20%) |

| >30% | Every ten years (10%) |

| >40% | Every fifty years (2%) |

My study also shows that the market breaking a new high does not substantially change the odds of returns. In other words, the odds of the market dropping over 20% in the next twelve months are still about one in five; the odds of the market dropping over 30% in the next twelve months are still about one in ten.

Read the rest of this entry »

Financial author Allan Roth once wrote an article called “Investment Trick – Annuity Style” where he asks a rhetorical question, “If the S&P 500’s total return is 12% in a given year, what do you think your equity index annuity (that is supposed to track the S&P 500) would return”?

- 10%

- 8%

- 5.4%

- 3.4%

Allan Roth goes on to explain why the correct answer is 3.4%. Boy, was he wrong! Read the rest of this entry »

A client of mine bought a fixed rate annuity a few years ago. She was told by the agent that it’s just like a savings account, only with a higher interest rate of 3%.

A client of mine bought a fixed rate annuity a few years ago. She was told by the agent that it’s just like a savings account, only with a higher interest rate of 3%.

Recently, we took the money out in favor of a better investment, and boy was she in for a shock! There was a $17k surrender charge and nearly $3.6k in tax withholdings. All the interest she supposedly earned in the annuity went to the surrender charges, and now she has to pay income taxes on that interest!

Here is why a fixed rate annuity is nothing like a savings account.

1. A savings account is FDIC guaranteed, in other words, it has the full faith and credit of the US government behind it. A fixed rate annuity is NOT FDIC guaranteed, it only has the credit of the issuing company behind it. Think AIG! Read the rest of this entry »