Posts Tagged ‘harvard endowment’

Recently I asked my assistant John to pull up Harvard Endowment’s 13F filing for Q4 of 2010 and compare it to that for Q4 of 2009 (shown in table below).

Recently I asked my assistant John to pull up Harvard Endowment’s 13F filing for Q4 of 2010 and compare it to that for Q4 of 2009 (shown in table below).

Apparently, Harvard Endowment’s year-end position in 2010 had changed significantly from that of 2009. The way I see it, there are three significant changes:

1. At the end of 2009, Harvard Endowment was extremely bullish on emerging markets; the top 10 positions were emerging market positions. That number was reduced to 5 at the end of 2010. On top of that, the size of each emerging market position has been reduced. Take China for example; the value of shares of FXI was reduced from 365k to 203k.

Harvard University Endowment significantly increased its holding of iShare S. Korea, iShare Taiwan and iPath India in second quarter of 2009.

Table: Top 10 holdings in Harvard University Endowment’s public portfolio

| Rank | Names | 3/31/09 (x1000sh) | 6/30/09 (x1000sh) | Change |

| 1 | iShares E. Mkt | 8276 | 9712 | +1436 |

| 2 | iShares Brazil | 3170 | 3294 | +124 |

| 3 | iShares China | 3162 | 4178 | +1016 |

| 4 | iShares S. Korea | 1737 | 4349 | +2612 |

| 5 | iShares S. Africa | 1222 | 1595 | 373 |

| 6 | iShares Taiwan | 0 | 6836 | New |

| 7 | iPath India | 446 | 1388 | +942 |

| 8 | iShares Mexico | 1380 | 570 | -810 |

| 9 | Vanguard E. Mkt | 2289 | 1758 | -531 |

| 10 | Market Vectors Russia | 1762 | 882 | -880 |

| Drop | China Mobile | 376 | 459 | +83 |

| Drop | Stoneleigh Partners | 2626 | 0 | Sold Out |

Need help with investment? Call 301-452-4220.

Get informed about wealth building, sign up for The Investment Scientist newsletter

“They are the cancer of the institutional investment world.” – David Swensen

Would you consider forming a partnership with someone you don’t know, in which you would contribute the money and that someone would conduct a business that you don’t understand, and do the accounting as well?

Would you consider forming a partnership with someone you don’t know, in which you would contribute the money and that someone would conduct a business that you don’t understand, and do the accounting as well?

Most business owners would respond with a resounding “No!” The reason is obvious: such an arrangement is the surest way to lose money.

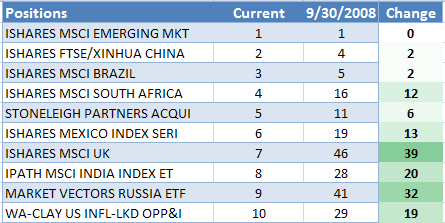

During the last quarter of 2008, the Harvard University Endowment quietly overhauled its public equity investment portfolio. By the end of the overhaul, the top 10 positions in the portfolio looked like this:

Chart credit: Paul Kedrosky

Most strikingly, seven out of the top 10 are emerging-market exchange trading funds (ETFs), with emerging-market index fund EEM and China index fund FXI the largest and second largest holdings, respectively. Year to date, EEM is up 24.55%, and FXI is up 20.85%. Comparatively, the S&P 500 is flat.

University endowments are important institutions. They play a critical role in maintaining the academic excellence of the universities that rely heavily on their income. Recently, these endowments have drawn much attention because of their superior investment returns compared to other institution investors, such as investment banks and insurance companies.

There is much diversity among university endowments. Ivy League endowments such as those of Yale and Harvard are well ahead of the pack in terms of investment returns.

Boston Globe: “Harvard’s endowment plunges $8 billion”

WSJ: “Harvard hit by loss as crisis spreads to college”

Harvard Crimson: “Yale losses a quarter of its endowment”

Edward Eptein in The Huffington Post argues in “How much has Harvard really lost?” that Harvard endowment loss could be a lot higher than disclosed.

Check out how Harvard and Yale endowments performed prior to this fiscal year here. Note their fiscal year ends in June 30th.

Get informed about wealth building, sign up for The Investment Scientist newsletter

All-weather portfolio: how Harvard and Yale Endowments invest for bad times

Posted on: September 21, 2008

This post was written at the depth of the financial crisis. If you stuck to the Swensen Model through out the crisis, you would be ahead now. See our model portfolio.

– Michael Zhuang

Wall Street Journal headline: “Harvard Endowment Returned 8.6%”

In light of the events of the last few weeks when financial companies collapsed in rapid succession, an all-weather portfolio is what all of us need. Yale and Harvard University endowments have portfolios that do well in both good and bad times. You’d expect these smart people to know what they are doing. They do!

In any one fiscal year (ending in June) since 2000, The Yale Endowment has never had a loss. Don’t you wish you had a portfolio that could do so well? Sadly, your record is likely to be worse than that of S&P 500. Harvard’s endowment portfolio had only two years with small losses. The worst was in 2001. That was when it suffered a loss of 2.7%. Here are the details:

Table 1: Comparison of returns for Yale, Harvard, and the S&P 500

| Year | Economic Cycle | Yale | Harvard | S&P 500 |

| 2000 | Tech bubble | 41% | 32% | 7% |

| 2001 | Tech bubble bust | 9.2% | -2.7% | -14.83% |

| 2002 | Tech bubble bust | 0.7% | -0.5% | -17.99% |

| 2003 | 8.8% | 12.5% | 0.25% | |

| 2004 | 19.4% | 21.1% | 19.11% | |

| 2005 | RE bubble | 22.3% | 19.2% | 6.32% |

| 2006 | RE bubble | 22.9% | 16.7% | 8.63% |

| 2007 | RE bubble bust | 28% | 23% | 21% |

| 2008 | RE bubble bust | 4% | 8.6% | -14.8% |

| Average Return | 17.8% | 14.4% | 1.6% | |

| Volatility | 12.4% | 11.3% | 14.6% | |

How did Yale and Harvard achieve such return stability through two major cycles of boom and bust?

The answer lies in their unconventional asset allocation. The typical US investor allocates 60% to domestic equity, primarily in large-cap growth stocks, and 40% to fixed income assets. In contrast, the endowments allocate to six non-cash asset classes that have low correlation with each other. In particular, domestic equity and fixed income make up only a small percentage of the overall portfolio: see Table 2 below. This broad diversification across weakly correlated asset classes is the primary reason why the endowment portfolios did well in both boom and bust times. (I will discuss secondary reasons in the future.)

Table 2: Asset allocations of Yale and Harvard endowments

| Asset Classes | Domestic Equity | Absolute Return | Foreign Equity | Private Equity | Real Assets | Fixed Income | Cash |

| Yale | 11% | 23.3% | 14.1% | 18.7% | 27.1% | 4% | 1.9% |

| Harvard | 12% | 18% | 22.% | 11% | 26% | 16% | -5% |

Both endowments allocate over 25% to real assets, such as real estate and basic materials. This allocation seeks to protect against the double threat of a weak dollar and inflation.

Chart: Evolution of Yale Endowment asset allocation

As the chart above shows, Yale Endowment significantly increased its exposure to real assets in the last three years. Average investors like you and me would be well-served to heed the unspoken message of these intelligently-managed endowments. And now for your take-home lesson:

1. Broadly diversify

2. Hedge against inflation and the weak dollar.

Get informed about wealth building, sign up for The Investment Scientist newsletter