Author Archive

Lack of time

Lack of time

“Life is short, time is never enough!” lamented a lawyer client of mine. With intense pressure to meet billable hour requirements, some attorneys don’t even have time for their spouse and children, let alone their personal finances. It also doesn’t help that the financial world is becoming increasingly complex.

Professional stress

Believe it or not, law practice is one of the most stressful jobs – despite the great pay. No other job is as focused on the adversarial aspect of life as law practice. Martin Seligman’s research shows that 52% of lawyers are unhappy. When people are stressed and unhappy, they can’t do proper financial planning.

Beyond the S&P 500

Posted on: November 4, 2009

If you are like most investors, your equity portfolio will have a few auspiciously named stock funds and a few company stocks you feel comfortable with. You think you are well-diversified, but you really are only investing in the universe of the S&P 500 – the largest 500 stocks of the US equity market.

If you are like most investors, your equity portfolio will have a few auspiciously named stock funds and a few company stocks you feel comfortable with. You think you are well-diversified, but you really are only investing in the universe of the S&P 500 – the largest 500 stocks of the US equity market.

Can experts predict the future?

Posted on: October 28, 2009

“When the blind lead the blind, both shall fall into a ditch.” – Old Proverb.

“When the blind lead the blind, both shall fall into a ditch.” – Old Proverb.

In July 2007, I went to an event where the keynote speaker was a former Federal Reserve Board governor who had worked with Alan Greenspan for many years.

I had had a hunch since early 2006 that the housing bubble would end badly. However, the market had proven me wrong month after month. Bewildered, I felt an expert of that caliber could help prove or disprove my hunch once and for all.

The Significance of Dow 10,000

Posted on: October 15, 2009

“It is a tale told by an idiot, full of sound and fury, signifying nothing.” – Shakespeare

“It is a tale told by an idiot, full of sound and fury, signifying nothing.” – Shakespeare

Yesterday, the Dow passed 10,000 again. Predictably, the press kicked up a big storm about it.

Even a relatively unknown like me got a call from a major newspaper asking me to comment whether this was a sign that the market would keep going up. I really struggled to answer. I knew that if I could spin a good story, the reporter would come back to me for more and more comments. Pretty soon, I would look like a stock market guru to my clients and prospects. This would surely be a win-win for me and the newspaper – if only I could bring myself to pretend.

“The recession is very likely over.” – Fed Chairman Bernanke on 9/15/09.

What does the fed chairman’s statement mean for stocks, if indeed the worst recession since 1929 is over? We don’t know for sure. We can, however, let history be our guide.

In this spirit, I studied the one-year and three-year returns of the S&P 500 Index and the Fama/French Small Cap Value Index coming out of a recession for the nine recessions since 1950.

My friend Carl Richards made an interesting observation in his last post:

Just when we need something to zig, they all zagged together!

Some people draw the conclusion that diversification no longer works. I strongly disagree.

Some people draw the conclusion that diversification no longer works. I strongly disagree.

Starting from tax year 2010, the Tax Reconciliation Act permits all taxpayers to make Roth IRA conversions, regardless of income level. Previously, taxpayers with a modified adjusted gross income of $100,000 (or more) were not permitted to make Roth IRA conversions.

Starting from tax year 2010, the Tax Reconciliation Act permits all taxpayers to make Roth IRA conversions, regardless of income level. Previously, taxpayers with a modified adjusted gross income of $100,000 (or more) were not permitted to make Roth IRA conversions.

With a stroke of the pen, many affluent Americans can increase their wealth by 10-20% in their lifetime. If circumstances are right, they may even double their wealth for their family.

In the mind of an investor

Posted on: August 31, 2009

Found this chart on digg.com … don’t know who to give credit to. Whoever drew this is brilliant.

Harvard University Endowment significantly increased its holding of iShare S. Korea, iShare Taiwan and iPath India in second quarter of 2009.

Table: Top 10 holdings in Harvard University Endowment’s public portfolio

| Rank | Names | 3/31/09 (x1000sh) | 6/30/09 (x1000sh) | Change |

| 1 | iShares E. Mkt | 8276 | 9712 | +1436 |

| 2 | iShares Brazil | 3170 | 3294 | +124 |

| 3 | iShares China | 3162 | 4178 | +1016 |

| 4 | iShares S. Korea | 1737 | 4349 | +2612 |

| 5 | iShares S. Africa | 1222 | 1595 | 373 |

| 6 | iShares Taiwan | 0 | 6836 | New |

| 7 | iPath India | 446 | 1388 | +942 |

| 8 | iShares Mexico | 1380 | 570 | -810 |

| 9 | Vanguard E. Mkt | 2289 | 1758 | -531 |

| 10 | Market Vectors Russia | 1762 | 882 | -880 |

| Drop | China Mobile | 376 | 459 | +83 |

| Drop | Stoneleigh Partners | 2626 | 0 | Sold Out |

Need help with investment? Call 301-452-4220.

Get informed about wealth building, sign up for The Investment Scientist newsletter

If you are a typical 401(k) participant, you have stuffed 32% of your retirement money in a stable value fund offered by your company’s retirement plan. Throughout this crisis, stable value funds have lived up to their billing as “money market funds with better yields” or “intermediate bond funds sans the volatility.”

If you are a typical 401(k) participant, you have stuffed 32% of your retirement money in a stable value fund offered by your company’s retirement plan. Throughout this crisis, stable value funds have lived up to their billing as “money market funds with better yields” or “intermediate bond funds sans the volatility.”

But do you know what a stable value fund is? Not according to a recent survey. Close to 90% of retirement plan sponsors (employers) don’t know the difference between a stable value fund and a regular bond fund, let alone plan participants (employees).

Investors don’t need outside help to hurt themselves. I’ve been writing about how ignoring conflict of interest, hidden fees, and not taking the necessary time to do due diligence costs investors a great deal of money. Today, I’m going to show you another way they self-inflict pain, and what to do about it.

Let’s imagine you’re in your car. Your vehicle is traveling at 60 mph. How can you, as a passenger, only be going 30 mph? You can’t. It’s an impossibility. Nevertheless, it happens in the financial world all the time.

How Madoff did it

Posted on: July 3, 2009

This week, Bernie Madoff was sentenced to 150 years in prison by New York District Judge, Denny Chin. With the trial now over, Madoff’s victims are still fighting over what little is left of his fund. They want to know: Where was the SEC?

This week, Bernie Madoff was sentenced to 150 years in prison by New York District Judge, Denny Chin. With the trial now over, Madoff’s victims are still fighting over what little is left of his fund. They want to know: Where was the SEC?

More appropriate questions should be: How did Madoff do it? What human frailties did he exploit? How was he able to con $65 billion out of the most sophisticated members of our society? Here’s how his scam worked:

Affinity

We humans lower our guard when we believe other people are similar to us. Madoff exploited this one masterfully. Much like Charles Ponzi, who looked for his prey among Italians, Bernie Madoff focused on exclusive Jewish social clubs and Jewish foundations.

“They are the cancer of the institutional investment world.” – David Swensen

Would you consider forming a partnership with someone you don’t know, in which you would contribute the money and that someone would conduct a business that you don’t understand, and do the accounting as well?

Would you consider forming a partnership with someone you don’t know, in which you would contribute the money and that someone would conduct a business that you don’t understand, and do the accounting as well?

Most business owners would respond with a resounding “No!” The reason is obvious: such an arrangement is the surest way to lose money.

The Harvard Management Company, which oversees the $26 billion Harvard University Endowment, recently filed a 13F-HR quarterly report with the Securities and Exchange Commission (SEC) disclosing its portfolio of publicly traded securities as of the end of Q1 2009.

The Harvard Management Company, which oversees the $26 billion Harvard University Endowment, recently filed a 13F-HR quarterly report with the Securities and Exchange Commission (SEC) disclosing its portfolio of publicly traded securities as of the end of Q1 2009.

Here are the most significant changes to Harvard’s portfolio:

Three dropouts

IShares MSCI UK Index Fund, iPath MSCI India Index Fund, and Western Asset Claymore Inflation-Linked Opportunities & Income Fund are no longer in the top 10. In fact, Harvard completely sold its UK index fund holding during Q1 2009.

Three additions

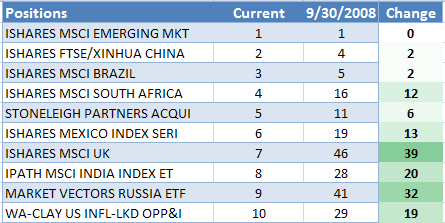

During the last quarter of 2008, the Harvard University Endowment quietly overhauled its public equity investment portfolio. By the end of the overhaul, the top 10 positions in the portfolio looked like this:

Chart credit: Paul Kedrosky

Most strikingly, seven out of the top 10 are emerging-market exchange trading funds (ETFs), with emerging-market index fund EEM and China index fund FXI the largest and second largest holdings, respectively. Year to date, EEM is up 24.55%, and FXI is up 20.85%. Comparatively, the S&P 500 is flat.