Author Archive

Yale’s Swensen in the press

Posted on: January 5, 2009

- In: Uncategorized

- Leave a Comment

Boston Globe: “Harvard’s endowment plunges $8 billion”

WSJ: “Harvard hit by loss as crisis spreads to college”

Harvard Crimson: “Yale losses a quarter of its endowment”

Edward Eptein in The Huffington Post argues in “How much has Harvard really lost?” that Harvard endowment loss could be a lot higher than disclosed.

Check out how Harvard and Yale endowments performed prior to this fiscal year here. Note their fiscal year ends in June 30th.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Has the market hit bottom?

Posted on: December 9, 2008

“Successful investing,” in the words of British economist John Maynard Keynes, “is anticipating the anticipations of others.” In this vein, a market hits bottom when most people think that most other people think it has hit bottom. Only then, most people start to buy stocks, creating a self-fulfilling prophecy. If most people think the market should hit bottom, but they also think that most other people don’t think that, they won’t buy stocks and the market will continue to drop. So, predicting when a market will hit bottom is a mind game on a grand scale. If there are people who are good at that, I am certainly not one of them.

Prescience not needed, discipline required

Now let me ride a time machine to January 1929. Let’s say I committed to invest $100 every month in the S&P 500 index. I did not have the prescience to know that the market would crash in October and the Great Depression would follow. But if I had the discipline to carry out that investment plan over 30 years, the table below summarizes what would have happened to my investment through the worst stock market period in history.

| Year from Jan 1929 | Total invested | Portfolio value | Total dividend received | Total gain (loss) | Dividend contribution to the gain |

| 1st year | 1,300 | 1,115 | 23 | (161) | |

| 2nd year | 2,500 | 1,779 | 98 | (623) | |

| 3rd year | 3,700 | 1,737 | 230 | (1,734) | |

| 4th year | 4,900 | 2,771 | 415 | (1,714) | |

| 5th year | 6,100 | 5,547 | 629 | 76 | 100% |

| 10th year | 12,100 | 12,835 | 3,024 | 3,759 | 80.4% |

| 20th year | 24,100 | 30,786 | 13,683 | 20,369 | 67.2% |

| 30th year | 36,100 | 135,992 | 47,960 | 147,852 | 32.4% |

Data source: Professor Robert Shiller’s website

The total gain from my investment plan is the portfolio value plus total dividends received minus total money invested. As you can see, though I suffered losses in the first four years, I had a small gain in the fifth year (January 1934)! This result is not bad, considering that between1929 and 1934 were the worst years for the stock market (an 89% drop) in history.

For the first 10 years of my hypothetical investment, dividends accounted for 80.4% of the total investment gain. This means that if I had invested in high dividend stocks, I would have done even better. (Also see my newsletter article, “Dividends to the rescue in a Great Depression“.)

Here is the take-home lesson from my time travel experiment: to recover from the market crash and to survive a recession, however deep, you don’t need prophecy, just discipline and patience.

The author is president of MZ Capital, a RIA serving DC/MD/VA. Get his monthly newsletter in your mailbox or get to the directory of his past articles.

I wrote this article in early December 2008. Amazingly, it is one of the least read in my blog. Had someone read it and followed it, he would have earned 10% return so far in 2009.

someone read it and followed it, he would have earned 10% return so far in 2009.

– Michael Zhuang 3/10/2009

At the moment of writing this, SPY, the exchange traded fund (ETF) for the S&P 500 index, is trading at $85.95 and the near at-the-money call option (with strike 86 and only eight days until expiration) is trading at $3.45! (A call option is the right to buy the underlying stock at the strike price. At-the-money means the option strike price is equal to the price of the underlying stock.)

The at-the-money call premium is a full 4% of the underlying index price! Historically, that number has been in the 1% to 2% range.

What does 4% premium imply?

After the election of Barak Obama as our next president last night, I did an exercise to find out the historical stock market performance under a Democratic vs. Republican administration since 1900.

My examination showed that the view that a Democratic president is bad for the market is unfounded. In three important measurements: S&P 500 return, dividend growth and earning growth, stocks have done better under a Democrat administration.

However, the notion that a Democrat is bad for inflation does ring truth, as evident by the 4.8% inflation rate under a Democratic White House compared to the 2% under a Republican one.

| S&P 500 return | Dividend growth | Earning growth | Inflation | |

| Democrat | 8.1% | 5.6% | 10.6% | 4.8% |

| Republican | 6% | 5% | 5.7% | 2% |

Data source: Yale University Professor Robert Shiller’s database

My next exercise is to find out how the market performed during periods of Democratic control of both the White House and Congress. Sign up for my newsletter to get this information.

David Swensen in the press

Posted on: November 4, 2008

“Don’t give up on financial innovation” by William Watson is more about Robert Shiller’s view. David Swensen did get a cusory mention.

The Economist has a piece “All bets are off” that is highly skeptical about David Swensen’s multiple asset class approach. It argues that all asset classes were driven (higher) by two factors: low interest rate and healthy global growth.

Princeton’s endowment, managed by David Swensen’s disciple Andrew Golden, earned 5.6% in 2008 (fiscal year ended in June). The performance was attributable to “non-marketable exposures and independent return managers.”

Yale Daily News: David Swensen got a raise. Now he makes $2 million dollar a year.

David Swensen derides securities lending as “make a little, make a little, make a little, lost a lot.”

Get informed about wealth building, sign up for The Investment Scientist newsletter

In his book “Unconventional Success: A Fundamental Approach to Personal Investing,” David Swensen prescribes for retail investors an asset allocation markedly different from his management of Yale Endowment.

- Domestic Equity (30 percent) – Stocks in U.S.-based companies listed on U.S. exchanges.

- Emerging Market Equity (5 percent) – Stocks from emerging markets across the globe. Brazil, Russia, India, China, etc.

- Foreign Developed Equity (15 percent) – Stocks listed on major foreign markets in developed countries, such as the UK, Germany, France, and Japan.

- REITs or Real Estate Investment Trusts (20 percent) – Stocks of companies that invest directly in real estate through ownership of property.

- U.S. Treasury Notes and Bonds (15 percent) – These are fixed-interest U.S. government debt securities that mature in more than one year. Notes and bonds pay interest semi-annually. The income is only taxed at the federal level.

- TIPs or U.S. Treasury Inflation-Protection Securities (15 percent) – These are special types of Treasury notes that offer protection from inflation, as measured by the Consumer Price Index. They pay interest every six months and the principal when the security matures.

Is stock market volatility justified by subsequent changes in dividends?

Posted on: October 24, 2008

Warren Buffet: “Price is what you pay, value is what you get.”

The value of a stock is its dividend stream. (Also see Dividends to rescue in a “Great Depression”.) So far in this bear market, the S&P 500 has tumbled close to 50%. Does that mean dividends will fall by 50% … permanently?!

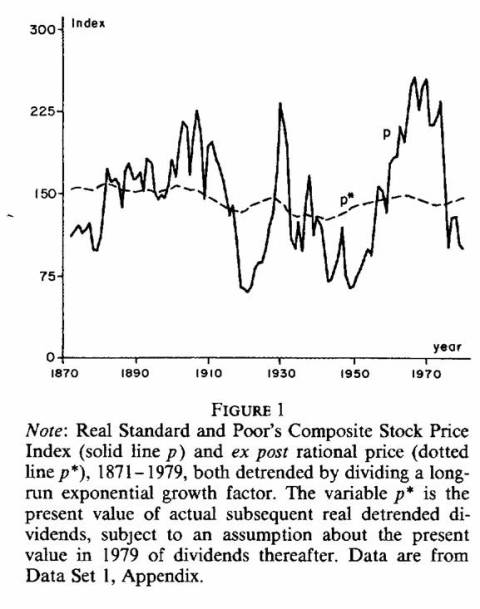

During the Great Depression, the S&P 500 fell by more than 80%, and yet the discounted value of the subsequent dividend stream barely declined (See Chart). In fact, the detrended value of the S&P 500 dividend stream was fairly stable throughout history while the index itself gyrated wildly. This led Yale Professor Robert Shiller to conclude:

Stock prices move too much to be justified by subsequent changes in dividends.

Chart: Price volatility compared to “value” volatility, from Robert Shiller’s 1981 paper “Do stock prices move too much to be justified by subsequent changes in dividends?”

Get my white paper: The Informed Investor: 5 Key Concepts for Financial Success.

Get informed about wealth building, sign up for The Investment Scientist newsletter

This is the complete list of US dividend oriented ETFs.

| Symbol | Asset (mm) | Expense | Yield* | Name |

| DVY | 4782 | 0.40% | 4.67% | iShares DJ Select Dividend |

| VIG | 402 | 0.28% | 2.20% | Dividend Achievers Select |

| PFF | 308 | 0.48% | 11.21% | iShares S&P US Preferred Stock |

| DLN | 288 | 0.28% | 3.61% | WisdomTree LargeCap Dividend |

| SDY | 230 | 0.35% | 4.40% | SPDR S&P High Yield Dividend Aristocrats |

| DTN | 145 | 0.38% | 4.82% | WisdomTree Dividend 100 |

| PEY | 139 | 0.60% | 5.69% | Mergent Dividend Achievers 50 |

| FVD | 137 | 0.70% | 3.20% | First Trust Value Line Dividend |

| VYM | 120 | 0.25% | 3.72% | FTSE High Dividend Yield |

| DHS | 120 | 0.38% | 5.50% | WisdomTree High-Yielding Equity |

| DES | 80 | 0.38% | 4.73% | WisdomTree SmallCap Dividend |

| DTD | 80 | 0.28% | 3.71% | WisdomTree Dividend |

| DON | 78 | 0.38% | 4.31% | WisdomTree MidCap Dividend |

| PFM | 53 | 0.60% | 2.72% | PowerShares Dividend Achievers |

| CVY | 50 | 0.60% | 7.61% | Claymore Yield Hog |

| FDL | 45 | 0.45% | 5.52% | First Trust Morning Star Dividend |

| PHJ | 23 | 0.61% | 2.70% | PowerShares High Grow Rate Dividend Achievers |

| LVL | 7 | 0.60% | 11.21% | Claymore High Income |

* Yield information is according to Yahoo Finance as on 9/30/08.

The high-dividend-yield ETFs could come to the rescue of your retirement if we have a prolonged recession.

Need help with investment? Call 301-452-4220.

Sign up for The Investment Fiduciary monthly newsletter.

David Swensen’s 2008 public equity investments in Yale Endowment portfolio

Posted on: October 15, 2008

Yale Endowment, as an institution investor, has to disclose to SEC its public equity holdings every quarter. This allows us to get a glimpse of David Swensen’s direct stock investments. Since Yale Endowment does not have to disclose its private equity investments and its allocations to money managers, this is not the complete picture of its asset allocation.

The author is president of MZ Capital, a RIA serving DC/MD/VA. Get his monthly newsletter in your mailbox or get to the directory of his past articles.

Table: David Swensen’s stock portfolio

| Ticker | % weight of portfolio | Name |

| OEF | 1.24% | iShares S&P 100 Index |

| INFN | 0.12% | Infinera Corp |

| EFA | 13.82% | iShares MSCI EAFE Index |

| EEM | 37.42% | iShares MSCI Emerging Market Index |

| AKR | 7.12% | Acadia Realty Trust |

| XTXI | 1.39% | Crosstex Energy Inc. |

| WWW | 0.07% | Wolverine World Wide |

| CELG | 0.05% | Celgene Corp |

| DEI | 29.47% | Douglous Emmett Inc. |

| CXO | 8.39% | Concho Resources Inc |

| SPY | 0.9% | SPDR S&P 500 Index |

“This sucker could go down!”

That was what President Bush said during the recent $700 billion bailout plan meeting with congressional leaders at the White House. The market has gone down another 20% and talk of another Great Depression has filled the airwaves ever since.

If you are a listener of Jim Cramer, you would have heard his advice: Sell, sell, sell! He constantly reminds his listeners how the Dow went down 83% during the Great Depression; and never fully recovered until 1954.

Cramer forgot to account for dividends. If dividends from the Dow stocks were reinvested, then investors would have been able to recoup all losses by 1945. That’s a full nine years sooner! Think about this: what if investors held only high-dividend stocks? Would they have recovered their investments even sooner?

To find out, I examined the following four portfolios’ performance from 1929 onwards:

- Portfolio A: stocks with zero dividends.

- Portfolio B: stocks with bottom 30% dividend yields.

- Portfolio C: stocks with middle 40% dividend yields.

- Portfolio D: stocks with top 30% dividend yields.

All four portfolios peaked in August, 1929. With the exception of portfolio B, all portfolios bottomed in May, 1933. Portfolio B bottomed in June, 1933. For each of the four portfolios, the total peak-to-trough decline (drawdown) and the number months it took to recover are presented here:

| Buy at the top and hold during Great Depression | ||||

| A | B | C | D | |

| Drawdown | 89% | 86% | 85.4% | 84% |

| Months to recover | 132 | 154 | 144 | 44 |

Data source: Kenneth French Data Library

It is probably not surprising that the highest dividend-yielding portfolio D fell a little less than other portfolios. It’s striking that portfolio D recouped all losses in just three-and-a-half years – eight to nine years before other portfolios.

Why did high dividend-yield stocks performed so well?

During the Great Depression, stock prices on average fell more than 80%. Dividends fell only about 11%. (See Chart below) As Yale University professor Robert Shiller has found, historically dividend volatility was about 15% of price volatility (meaning dividend declines were a fraction of price declines in recessions.) Stable dividend payments quickly made up for losses in price.

If the price gyration makes you dizzy, focus on dividends instead. They don’t gyrate and ultimately, they will sustain your retirement.

Schedule a 2nd opinion financial review, buy my wealth mgmt books on Amazon.

Get informed about wealth building, sign up for The Investment Scientist newsletter

Great Depression II?

Posted on: October 9, 2008

Since President Bush declared that if the Congress does not give Secretary Paulson the $700 billion blank check, “the sucker could go down!” the talks of another Great Depression have filled the air waves.

So how much today resembles the Great Depression that lasted from 1929 to 1933?

It doesn’t take a lot to bring together data from various government sources to present a comparison in the table below.

Table: Comparison of the Great Depression and today

| Factor | Great Depression | Today |

| GDP growth | -27% | +1% |

| Unemployment rate | 25% | 6% |

| US exports | -66% | +15% |

| Inflation | -27% | +4% |

| Stock market | -83% | -43% |

Data source:

Granted, the situation today could get a lot worse before getting better, it simply does not resemble the Great Depression. However, the stock market already have priced in half the chance of that.

Did President Bush and Secretary Paulson scare us so much, we not only handed over the $700 billion blank check, but we pee our pants as well?

Get informed about wealth building, sign up for The Investment Scientist newsletter

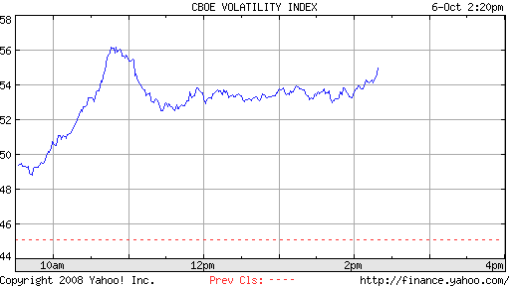

Fear (VIX) at all-time high!

Posted on: October 7, 2008

Today, the VIX index reached all-time high of 56 and closed at 52. To give a measure of how fearful investors are, in 9/11/01 during the terrorist attach the index only reached a lowly 39.

In days like this, it helps to remember Warren Buffet’s mantra: “Be greedy when others are fearful!”

Get informed about wealth building, sign up for The Investment Scientist newsletter

In a recent ABC news piece, Dr. David Swensen, manager of $34 billion Yale Endowment had this to say about Jim Cramer:

On ‘Mad Money,’ Cramer promotes a mindless short-term approach to markets by encouraging frenetic trading of individual stocks. Such a high-cost, tax-inefficient strategy almost guarantees failure.

In the same article, my view on Jim Cramer was also mentioned:

Zhuang is no fan of Cramer. Like Swensen and Ehrenberg, he argues against frequent trades and says Cramer may be influencing investors to overreact to financial news.

(For Swensen’s stellar track record, click here.)

Get informed about wealth building, sign up for The Investment Scientist newsletter

Jim Cramer on Wachovia (WB)

Posted on: October 2, 2008

8/11/08 Mad Money:

I called the bottom in the financial stocks on July 15. Since that call, many of the banking stocks are up, and up big. Wachovia Bank was $8.90; now $18.60 a share. WaMu was $3; now $4.08 a share. Incredibly AIG was $20; now $24 a share. Even the troubled Fannie Mae is up from a low of $6.90 a share to $8.30 a share today.

9/5/08 Lightning Round:

I like (Wachovia) CEO Bob Steele, so this stock is a buy.

9/10/08 Lightning Round:

Consider buying Wachovia on any weakness.

9/18 Mad Money:

Investment banks, like Goldman Sachs just cannot be owned …The time has come to put the investment banks, like Goldman, on the back burner, and instead focus on the deposit banks, such as Wells Fargo, US Bancorp, Bank of America, Wachovia and JPMorgan Chase.

9/25 Mad Money:

Wachovia will also benefit from the bailout. With CEO Bob Steel’s previous government experience, he will be able to take advantage of the plan by splitting Wachovia into good and bad components and sell off the bad parts quickly to the government.

9/29/08 Mad Money:

Wachovia was toast.

Note: Jim Cramer is a vivid example of investing by a hunch, a gut feeling and hearsay. The opposite is Harvard and Yale style of investing, which is rigorous and disciplined.

Get informed about wealth building, sign up for The Investment Scientist newsletter

President Bush: “This sucker is going down!”

Today the Dow dropped 777 or 6.98%, making it the largest one-day point drop in history.

The ten largest one-day point drops in history of the Dow (before this one) are recorded in the table below, with subsequent one year returns calculated.

| rank | date | close | drop | % drop | 1 yr later | 1 yr return |

| 1 | 9/17/2001 | 8920.7 | -684.81 | -7.13% | 8380.18 | -6.06% |

| 2 | 4/14/2000 | 10305.77 | -617.78 | -5.66% | 10126.94 | -1.74% |

| 3 | 10/27/1997 | 7161.15 | -554.26 | -7.18% | 8432.21 | 17.75% |

| 4 | 8/31/1998 | 7539.07 | -512.61 | -6.37% | 10914.13 | 44.77% |

| 5 | 10/19/1987 | 1738.74 | -508 | -22.6% | 2137.27 | 22.92% |

| 6 | 9/15/2008 | 10917.51 | -504.48 | -4.42% | TBD | TBD |

| 7 | 9/17/2008 | 10609.66 | -449.36 | -4.06% | TBD | TBD |

| 8 | 3/12/2001 | 10208.25 | -436.37 | -4.10% | 10632.35 | 4.15% |

| 9 | 2/27/2007 | 12216.24 | -416.02 | -3.29% | 12684.92 | 3.84% |

| 10 | 7/19/2002 | 8019.26 | -390.23 | -4.64% | 9188.15 | 14.58% |

Data source: Yahoo Finance

History seems to suggest guarded optimism but I will let you decide if history is any guide for the situation today. We don’t know what the future will bring, but if we have a globablly diversified all-weather portfolio, we will be fine.