I have done many portfolio reviews over the years and I’ve seen all kinds of mistakes people make with their investments. Starting today I will do a series of articles on this specific topic. Hopefully, you will learn from these examples and therefore avoid repeating them.

First let me clarify a couple of terms:

- Financial Advisor: the guy who gives you financial advice and tells you where (what funds) to invest your money. Most of them work for big brokerages like Merrill Lynch, Morgan Stanley, and others (therefore the conflict of interest), and most of them can direct your money.

- Fund Manager: the guy who works at a mutual fund who does not interact directly with you, but nevertheless decides what stocks and bonds or other funds your money should be invested in once your financial advisor has invested your money in his fund.

To review a portfolio, first and foremost, I examine the hidden costs:

Read the rest of this entry »Today, a client of mine invited me to his house for lunch. His son Kevin has just finished college and started a job. The lunch invitation was not just for a celebration, but also to give Kevin a quick financial education and set him up for future financial success.

Kevin is employed by a small company that pays him a $60k starting salary. As part of his employment benefits, he also gets a 401k plan with 3% employer match.

As I sat down with Kevin, I had a clear plan of what I wanted to convey to him in the form of questions that I would answer for him.

When should he start saving and investing?

Read the rest of this entry »Invest In Your Brain Health

Posted on: December 29, 2023

If you are like me, (I’m in my mid-50s), please take my message to heart: start investing in your brain health because doing so will pay huge dividends.

It’s in our 50’s when our cognitive ability usually begins to decline. If we don’t intervene, this decline will only accelerate as we age. One consequence of cognitive decline is that we become prone to making stupid financial mistakes that can cost us a lot of money! I have seen this happen with my clients, my clients’ parents, and even my own parents. The total amount lost is in the millions. The parents of one of my clients lost their entire life savings to scams. They lost half ten years ago to an email scam. One would have thought they had learned their lesson. No, just this year, they lost the remainder to a telephone scam.

Luckily, this decline is not inevitable. Our brain is like our other muscles, the more we exercise it, the more we maintain, even build up, its strength and power. Here are a few things I have done in the last few years to exercise my brain:

Read the rest of this entry »Have you heard of EMS (Electrical Muscle Stimulation) Training? I came to know about this type of training only after my family moved to Germany and I spent part of my time there.

Essentially, you put on a special tight suit that sends electrical pulses through your body as you exercise. This is supposed to stimulate whole body muscle contractions including muscles that were not in use.

In Germany, an EMS Training session usually lasts 20 minutes. This is probably the most efficient strength exercise I know. You don’t have to spend hours at the gym, exercising each and every muscle one at a time. You spend 20 minutes a week and your entire body gets an intense workout.

From my personal experience, it is indeed very effective. I spend my time between Germany and the United States and when I am in the US, I don’t have access to EMS Training in my neighborhood. Despite keeping active with an exercise routine of Yoga and Tabata, I can feel myself losing muscle strength while I am in the US. After a few rounds of EMS Training in Germany, however, I can feel myself regaining muscle strength.

Why Is It Important?

Read the rest of this entry »Cash Is No Longer Trash

Posted on: November 9, 2023

If you keep your money in cash reserves (usually in the form of a money market fund) in a brokerage account like Fidelity, you are likely to get a yield of over 5%. This has never happened before during my time as an investment advisor. For a long time, cash reserves were paying nothing. No wonder the saying “cash is trash” became a golden rule. But not anymore.

Even banks are offering CDs that have a yield of 5%. However, it’s important to note the difference between a CD and cash reserves. The CD is illiquid money that you can not use until it matures. Cash reserves, on the other hand, are completely liquid. You can withdraw your cash at any time. This is what makes it superior to CDs.

Read the rest of this entry »In this article, I want to show how, in the last 15 years, the Fed’s money supply has driven stock prices higher and higher and how this situation going to reverse.

Prior to the 2008 financial crisis, the Fed kept the money in circulation in the economy relatively steady, just under $1T. Then the 2008 recession hit and to save the economy, the Fed began to “print” money. This action is given various lofty names like Quantitative Easing and Balance Sheet Expansion. The end result, however, was the same, about $1T was released into the economy. This is illustrated in spot (1) in the chart below.

A Federal Budgetary Hell?

Posted on: October 4, 2023

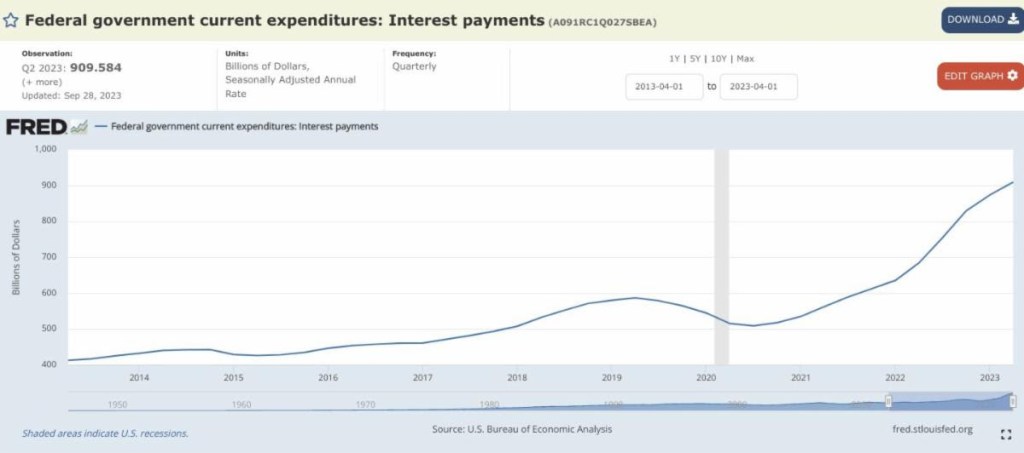

Two weeks ago, I wrote about the retirement income nirvana that is allowing retirees to finally get some serious income from their savings, starting with Treasury bills. The money that goes into retirees’ pockets has to come from somewhere, so let’s look at this chart produced by the Saint Louis Fed.

It shows the interest payments the federal government has made every year up to 2023. One can see that, ten years ago, the interest payments came to about $400 Billion. Today, it’s over $900 Billion! Now, it’s true that some of these payments are to other government agencies like the Social Security trust fund or the Medicare trust fund. Even after adjusting for that, the NET interest payments by the federal government rose from about $225b in 2014 to $700b in 2023.

The federal budget is a trainwreck waiting to happen – a disaster that would make the current government shutdown drama look like child’s play.

In 2023, the actual federal revenue is $4.3 Trillion, but the federal expenditures total $6.2 Trillion, resulting in a budget deficit of nearly $2 Trillion. Since the government is short of this money, they have to borrow it.

How does the government spend money?

Read the rest of this entry »A Retirement Income Nirvana!

Posted on: September 27, 2023

Barely a year and a half ago, the Fed fund rate for overnight lending stood at (annualized) 0.08%. Now it is between 5.25% and 5.50%.

This has tremendous positive implications for retirees who need a steady fixed income. Imagine that you are someone who has accumulated $1mm for retirement. If you didn’t want to take any risks and you invested your entire nest egg in the Fed fund (not that this is even possible), you would have a grand total of $800 a year! That’s why a year and a half ago, I had to expose my clients’ money to stock market risk, duration risk and interest rate risk just to earn some real returns.

Then the Fed realized that inflation was out of control, and geopolitically the US needed to defend against de-dollarization, so since the middle of 2022, it has driven the Fed fund rate up. At the current upper rate of 5.5%, a $1mm investment will earn one $55,000 in totally safe interest income. $55,000 vs $800 – that is quite a difference! Who would have thought fighting inflation would be a blessing for retirees on fixed incomes?

Read the rest of this entry »My Experience of German Spa

Posted on: September 22, 2023

In the last three or four years since my family moved to Germany, I have slowly adopted some German health practices that might be considered unusual in America. One of these is regularly going to the Spa.

A German spa usually consists of several (dry) Sauna rooms all set at different temperatures, at least one steam room, several ice water pools, and basins to wash your feet. A German spa is a great place to subject my body to a bit of stress. I have reaped tremendous health benefits since what doesn’t kill me makes me stronger.

Heat Stress

Spas in Germany usually have a Finnish sauna room. In these rooms the going temperature is usually 90 degrees celsius. Every so often an Aufgussmeister (water pouring master) will bring a scented bucket of water and pour it on the red hot stones. The steam rises from the stones and the Aufgussmeister then does a dance to push the steam toward the patrons in the sauna room, all of them sweaty and naked. For a moment, the temperature in the room can reach 100 degrees celsius. My entire body was under heat stress. It’s said that sitting in such a sauna room for 15 minutes is like sprinting for 15 minutes straight.

Read the rest of this entry »The Wealth of A German Doctor

Posted on: August 19, 2023

Last year on a train trip in Germany, I got to know a retired German doctor and we became good friends. When I travel to Germany to see my children, sometimes he invites me to stay at his home. He lives in a very humble place, a one-bedroom apartment with a monthly rent of about $700. When I stay with him, I coachsurf in his living room since he does not have a guestroom.

Out of professional interest, I asked him about his income during his working years and how he provided for his retirement security. As an internist, he made about $100k a year. He does not receive the German national social security income. Instead, his pension is currently provided by a doctor’s association he belongs to. This pension pays him about $60k a year. He has no real property to his name, other than an old beat-up VW.

He lives in the Rhein River area near a train station. The two banks of the Rhein river are not only picturesque but also historical – dotted with old castles. Every morning he wakes up at 5 and takes a 30 minute train ride to hike his favorite mountain. He arrives back home around 9 am to have a breakfast of coffee and German brot (bread). I joined him once, and the hike was strenuous, lasting for a few hours.

Read the rest of this entry »Stock market sentiment refers to the overall sentiment of investors towards the stock market. This sentiment can be either positive or negative, indicating whether investors are optimistic or pessimistic about the future direction of the market.

There is a lot of evidence that stock market sentiment is a contrarian indicator of future market returns. Let me cite a few recent examples.

- When Covid hit the US in March of 2020, the entire market was gripped with fear and there was panic selling. Since then, however, the market has nearly doubled.

- In February of 2022 when the Ukraine War broke out, European markets also experienced panic selling. It was rumored that billions upon billions of dollars were moved from Europe to invest in the US market. Who would have thought that by the end of 2022, European markets would have higher returns than the US market?

- In March of this year, the US experienced two of the largest bank collapses in history. Some of my clients sent me doomsday articles and asked me if they should pull all their money out of the market just to be safe. Since then, the market has gone up around 20%.

In fact, this phenomenon has been rigorously studied. The chart below details the research results of Harvard Professor of Business Administration Malcolm Baker and NY University Nomura Professor of Finance Jeffrey Wurgler. Here you can see that across all market capitalizations (that is regardless of large stocks or small stocks) the negative sentiment leads to better subsequent one-year returns than the positive sentiment.

Read the rest of this entry »How My Mom Was Scammed

Posted on: June 20, 2023

This article is a sequel to my last article about how my mom was introduced to a “great” investment opportunity by someone she trusted in her church. If you have not read that one, read it first. At the end of the article, I asked my readers to guess how much money my mom got back.

Here is the answer: she lost more than 90% of her money.

In the first three months after she “invested”, she did receive the promised 3% monthly interest on time. No doubt she shared her good experiences with others and may have even encouraged others to “invest.” She was then persuaded to reinvest all her interest income to make her money grow even faster. After a few months, the so-called brother in Christ stopped coming to church and seemed to drop off the face of the earth. In the end, my mom got just 9% back out of about $50k she invested. My mom is not uneducated, she was an OBGYN doctor. She still fell for the scam. So today I want to discuss the telltale signs of judgment manipulation by scam artists.

Trust shortcut

Trust is extremely hard to build. It takes years to earn a stranger’s trust. But scammers are experts at winning trust. Here are some of the trust triggers they like to pull:

Read the rest of this entry »It happened when she still lived in China. One day she telephoned me, saying that a friend from her church told her about a fantastic investment opportunity. A brother in Christ had an ingenious business idea; he would buy water ponds, set them up for fish farming and sell his daily yield to restaurants for profit. He promised great returns. To get it going, he needed to borrow money with an annual interest rate of 36% (or 3% monthly.) He also wanted to keep this lucrative opportunity exclusively for fellow believers. My mom’s friend further testified to her that she had invested $10k and had already received her monthly interest, which she promptly invested back into the enterprise upon advice of this fellow Christian.

I told my mother to stay away from such a scheme since it made neither economic sense nor incentive sense – see my previous article.

My mom countered with these arguments:

Read the rest of this entry »I got a message from a physician client of mine who wanted me to evaluate a real estate deal that was supposed to give him a 32x Return in 10 years, tax free. Note that the promised return is not 32%, but 32x, meaning that if one were to put in $400k today, he would get back $12.8mm in ten years. The proprietors of the deal explained it in a 90-minute long video message that was uploaded to a popular video platform. The proprietors further shared that there were only very limited spots left for investors to take advantage of this awesome opportunity.

Let’s ignore the “tax free” claim for now, since that usually has to do with investments in qualified opportunity zones, about which I have previously written an article. For now, I am primarily interested in thinking through the economic possibility of achieving the 32x return. The video explains that they double their money every two years by investing in multifamily units. (Buy and renovate for $400k, then sell for $800k.) By compounding their income over five two-year periods, or ten years, they achieve a 32x return. It’s simple as that. The proprietors have done it themselves, and the wife of one of them is a mathematician – she has confirmed the compounding formula: 2^5 = 32.

Now I am not a real estate expert, but this level of returns does not make economic sense to me. Here is how I explained my misgivings to my client.

Read the rest of this entry »I must admit that I used to have a very weak immune system. Every year during flu season, I usually caught the flu twice. While others would get well within a week, my flu symptoms lasted for weeks. The worst part was the endless coughing, all day and night. Not only could I not get good sleep, I also coughed so much that my ribcage hurt. I couldn’t have imagined that I could cure all of that simply by taking cold showers.

I started doing that the year before the Pandemic. Throughout the subsequent two years, while Covid raged through the world, I had to travel frequently between Europe and America since my kids live in Germany. I saw my friends fall ill with Covid one by one, and then all my immediate family fell ill, not once but twice. All throughout that frightening time, I never got sick from Covid, or the cold, or the flu. I have to give the credit to cold showers.

Read the rest of this entry »Today I had a conversation with a friend of mine who recently participated in a conference with the mayor of Washington, DC regarding the dire state of the office rental market. The bottom line is that people love working from home, they are not coming back to the office after the Pandemic as initially expected. This means that companies and even government branches are not renewing their office space leases. The ones that do need a much smaller footprint. Developers are considering converting office spaces into residential homes, but that’s easier said than done since office buildings are constructed differently.

On top of that, most real estate companies use debt financing and since last year, the financing cost has skyrocketed, thanks to the Fed. They are really caught between a rock and a hard place.

Read the rest of this entry »