Recently, a long-time reader of my newsletter came to me for a second opinion financial review. His current financial advisor from Edward Jones had highly recommended a Variable Universal Life Insurance policy as an awesome investment vehicle for his family.

This reader of mine, I’ll call him Jon, is married with two teenagers. Both are very healthy and will go to college in a few years.

The pitch his advisor made for this product includes: 1) it is very flexible, you can decide when and how much to make the premium payments; 2) you can invest in the stock market through various mutual funds to build up cash value, and 3) with this product, you can achieve tax-free growth of the cash value.

I went over the list of available mutual funds and the one with the lowest expense ratio is the Fidelity VIP 500 Index Fund at 0.35%. About one-third of the funds have an expense ratio higher than 1% however.

For this policy that pays a death benefit of $2mm, Jon needs to pay about $17k per year until he is 70, after that, he can stop paying and the policy will remain valid, according to the policy illustration.

Do you think Jon should buy this VUL policy as an investment or not? If you think the answer is yes, reply and give me three reasons. If it’s no, also give me three reasons. Next week I will share my thoughts.

Get informed about wealth building, sign up for The Investment Scientist newsletter

I was invited to a dinner by a client couple of mine. Their youngest daughter has been accepted to three universities and they are having a hard time picking the right one and they wanted my help.

Universities A and B are both out-of-state Ivy League universities that cost more than $60k a year in tuition. University C is an in-state university that costs only $15k. I listened to their reasoning as to why it is so hard to make a decision. They really want to give the best to their daughter and besides, an Ivy League university would give them a lot of face (there you know they are a Chinese American family) since their peer families all brag about their children’s academic achievements and they feel pressured to keep up.

Before I said anything, I forewarned them that the choice of university is a very personal one for them and their child so they should take my words only as my observations and not as my professional advice.

First, since universities A and B are four times as expensive as university C, do they provide four times more value? By this I mean, would their child acquire four times as much knowledge or earn four times as much after graduation? (I will get to this point later.) If not, they would be paying the extra just for the bragging rights.

Second, what financial values do they want to impart on their children? That they should borrow money to pay for something they can’t afford just for vanity? Would such a value system not lead to financial ruin for their children down the road?

Read the rest of this entry »Two weeks ago I wrote about the tax strategy to use during a sabbatical, career transitions, and early retirement. This week’s article is a continuation of that theme, focusing on tax gain harvesting.

This discussion stems from the fact that investment gains are taxed differently than our ordinary income. In fact, they have their own tax brackets. See below:

Let’s take Joe Doe for example. He is a lawyer and his usual taxable income is $600k. That puts him squarely in the 20% capital gains tax bracket. On top of that, based on his income, he must also pay the Obamacare surtax of 3.8%. That makes the tax rate on his investment gains (and qualified dividends) 23.8%.

Read the rest of this entry »Tax Saving Strategies for Sabbaticals, Career Transitions or Early Retirement

Posted on: April 10, 2024

I have a client who is planning to take a year off to take care of her mother, another one who has quit his job to launch a new business, and yet another one who has retired early and needs to wait a few years to receive her pension and social security.

What they all have in common is that they will have at least one year during which they will have very low or even no income. I have been thinking about how they can take advantage of their situations to increase their lifetime wealth-being, or more specifically to reduce their lifetime tax liabilities. Here are two strategiesI came up with: 1) Roth Converstion and 2) Tax Gain Harvesting.

Folks who save money for retirement usually stash their money in three types of accounts: taxable accounts like banks and brokerages; tax-deferred accounts like IRAs, SEPs and 401ks, or tax-exempt accounts like Roth IRAs and HSAs.

With tax-deferred accounts, once you are over 71 years old, there will be a RMD (required minimum distribution) that will increase as you age. If you invest well, eventually this RMD will push you into the higher tax brackets like 35% or even 37%. Here is a table of tax brackets for 2024.

Read the rest of this entry »America’s national debt is spiraling out of control. It’s at $34.4T right now and is increasing at a rate of $2T per year. Today I am going to prognosticate what will likely happen and what it will mean for us investors.

To make the projection, I will assume things will stay largely as they are:

- Inflation around 4%

- Interest rate about 5%

- Budge deficit around at $2T

At this rate, in five years, the total federal debt will be over $44T. At an average interest rate of 5%, the total interest payments in the federal budget will be $2.2T. In 2023, the total federal tax revenue came at only $4.6T. In other words, in five years or so, the interest payments alone will amount to nearly half of the federal tax revenue.

With a budgetary shortfall at that level, there will be no other option but to “print’ more dollars. Today I will not discuss the mechanism of printing money. Suffice to say that printing money will lead to inflation and inflation necessitates that the Fed keeps the Fed fund rate high.

Read the rest of this entry »I have done many portfolio reviews over the years and I’ve seen all kinds of mistakes people make with their investments. Starting today I will do a series of articles on this specific topic. Hopefully, you will learn from these examples and therefore avoid repeating them.

First let me clarify a couple of terms:

- Financial Advisor: the guy who gives you financial advice and tells you where (what funds) to invest your money. Most of them work for big brokerages like Merrill Lynch, Morgan Stanley, and others (therefore the conflict of interest), and most of them can direct your money.

- Fund Manager: the guy who works at a mutual fund who does not interact directly with you, but nevertheless decides what stocks and bonds or other funds your money should be invested in once your financial advisor has invested your money in his fund.

To review a portfolio, first and foremost, I examine the hidden costs:

Read the rest of this entry »Today, a client of mine invited me to his house for lunch. His son Kevin has just finished college and started a job. The lunch invitation was not just for a celebration, but also to give Kevin a quick financial education and set him up for future financial success.

Kevin is employed by a small company that pays him a $60k starting salary. As part of his employment benefits, he also gets a 401k plan with 3% employer match.

As I sat down with Kevin, I had a clear plan of what I wanted to convey to him in the form of questions that I would answer for him.

When should he start saving and investing?

Read the rest of this entry »Invest In Your Brain Health

Posted on: December 29, 2023

If you are like me, (I’m in my mid-50s), please take my message to heart: start investing in your brain health because doing so will pay huge dividends.

It’s in our 50’s when our cognitive ability usually begins to decline. If we don’t intervene, this decline will only accelerate as we age. One consequence of cognitive decline is that we become prone to making stupid financial mistakes that can cost us a lot of money! I have seen this happen with my clients, my clients’ parents, and even my own parents. The total amount lost is in the millions. The parents of one of my clients lost their entire life savings to scams. They lost half ten years ago to an email scam. One would have thought they had learned their lesson. No, just this year, they lost the remainder to a telephone scam.

Luckily, this decline is not inevitable. Our brain is like our other muscles, the more we exercise it, the more we maintain, even build up, its strength and power. Here are a few things I have done in the last few years to exercise my brain:

Read the rest of this entry »Have you heard of EMS (Electrical Muscle Stimulation) Training? I came to know about this type of training only after my family moved to Germany and I spent part of my time there.

Essentially, you put on a special tight suit that sends electrical pulses through your body as you exercise. This is supposed to stimulate whole body muscle contractions including muscles that were not in use.

In Germany, an EMS Training session usually lasts 20 minutes. This is probably the most efficient strength exercise I know. You don’t have to spend hours at the gym, exercising each and every muscle one at a time. You spend 20 minutes a week and your entire body gets an intense workout.

From my personal experience, it is indeed very effective. I spend my time between Germany and the United States and when I am in the US, I don’t have access to EMS Training in my neighborhood. Despite keeping active with an exercise routine of Yoga and Tabata, I can feel myself losing muscle strength while I am in the US. After a few rounds of EMS Training in Germany, however, I can feel myself regaining muscle strength.

Why Is It Important?

Read the rest of this entry »Cash Is No Longer Trash

Posted on: November 9, 2023

If you keep your money in cash reserves (usually in the form of a money market fund) in a brokerage account like Fidelity, you are likely to get a yield of over 5%. This has never happened before during my time as an investment advisor. For a long time, cash reserves were paying nothing. No wonder the saying “cash is trash” became a golden rule. But not anymore.

Even banks are offering CDs that have a yield of 5%. However, it’s important to note the difference between a CD and cash reserves. The CD is illiquid money that you can not use until it matures. Cash reserves, on the other hand, are completely liquid. You can withdraw your cash at any time. This is what makes it superior to CDs.

Read the rest of this entry »In this article, I want to show how, in the last 15 years, the Fed’s money supply has driven stock prices higher and higher and how this situation going to reverse.

Prior to the 2008 financial crisis, the Fed kept the money in circulation in the economy relatively steady, just under $1T. Then the 2008 recession hit and to save the economy, the Fed began to “print” money. This action is given various lofty names like Quantitative Easing and Balance Sheet Expansion. The end result, however, was the same, about $1T was released into the economy. This is illustrated in spot (1) in the chart below.

A Federal Budgetary Hell?

Posted on: October 4, 2023

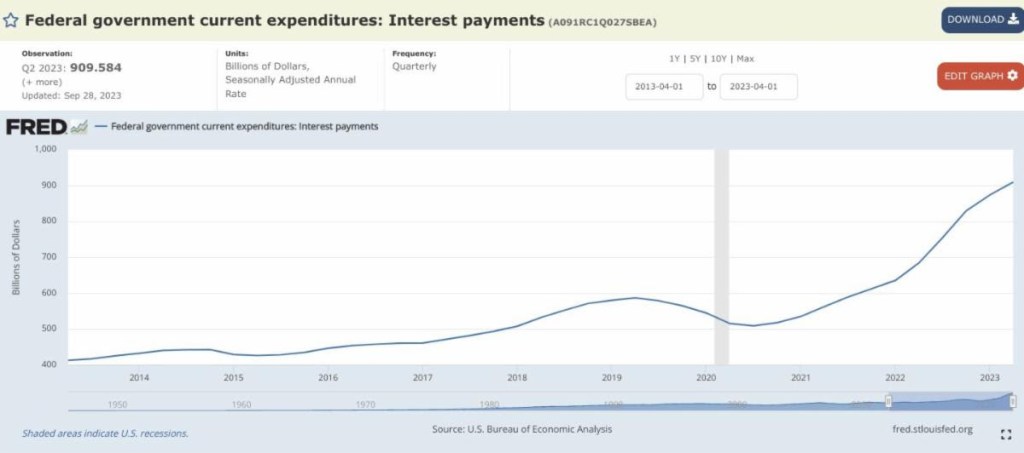

Two weeks ago, I wrote about the retirement income nirvana that is allowing retirees to finally get some serious income from their savings, starting with Treasury bills. The money that goes into retirees’ pockets has to come from somewhere, so let’s look at this chart produced by the Saint Louis Fed.

It shows the interest payments the federal government has made every year up to 2023. One can see that, ten years ago, the interest payments came to about $400 Billion. Today, it’s over $900 Billion! Now, it’s true that some of these payments are to other government agencies like the Social Security trust fund or the Medicare trust fund. Even after adjusting for that, the NET interest payments by the federal government rose from about $225b in 2014 to $700b in 2023.

The federal budget is a trainwreck waiting to happen – a disaster that would make the current government shutdown drama look like child’s play.

In 2023, the actual federal revenue is $4.3 Trillion, but the federal expenditures total $6.2 Trillion, resulting in a budget deficit of nearly $2 Trillion. Since the government is short of this money, they have to borrow it.

How does the government spend money?

Read the rest of this entry »A Retirement Income Nirvana!

Posted on: September 27, 2023

Barely a year and a half ago, the Fed fund rate for overnight lending stood at (annualized) 0.08%. Now it is between 5.25% and 5.50%.

This has tremendous positive implications for retirees who need a steady fixed income. Imagine that you are someone who has accumulated $1mm for retirement. If you didn’t want to take any risks and you invested your entire nest egg in the Fed fund (not that this is even possible), you would have a grand total of $800 a year! That’s why a year and a half ago, I had to expose my clients’ money to stock market risk, duration risk and interest rate risk just to earn some real returns.

Then the Fed realized that inflation was out of control, and geopolitically the US needed to defend against de-dollarization, so since the middle of 2022, it has driven the Fed fund rate up. At the current upper rate of 5.5%, a $1mm investment will earn one $55,000 in totally safe interest income. $55,000 vs $800 – that is quite a difference! Who would have thought fighting inflation would be a blessing for retirees on fixed incomes?

Read the rest of this entry »My Experience of German Spa

Posted on: September 22, 2023

In the last three or four years since my family moved to Germany, I have slowly adopted some German health practices that might be considered unusual in America. One of these is regularly going to the Spa.

A German spa usually consists of several (dry) Sauna rooms all set at different temperatures, at least one steam room, several ice water pools, and basins to wash your feet. A German spa is a great place to subject my body to a bit of stress. I have reaped tremendous health benefits since what doesn’t kill me makes me stronger.

Heat Stress

Spas in Germany usually have a Finnish sauna room. In these rooms the going temperature is usually 90 degrees celsius. Every so often an Aufgussmeister (water pouring master) will bring a scented bucket of water and pour it on the red hot stones. The steam rises from the stones and the Aufgussmeister then does a dance to push the steam toward the patrons in the sauna room, all of them sweaty and naked. For a moment, the temperature in the room can reach 100 degrees celsius. My entire body was under heat stress. It’s said that sitting in such a sauna room for 15 minutes is like sprinting for 15 minutes straight.

Read the rest of this entry »The Wealth of A German Doctor

Posted on: August 19, 2023

Last year on a train trip in Germany, I got to know a retired German doctor and we became good friends. When I travel to Germany to see my children, sometimes he invites me to stay at his home. He lives in a very humble place, a one-bedroom apartment with a monthly rent of about $700. When I stay with him, I coachsurf in his living room since he does not have a guestroom.

Out of professional interest, I asked him about his income during his working years and how he provided for his retirement security. As an internist, he made about $100k a year. He does not receive the German national social security income. Instead, his pension is currently provided by a doctor’s association he belongs to. This pension pays him about $60k a year. He has no real property to his name, other than an old beat-up VW.

He lives in the Rhein River area near a train station. The two banks of the Rhein river are not only picturesque but also historical – dotted with old castles. Every morning he wakes up at 5 and takes a 30 minute train ride to hike his favorite mountain. He arrives back home around 9 am to have a breakfast of coffee and German brot (bread). I joined him once, and the hike was strenuous, lasting for a few hours.

Read the rest of this entry »Stock market sentiment refers to the overall sentiment of investors towards the stock market. This sentiment can be either positive or negative, indicating whether investors are optimistic or pessimistic about the future direction of the market.

There is a lot of evidence that stock market sentiment is a contrarian indicator of future market returns. Let me cite a few recent examples.

- When Covid hit the US in March of 2020, the entire market was gripped with fear and there was panic selling. Since then, however, the market has nearly doubled.

- In February of 2022 when the Ukraine War broke out, European markets also experienced panic selling. It was rumored that billions upon billions of dollars were moved from Europe to invest in the US market. Who would have thought that by the end of 2022, European markets would have higher returns than the US market?

- In March of this year, the US experienced two of the largest bank collapses in history. Some of my clients sent me doomsday articles and asked me if they should pull all their money out of the market just to be safe. Since then, the market has gone up around 20%.

In fact, this phenomenon has been rigorously studied. The chart below details the research results of Harvard Professor of Business Administration Malcolm Baker and NY University Nomura Professor of Finance Jeffrey Wurgler. Here you can see that across all market capitalizations (that is regardless of large stocks or small stocks) the negative sentiment leads to better subsequent one-year returns than the positive sentiment.

Read the rest of this entry »